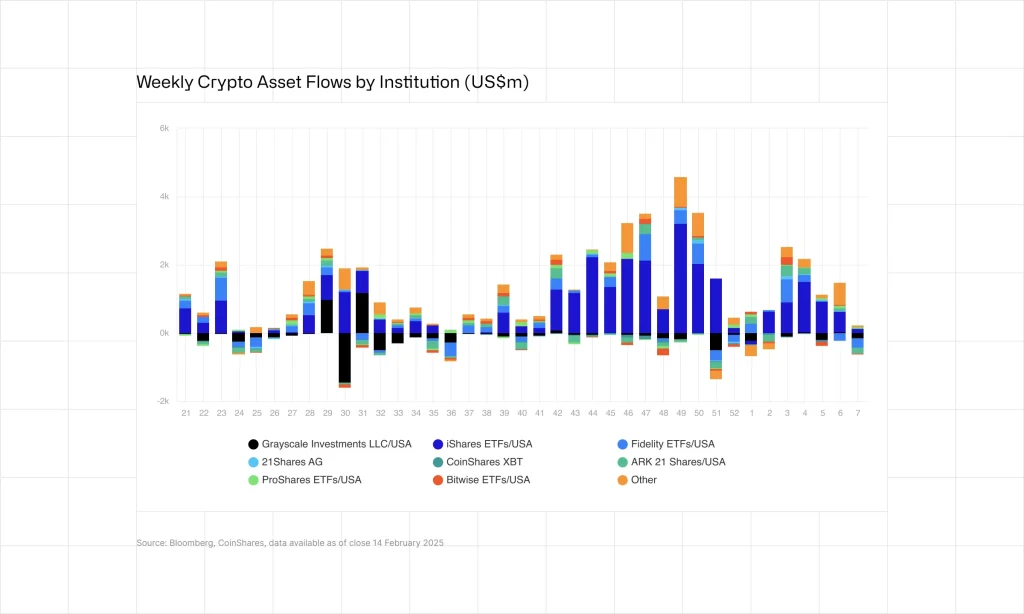

Digital Asset Investment Products Experience Major Outflows of $415 Million

Key Points:

- Digital asset investment products saw $415 million in outflows, ending a record 19-week inflow streak of $29.4 billion.

- U.S. inflation pressures and a hawkish stance from the Federal Reserve contributed to the outflows.

Digital asset investment products have experienced their first significant outflows in recent weeks, totalling $415 million, following an unprecedented 19-week streak of inflows that amassed $29.4 billion.

Read more: Metaplanet Bitcoin Investment Surges With 269 BTC Purchase

Digital Asset Investment Products Face Major Outflows After Setting Record 19 Consecutive Weeks of Inflows

The streak had far outpaced the $16 billion seen in the first 19 weeks of U.S. spot ETF launches starting in January 2024.

The outflows of digital asset investment products were predominantly concentrated in the U.S., which saw a withdrawal of $464 million. Other countries, including Germany, Switzerland, and Canada, remained largely unaffected by the shift.

Bitcoin, sensitive to interest rate expectations, bore the brunt of the outflows, with $430 million withdrawn last week. Interestingly, there were no significant inflows into short-Bitcoin products, which instead faced outflows of $9.6 million.

In contrast, Solana saw the largest inflows of any digital asset, totalling $8.9 million, while XRP and Sui recorded inflows of $8.5 million and $6 million, respectively. Blockchain equities also experienced strong demand, with inflows totalling $20.8 million, bringing year-to-date inflows to $220 million.

U.S. Inflation and Fed’s Hawkish Stance Trigger Market Volatility

The outflows coincided with a more hawkish stance on monetary policy from the U.S. Federal Reserve. During a Senate hearing, Fed Chairman Jerome Powell indicated that inflationary pressures could delay interest rate cuts, triggering concerns among investors.

US inflation accelerated in January, with the consumer price index rising 3% from a year earlier, raising concerns among investors about prolonged restrictive policies.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |