GameStop CEO Confirms Letter Urging Bitcoin Adoption From Strive Asset Management

Key Points:

- Strive Asset Management suggested that GameStop CEO Ryan Cohen should consider converting nearly $5 billion of the company’s cash reserves into Bitcoin.

- GameStop has stabilized its balance sheet by reducing operating losses and generating interest income from cash holdings, setting the stage for potential strategic changes.

GameStop CEO has received a bold proposal from Strive Asset Management with a push to adopt Bitcoin as a reserve asset.

The investment firm, co-founded by former U.S. presidential candidate Vivek Ramaswamy, has recommended that GameStop convert nearly $5 billion of its cash reserves into Bitcoin.

GameStop CEO Urged to Convert $5 Billion Cash to Bitcoin

The proposal, dated February 24, was addressed to GameStop CEO Ryan Cohen, by Strive’s CEO, Matt Cole. Cohen acknowledged receipt of the letter on social media, simply stating “Letter received,” without providing further details.

The proposal came at a time when GameStop was reported exploring the addition of Bitcoin and other digital assets to its investment portfolio, according to CNBC. The move, according to Strive, would position the well-known video game retailer as the leading Bitcoin treasury company within the gaming sector.

The exploration of crypto investments comes as GameStop faces declining sales, with a 20% drop reported in Q3 2024 across both hardware and software segments. Not long ago, GameStop CEO met with Michael Saylor, co-founder of Strategy, which got the community excited about the possibility of the video game retailer getting involved in Bitcoin.

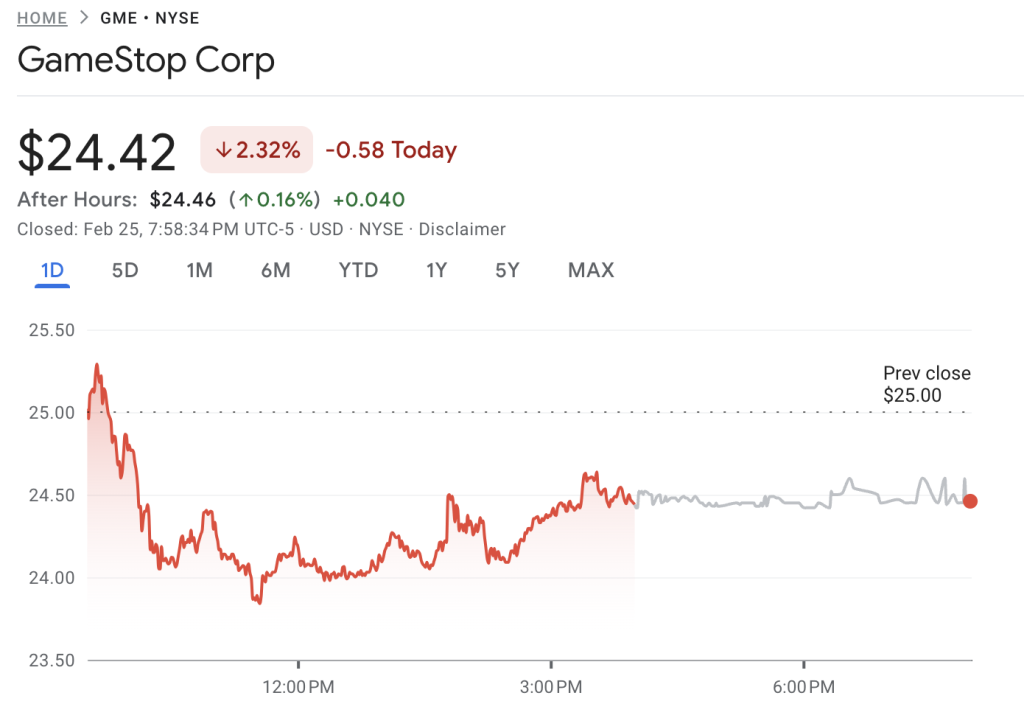

GME stock closed Tuesday’s trading session at $24.42, down 2.32% from the previous close of $25.

Financial Stability Paves Way for GameStop’s Potential Strategic Transformation

Strive’s letter highlights GameStop’s substantial cash reserves, approximately $4.6 billion as of the end of the third quarter of 2024, as disclosed in a December SEC filing. Cole argues that Bitcoin could serve as a hedge against inflation, offering better returns than traditional cash holdings, which he claims provide negative real returns.

The proposal advises GameStop to focus solely on Bitcoin, steering clear of other cryptocurrencies, and to leverage capital markets through at-the-market offerings and convertible debt securities. Over the past two years, GameStop has managed to reduce its operating losses, offsetting deficits through interest income from cash holdings generated by equity offerings.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |