Key Points:

- Hashdex received approval from Brazil’s CVM to launch the world’s first spot XRP ETF, with trading expected on the B3 exchange.

- The SEC is reviewing filings from major firms for a U.S.-based spot XRP ETF, though regulatory uncertainty remains due to ongoing legal disputes with Ripple Labs.

Hashdex has received approval from the Brazilian Securities and Exchange Commission (CVM) to introduce the world’s first spot XRP ETF in Brazil.

Read more: Brazil Stablecoin Withdrawal Ban Targets Self-Custody Wallets

Hashdex Secures Approval for World’s First Spot XRP ETF

The Hashdex XRP ETF will track the performance of XRP, the native cryptocurrency of the Ripple blockchain, marking a significant milestone in crypto investment products.

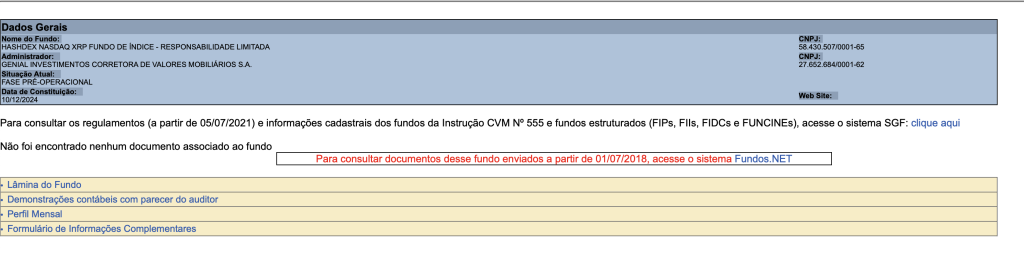

According to the CVM’s official records, the HASHDEX NASDAQ XRP INDEX FUND was established on December 10, 2023, and remains in a pre-operational phase. The fund is administered by brokerage firm Genial Investimentos, though detailed documentation has not yet been disclosed.

Hashdex confirmed the approval to Portal do Bitcoin but noted that an official launch date on the Brazilian stock exchange B3 has yet to be determined. The company assured that further details regarding the commencement of trading would be released soon.

Brazil has been expanding its presence in the cryptocurrency market, with B3 recently announcing plans to introduce Bitcoin (BTC) options and futures contracts for Ether (ETH) and Solana (SOL). The approval of the spot XRP ETF shows the country’s progressive stance on digital asset investments.

XRP ETF Market Is Widening Its Race in the US

In the United States, the race to launch a spot XRP ETF is gaining momentum. The U.S. Securities and Exchange Commission (SEC) has acknowledged filings from major financial firms such as Grayscale, 21Shares, Bitwise, and CoinShares.

Bloomberg ETF analysts James Seyffart and Eric Balchunas believe there is a 65% chance of approval for XRP ETF products.

However, the outcome remains uncertain as the SEC continues its legal battle with Ripple Labs over the classification of XRP as a security. Despite regulatory hurdles, analysts at JPMorgan estimate that if approved, spot XRP ETFs could attract between $3 billion and $6 billion in investments, Fortune reported.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |