Key Points:

- HYPE remains stable while major cryptocurrencies like Bitcoin and Ethereum suffer double-digit losses, defying the broader market downturn.

- The total cryptocurrency market saw $2.24 billion in liquidations within 24 hours, yet HYPE maintained its price range between $20 and $30 with a 3.57% daily increase.

As the cryptocurrency market experiences a sharp downturn, Hyperliquid’s native token, HYPE, has appeared as one of the few assets maintaining stability, defying the widespread sell-off that has affected major cryptocurrencies. While Bitcoin (BTC) and Ethereum (ETH) have suffered significant declines, HYPE has remained resilient, showing no major price drop during this period of heightened volatility.

HYPE Defies Market Trends Amid Broad Sell-Off

The general cryptocurrency market has been impacted by over $2.24 billion in liquidations within 24 hours, triggered by U.S. President Donald Trump’s announcement of new tariffs on imported goods.

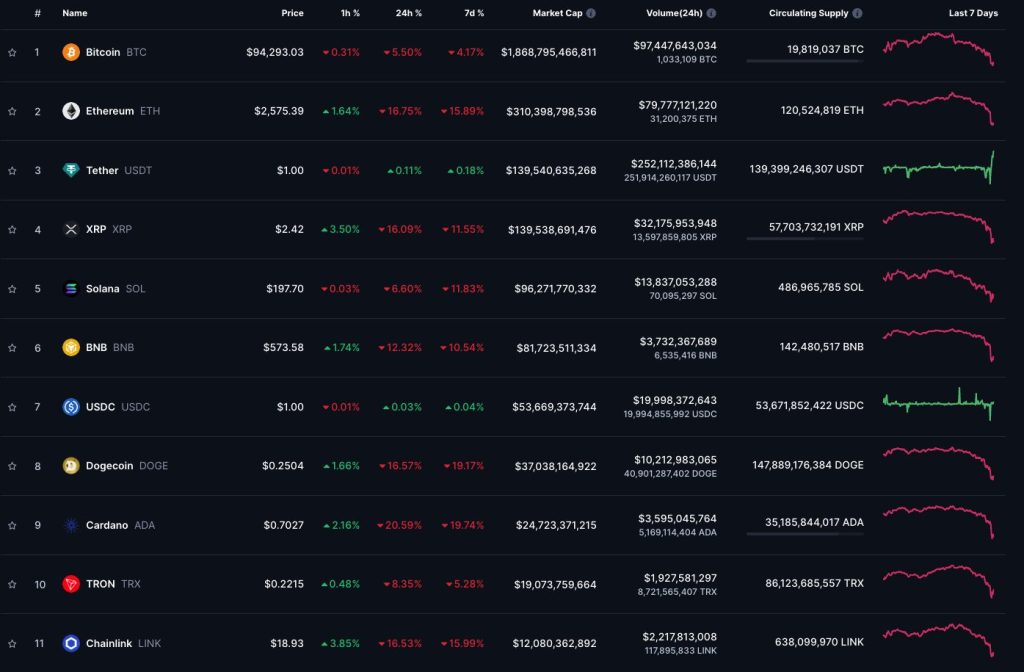

- Bitcoin (BTC) declined 10%, trading at $91,329.

- Ethereum (ETH) fell 33%, reaching $2,127.

- Total cryptocurrency market capitalization dropped by 16%, standing at $3.08 trillion, according to CoinMarketCap data.

Despite these notable losses, HYPE has maintained its price range between $20 and $30, showing resilience compared to other digital assets. The token is currently trading at $23.15, a 3.57% increase on the day, with trading volume recorded at 825.36K.

The Multi EMA (Exponential Moving Average) is positioned at $23.339, with Supertrend resistance at $30.22, indicating a strong level of support.

Hyperliquid’s Trading Activity and Market Impact

Hyperliquid operates as a decentralized perpetual exchange, offering traders high-speed, on-chain transactions and leveraged trading comparable to centralized exchanges. Despite market volatility, the platform has seen sustained trading activity, allowing traders to execute high-leverage strategies successfully.

Data from HypurrScan recently revealed that a prominent trader identified as 0x20…44f5 has capitalized on market movements by executing a large short position on Ethereum (ETH) using Hyperliquid’s platform.

- The trader entered a short position at an average price of $3,388.58 with 50x leverage, leading to a profit exceeding $50 million since mid-to-late January.

- Additionally, the trader earned $2.38 million in funding fees while holding a position size of $137 million, with a liquidation price of $4,646.10.

Hyperliquid Analytics: Rising Derivatives Trading Activity

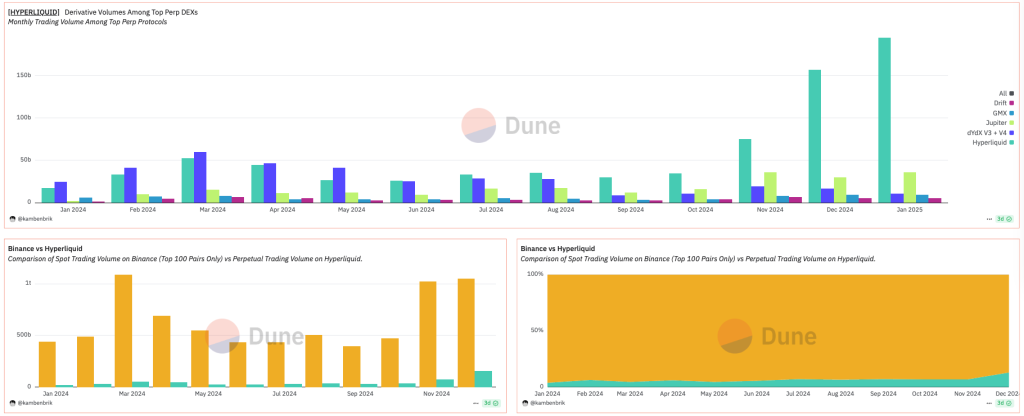

Recent data indicates that Hyperliquid’s monthly trading volume has exceeded 150 billion USD, surpassing other decentralized perpetual trading platforms such as dYdX, GMX, and Drift.

Analytics from Dune highlights Hyperliquid’s steady increase in trading volume throughout 2024, with the most notable spikes occurring in December 2024 and January 2025.

In a comparative analysis with Binance, data shows that Hyperliquid’s perpetual trading volume is steadily increasing against Binance’s spot trading volume. While Binance remains the dominant exchange, Hyperliquid has gained market share, indicating a shift towards decentralized trading options.

Liquidity and Market Positioning

Hyperliquid has also experienced a surge in total USDC deposits, with $2.34 billion in USDC bridged to the platform as of February 3, 2025. This increase underscores growing trader confidence in Hyperliquid’s on-chain infrastructure and liquidity management. Additionally, 80.95% of Arbitrum’s Total Value Locked (TVL) is allocated to Hyperliquid, showing the platform’s strong integration with the Layer 2 ecosystem.

Outlook for HYPE and The Market

While most cryptocurrencies have experienced double-digit losses, HYPE’s ability to sustain its price levels suggests strong market confidence in the Hyperliquid ecosystem. The token’s trading range stability between $20 and $30 makes it stand out in the current bearish market.

With key support levels holding steady, analysts are watching to see if HYPE can break the $30 resistance level, which could indicate further price strength. Meanwhile, support at $20 remains crucial in maintaining stability.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |