Key Points:

- SEC Crypto Task Force met with Jito Labs and Multicoin Capital to explore staking integration in crypto ETFs, including service-based and liquid staking models.

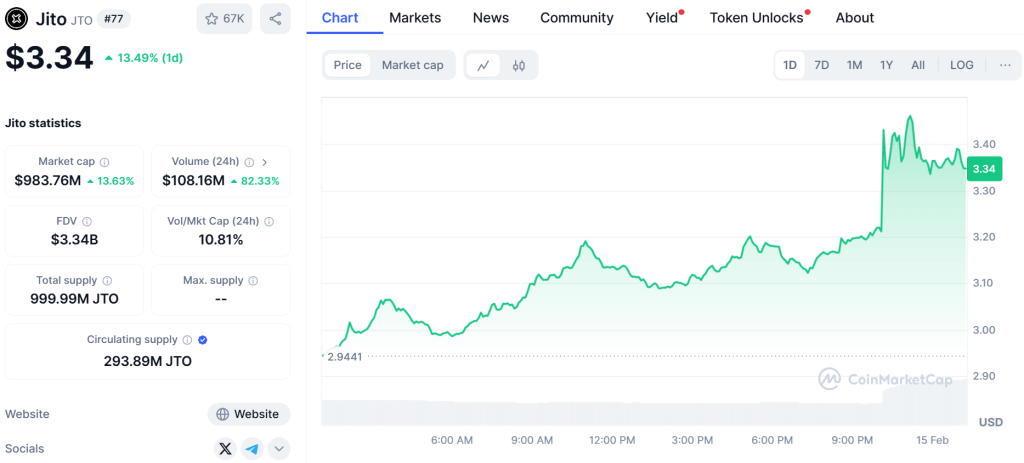

- The discussions signal potential regulatory shifts, boosting investor optimism. Jito’s token JTO surged over 15% following the news.

SEC Crypto Task Force discusses staking in ETFs with Jito Labs and Multicoin, weighing service-based and liquid staking models for regulated crypto products.

SEC Crypto Task Force Explores Staking for Crypto ETFs

According to a memo uploaded by the SEC, on February 5, 2025, the SEC Crypto Task Force held a meeting with Jito Labs and Multicoin Capital to discuss integrating staking into exchange-traded products (ETPs).

The conversation centered on two models: service-based staking, where ETFs stake assets via validators like Jito Labs, and liquid staking tokens (LSTs), allowing ETF issuers to hold tokenized staked assets for liquidity.

The potential inclusion of staking in ETFs could reshape the industry by enhancing yield opportunities for investors while contributing to blockchain security. SEC representatives acknowledged concerns regarding lock-up periods and tax implications but showed openness to exploring compliant solutions.

Read more: SEC Crypto Enforcement Efforts Now Curtailed With More Industry-Friendliness

Market Reactions & Future Implications

Following the meeting, Jito’s native token JTO surged over 15%, reflecting strong market optimism toward staking-enabled ETFs.

Speculation around the SEC Crypto Task Force’s meeting suggests the regulator is preparing for broader crypto ETF approvals in 2025. The discussions come amid rising interest in Solana (SOL) ETFs, with firms like VanEck leading the charge.

If approved, these products could drive significant institutional adoption, marking a milestone in the evolution of crypto investments.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |