Key Points:

- All stablecoin issuers should register in the U.S. for regulatory consistency.

- US stablecoin law is essential for all providers serving American customers.

- Regulation aims to boost consumer trust and protect the stablecoin market.

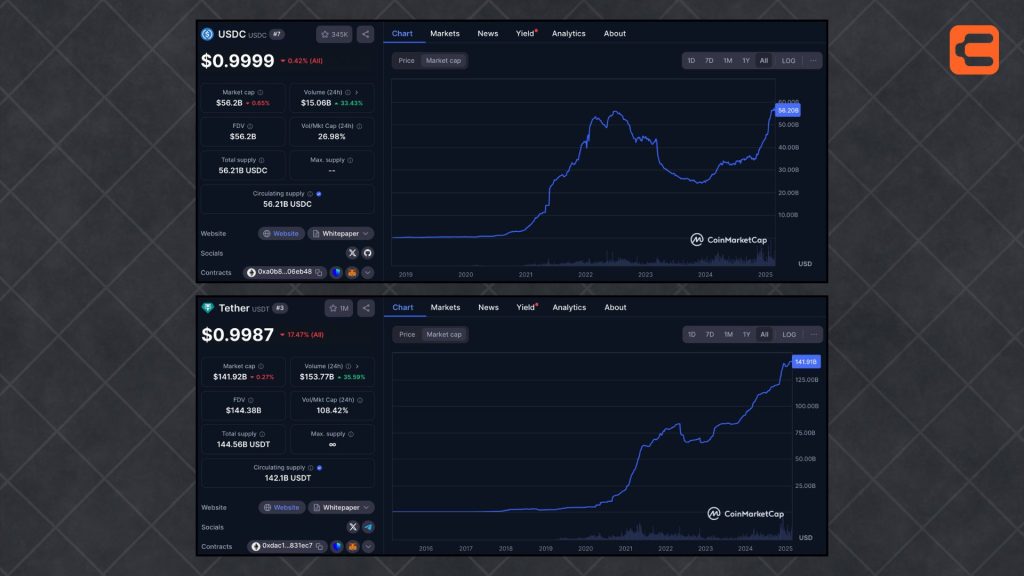

Circle CEO Jeremy Allaire advocates for mandatory U.S. registration of stablecoin issuers to guarantee consumer protection and regulatory compliance. His stance comes amid competition with Tether, which operates from El Salvador and holds a $142 billion market share compared to Circle’s $56 billion USD Coin.

Allaire emphasizes that all companies serving U.S. customers should follow American financial laws rather than allowing offshore operations to bypass regulations. The debate highlights broader questions about stablecoin oversight and market stability.

Allaire Advocates U.S. Oversight for Dollar-Pegged Stablecoin Issuers

Jeremy Allaire, co-founder of Circle Internet Financial, is reportedly supporting mandatory U.S. registration for stablecoin issuers. His push comes amid growing concerns over offshore stablecoin operators and their impact on consumer trust.

Circle’s USDC operates from New York, while Tether has moved to El Salvador, sparking calls for global regulatory standards. The debate intensified after former President Trump’s executive order supporting dollar-backed stablecoins and a regulatory proposal from Senator Bill Hagerty.

It shouldn’t be a free pass, right? Where you can just ignore the US law and go do whatever the hell you want wherever and sell into the United States.

Allaire said in an interview with reported by Bloomberg.

Allaire argues that firms issuing dollar-pegged stablecoins in the U.S. must register domestically, regardless of location, to ensure proper oversight and consumer protection in the evolving digital financial market.

US Stablecoin Law and Consumer Protection Priorities Under Trump Administration

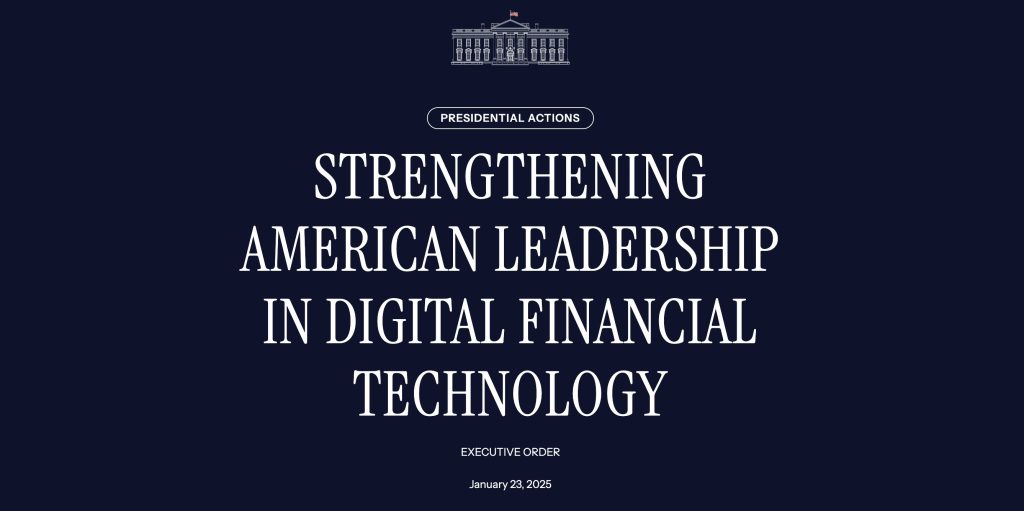

The Trump administration’s second term has introduced significant changes to the regulatory landscape for stablecoins. On January 23, 2025, an Executive Order titled “Strengthening American Leadership in Digital Financial Technology” was issued, outlining a comprehensive strategy for the oversight of stablecoins.

The Executive Order introduces a detailed framework aimed at ensuring the safety of stablecoin transactions and enhancing regulatory transparency through the establishment of a dedicated Working Group.

Promoting and protecting the sovereignty of the United States dollar, including through actions to promote the development and growth of lawful and legitimate dollar-backed stablecoins worldwide

Wrote in a The White House’s EXECUTIVE ORDER.

Notably, the framework explicitly prohibits central bank digital currencies (CBDCs) while advocating for the advancement of regulated dollar-backed stablecoins. The administration’s strategy aims to strike a balance between encouraging technological progress and ensuring consumer protection.

Competitive Tensions Between Major Stablecoin Issuers

Tensions between major stablecoin issuers Circle and Tether have escalated amid recent regulatory developments in the United States. Circle’s CEO, Jeremy Allaire, has called for regulatory parity, emphasizing that all stablecoin issuers that serve U.S. customers should register domestically.

In contrast, Tether has relocated its operations to El Salvador. Currently, Tether retains its status as the largest stablecoin provider in the market, with its market capitalization surpassing that of its closest competitor, USD Coin (USDC), issued by Circle.

USDT has a market capitalization of $142 billion, with $2 billion minted in 2025, including $1 billion on the Tron network. Meanwhile, USDC has reached $56 billion in market capitalization, driven by $6.5 billion in new USDC minted on Solana.

As of February 2025, USDT holds 5% of the market, down from previous highs. In contrast, USDC’s market share has grown to 2%, up from 1.03%, showing increased adoption, particularly in regulated markets like the U.S.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |