Key Points:

- Jito’s New Tokenomics proposal suggests reinvesting protocol revenues via buybacks or fee redistribution.

- The model introduces “Buyback and Barter” and “Real Yield Gauges” as potential mechanisms.

- Jito DAO aims to balance ecosystem growth and direct rewards for token holders.

- The proposal is not official but has sparked discussion in the Jito community.

Jito’s New Tokenomics proposal explores buybacks, liquidity incentives, and reinvestment strategies to maximize JTO’s value to align with ecosystem growth.

As DeFi protocols face increasing pressure to create sustainable revenue models, Jito’s approach mirrors strategies seen in MakerDAO and Curve. The proposal’s success could redefine governance token utility beyond mere voting rights.

Jito’s New Tokenomics Proposal: Expanding JTO’s Utility

Jito Foundation contributor Andrew Thurman has introduced a detailed proposal for Jito’s new tokenomics. The 12-page document suggests leveraging Jito’s growing revenue to benefit the ecosystem rather than just accumulating treasury funds.

The proposal is not an official governance initiative, nor does it represent the Jito Foundation, JitoDAO, or related stakeholders. However, it has already ignited discussions within the community about optimizing JTO’s role as a governance and utility token. Thurman argues that with Solana’s rapid expansion, Jito DAO should explore reinvestment strategies to sustain growth and enhance tokenholder incentives.

Buybacks vs. Fee Redistribution: Finding the Right Model

Thurman outlines two primary strategies: “value recycling” (reinvesting revenues into ecosystem growth) and “value rewards” (redistributing fees to token holders). The proposal suggests that Jito adopt a “recycling & rewards” approach—balancing both mechanisms to maximize long-term value.

One option is a buyback mechanism, which has been successfully implemented by protocols like MakerDAO, Raydium, and Jupiter. Buybacks reduce token supply, potentially increasing value for holders while maintaining liquidity.

Alternatively, Jito could explore a fee switch, similar to Uniswap’s debated revenue-sharing model. This would distribute protocol earnings directly to JTO holders. However, concerns remain about regulatory classification, as similar proposals have led to scrutiny regarding whether such rewards resemble securities distributions.

New Concepts: Buyback & Barter, Real Yield Gauges

To refine Jito’s New Tokenomics, Thurman introduces two innovative approaches:

- Buyback and Barter: Instead of simply buying back JTO, Jito DAO could exchange revenue for tokens of partner projects at favorable terms. This strategy could strengthen partnerships while simultaneously reducing JTO’s circulating supply. However, counterparty risks, such as project failures or token devaluation, remain key concerns.

- Real Yield Gauges: Inspired by Curve Finance, this model would allow JTO holders to stake in JitoSOL or JTO liquidity pools and vote on how Jito DAO reinvests protocol fees. This approach could enhance JTO’s governance role and provide direct incentives to long-term participants.

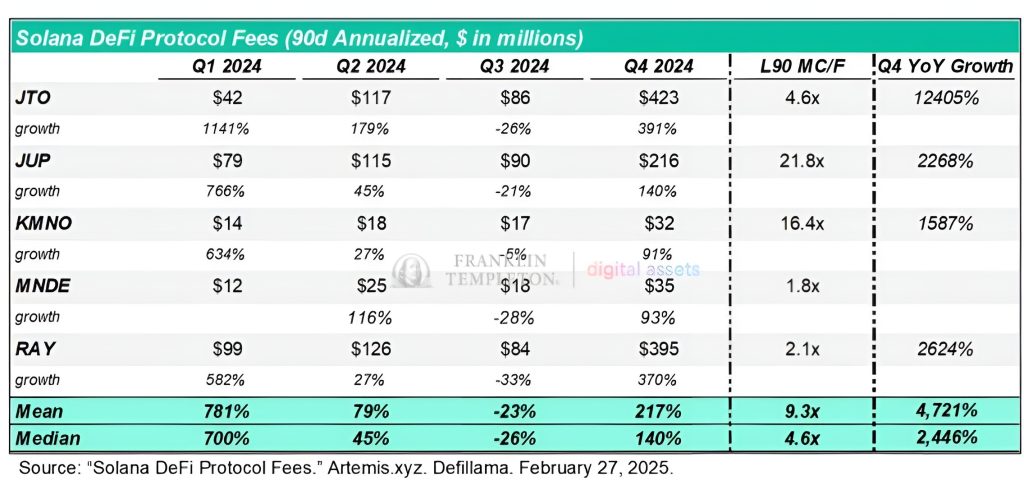

To date, the protocol receives 4% of all JitoSOL staking rewards, plus 3% of tips distributed via TipRouter, according to a claim from Thurman backed by data from Kairos Research.

Additionally, the proposal discusses protocol-owned liquidity, where Jito DAO could act as a liquidity provider of last resort. This would bolster market stability while generating sustainable yield.

Next Steps for Jito’s New Tokenomics Evolution

While Jito’s New Tokenomics proposal is still in its early stages, it has sparked significant debate. Some community members support buybacks during bear markets while favoring yield-boosting incentives during growth phases. Others believe a hybrid model could provide the best of both worlds.

JTO’s price remains stable at around $2.6, down 53% from its all-time high of $5.6 As competition in Solana’s ecosystem intensifies, the discussion around Jito’s new tokenomics will play a crucial role in shaping its future.

Ultimately, the decision lies with the Jito community and DAO. As Thurman himself notes, “No one knows what they’re doing” in this rapidly evolving DeFi landscape, but Jito has an opportunity to pioneer a sustainable, innovative approach to tokenomics.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |