LIBRA and MELANIA Teams Suspected in $2.73M Wash Trading Scheme

Key Points:

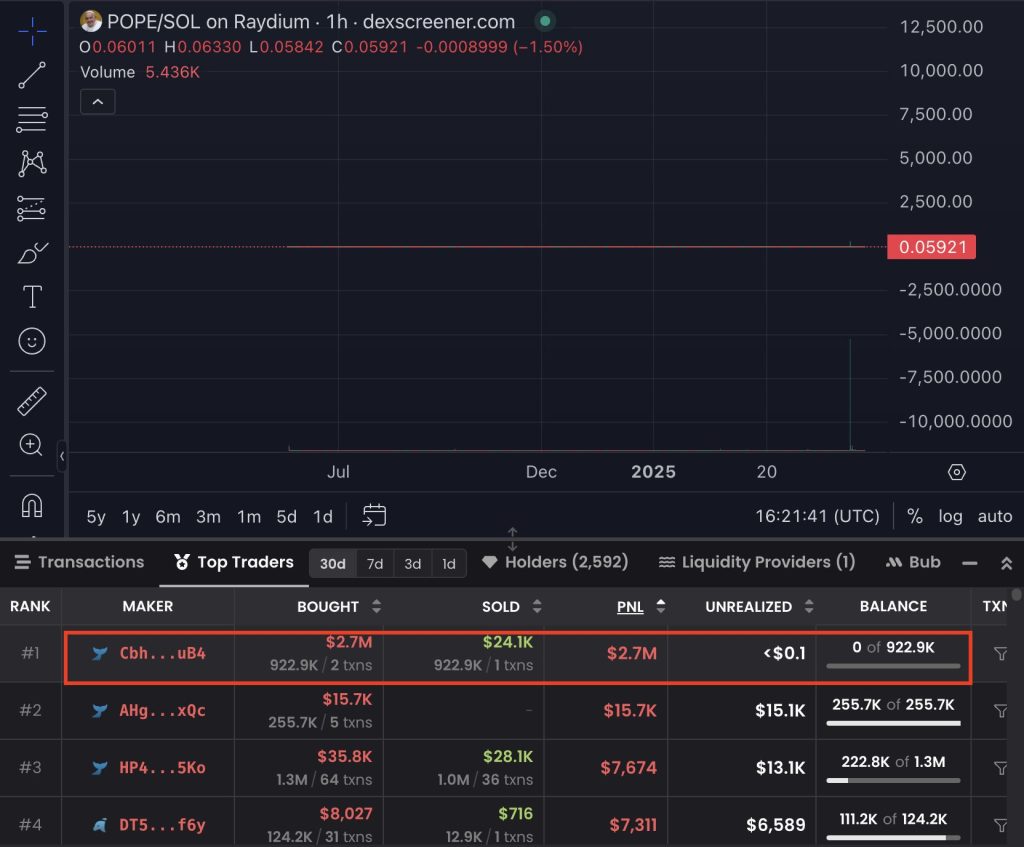

- LIBRA & MELANIA accused of laundering $2.73M via wash trading.

- POPE tokens bought for $2.76M, sold for $24K, raising suspicion.

- Funds allegedly redistributed to multiple wallets to mask transactions.

The teams behind the LIBRA and MELANIA tokens are facing accusations of money laundering through wash trading, according to a report by Lookonchain monitoring. Investigators allege that a wallet associated with these projects engaged in a suspicious transaction involving a meme coin, purchasing it with 19,846 SOL (approximately $2.76 million USD).

Shortly after the purchase, the POPE tokens were sold for just 175 SOL (about $24,000 USD), resulting in a $2.73 million USD loss. This loss was reportedly redistributed across multiple wallets in a manner that masked its true purpose.

LIBRA & MELANIA: $2.73M Alleged Money Laundering via Wash Trading

According to a report by Lookonchain monitoring, the teams behind the LIBRA and MELANIA tokens have been accused of laundering money through wash trading. The specific transaction under scrutiny involved the purchase of the POPE meme coin using 19,846 SOL (approximately $2.76 million USD).

Shortly after, the POPE tokens were sold for only 175 SOL (about $24,000 USD), resulting in an estimated loss of $2.73 million USD. Investigators allege that this loss was strategically transferred to other wallets in a manner designed to appear legitimate.

That $2.73M was effectively funneled to other wallets in a “legal” manner.

Lookonchain said in a recent post on X (Twitter).

Data from TradingView for the POPE/SOL trading pair, observed in a 1-hour timeframe, showed that the price of POPE stood at 0.05921 SOL, reflecting a 1.50% decline.

The recorded trading volume was 5.436K, with activity patterns consistent with the allegations of artificial trading. Lookonchain’s findings identified that the first wallet (Cbh…uB4) involved in these transactions was the same wallet linked to suspected wash trading activities, potentially implicating the LIBRA and MELANIA teams.

What is “Wash Trading”?

Wash trading is a deceptive market practice where entities simultaneously buy and sell the same financial instrument, creating an illusion of heightened trading activity. This technique is often used to manipulate prices or inflate volume metrics, misleading investors. The practice is illegal in most jurisdictions, including the United States, where it is explicitly banned under the Commodity Exchange Act.

The primary concerns surrounding wash trading include artificially inflated trading volume, price manipulation, and misleading market participants. The method can be executed through self-trading, coordinated transactions between multiple accounts, or automated algorithms that generate fake trades.

In the case of POPE, the rapid depreciation of tokens after large-scale transactions suggests an intentional effort to obscure the movement of funds rather than a typical market-driven loss.

$99 Million Exit Leaves LIBRA Investors Reeling

Beyond the wash trading allegations, LIBRA’s history raises further concerns. The LIBRA token first gained widespread attention in February 2025 when Argentine President Javier Milei publicly promoted it.

Following his endorsement, the token’s value skyrocketed, reaching an all-time high of $5.54 per token. However, a dramatic price collapse followed, with LIBRA now trading at approximately $0.12 as of February 26, 2025.

Investigations revealed that around $99 million USD was withdrawn from the LIBRA marketplace by wallets allegedly linked to its creators. This has led to accusations of insider profiteering, prompting multiple criminal complaints against President Milei.

The controversy, now referred to as “Cryptogate,” has triggered impeachment calls and heightened scrutiny over the regulation of political figures endorsing speculative assets.

$MELANIA Coin Crashes 90% After Initial Surge

Following the launch of the $TRUMP coin, former First Lady Melania Trump introduced the $MELANIA meme coin. Initially, the token experienced a surge in market interest, peaking at $13.73 on January 20, 2025. However, its value has since plummeted by nearly 90%, with the token currently trading at $0.90 as of February 26, 2025.

Critics have raised concerns about potential conflicts of interest surrounding Melania Trump’s involvement in the cryptocurrency space. Investigations have also revealed connections between the creators of $MELANIA and $LIBRA, suggesting a possible pattern of token launches designed to attract speculative investors before orchestrating large-scale sell-offs.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |