Key Points:

- Reeve Collins, a Tether co-founder, is backing Pi Protocol, a decentralized stablecoin project set to launch on Ethereum and Solana.

- The USP stablecoin will be over-collateralized with assets like Treasuries and insurance products.

Reeve Collins, one of Tether’s original founders, is backing a new stablecoin project called Pi Protocol, which aims to compete with Tether and other leading cryptocurrencies.

Read more: Tether’s Investment in Juventus FC Sparks Fan Token Surge

Tether Co-Founder Backs New Stablecoin Pi Protocol

Collins, who served as Tether’s CEO from 2013 to 2015, co-founded Pi Protocol, which plans to launch on Ethereum and Solana blockchains later this year.

Pi Protocol’s decentralized system will use smart contracts to mint its USP stablecoin, which is backed by real-world assets such as bonds. Minters of USP will receive another token, USI, as a reward.

According to Bloomberg, Pi Protocol hopes to capitalize on the growing demand for stablecoins and real-world assets by offering a unique over-collateralization model. Assets like Treasuries, money market funds, and insurance products will back the stablecoin, ensuring a stable value.

The platform’s smart contracts will monitor and enforce an over-collateralization ratio, adding an extra layer of security. Governance will be overseen by USPi token holders, who can vote on risk parameters and protocol revenue distribution.

A pre-sale of the USPi governance token is currently underway, with 25% of the token supply allocated to the project’s team and advisors.

Tether Expands Market Influence with Major Investments

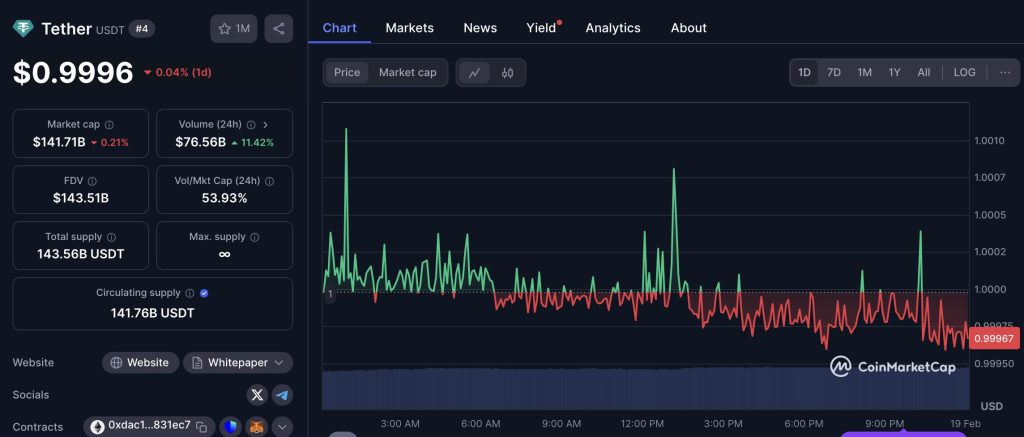

Tether, meanwhile, continues to dominate the stablecoin market, with over $141.7 billion in USDT tokens in circulation and $13 billion in profit last year.

Tether has been expanding its reach by investing in various industries. The world’s largest stablecoin issuer recently proposed to buy 51% of the shares of Adecoagro, an agricultural company operating in the South American region.

Recent moves include a $1 billion investment in Bitcoin mining firm Northern Data and $775 million into the video-sharing platform Rumble. Tether also announced plans to invest $5 billion in the commodity market by 2026 to boost lending capital and generate stable returns, The Block reported.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |