U.S. Releases Seized Chinese-Made Crypto Mining Equipment Amid Trade Tensions

Key Points:

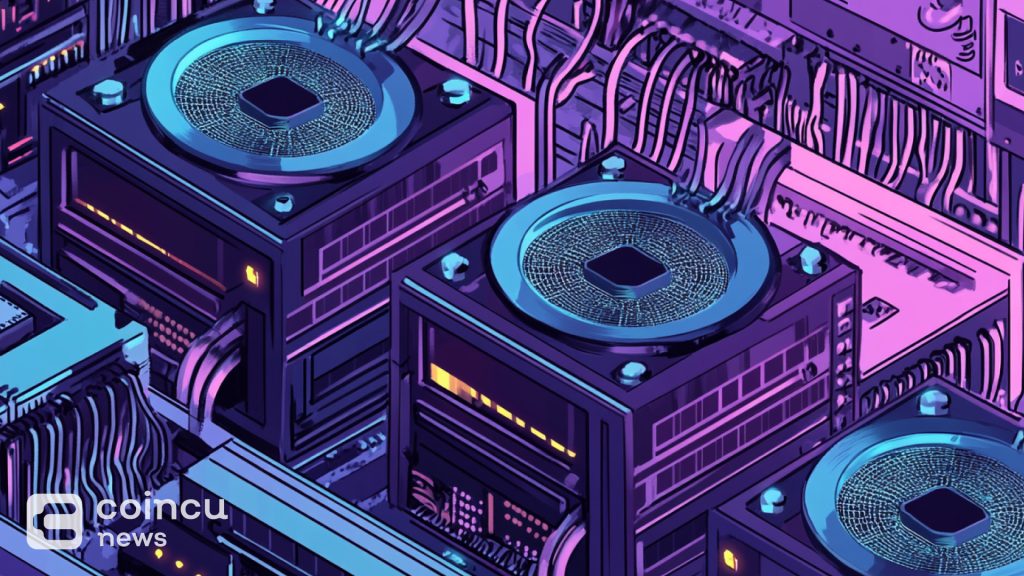

- Authorities have started releasing thousands of detained Chinese-made crypto mining equipments after months of scrutiny over trade compliance.

- Seizures were linked to concerns over radio frequency emissions and the use of blacklisted Chinese chips, amid escalating U.S.-China trade tensions.

U.S. authorities have begun releasing thousands of Chinese-made crypto mining equipments that were previously seized, according to industry executives.

The move follows months of detentions by U.S. Customs and Border Protection (CBP) and the Federal Communications Commission (FCC), which had raised concerns about trade compliance and national security.

U.S. Authorities Begin Releasing Seized Crypto Mining Equipment

Taras Kulyk, CEO and co-founder of Synteq Digital, a crypto mining equipment broker, told Reuters that “thousands of units have been released,” after as many as 10,000 machines had been held at various U.S. ports. Ethan Vera, chief operating officer of Luxor Technology, confirmed that while some shipments were being cleared, the majority remained detained.

The crackdown on crypto mining equipment stemmed partly from concerns over radio frequency emissions, though industry leaders dismissed these worries as unfounded.

Another major factor was the presence of chips from the Chinese semiconductor firm Sophgo, which had been blacklisted in the final months of the Biden administration. The company was accused of acting as an intermediary between Taiwanese chipmaker TSMC and Chinese telecom giant Huawei, which remains under U.S. trade restrictions.

The broader context of these enforcement actions is the escalating U.S.-China trade dispute. Tensions initially surged during Donald Trump’s presidency with the imposition of tariffs on Chinese goods. The Trump administration continued scrutinizing Chinese technology, expanding restrictions on key industries, including semiconductor manufacturing.

China Retaliates with Tariffs and Export Controls

By February, U.S. agencies had widened their seizures to include hardware from major crypto mining manufacturers such as MicroBT and Canaan. Meanwhile, Bitmain, which controls 90% of the Bitcoin mining hardware market, shifted production to Indonesia, Malaysia, and Thailand to bypass U.S. tariffs on Chinese-made products.

China, in response, announced retaliatory measures, including additional tariffs of up to 15% on certain U.S. goods, set to take effect on March 10.

Beijing also unveiled new export restrictions targeting U.S. entities. Officials warned they were prepared to escalate the trade conflict if necessary, as Trump’s administration intensified economic pressure by implementing additional 10% tariffs on Chinese imports.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |