| Key Points: – 21Shares actively managed ETFs, ARKC and ARKY, linked to Bitcoin and Ethereum futures, will be liquidated due to market volatility. – The closures follow a $1.67 billion outflow from a U.S.-listed spot Bitcoin ETF, reflecting wider investor caution. |

21Shares, a leading cryptocurrency asset manager, has announced plans to liquidate two of its actively managed exchange-traded funds (ETFs) linked to Bitcoin and Ethereum futures.

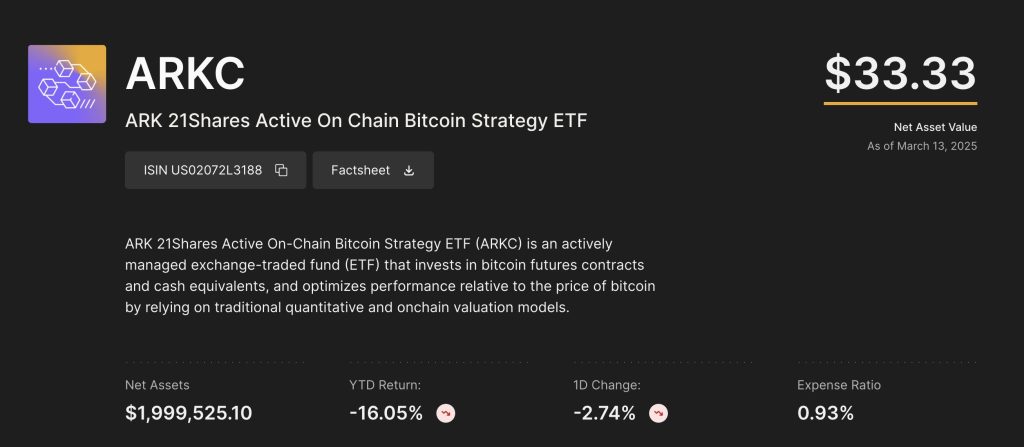

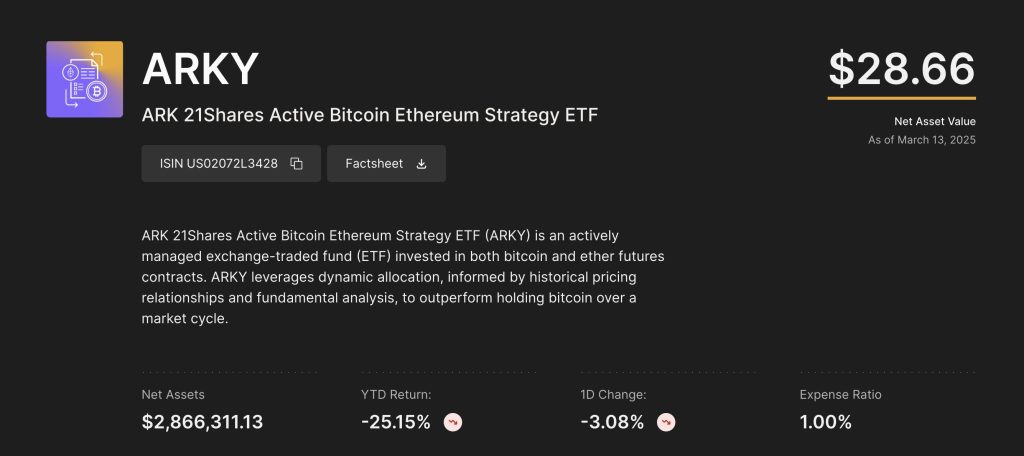

The 21Shares actively managed ETFs, ARK 21Shares Active On-Chain Bitcoin Strategy ETF (ARKC) and ARK 21Shares Active Bitcoin Ethereum Strategy ETF (ARKY), will cease trading as part of the company’s strategic response to market conditions.

21Shares Actively Managed ETFs Shut Down Due to Market Downturn

According to a statement from 21Shares, investors can continue trading shares of both ETFs until the market closes on March 27. Liquidation of the funds is set to occur on or around March 28, after which shareholders will receive payouts equivalent to their share of the net asset value.

ARKC, designed to invest in Bitcoin futures contracts and cash equivalents, sought to outperform Bitcoin by leveraging financial analysis models and on-chain valuation techniques. However, it has faced a challenging market environment, posting a year-to-date return of -16.05%.

Similarly, ARKY, which allocates assets across both Bitcoin and Ethereum futures contracts in an attempt to outperform holding both assets over a full market cycle, has struggled with a year-to-date return of -25.15%.

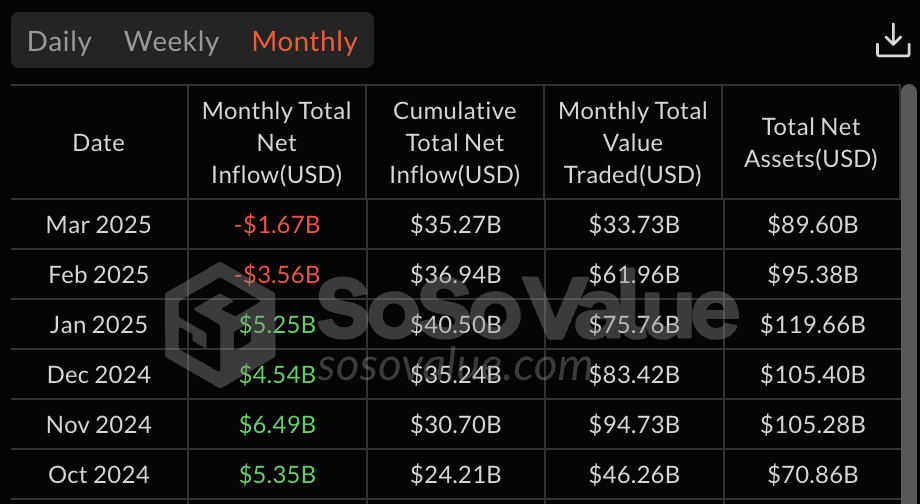

As of March, U.S.-listed spot Bitcoin ETFs saw outflows of approximately $1.67 billion. The persistent downturn in digital asset markets has led fund managers to reassess their offerings, with some opting to consolidate or shut down underperforming products.

Future Outlook for 21Shares and Crypto Investments

The decision to wind down 21Shares actively managed ETFs follows a broader downturn in the cryptocurrency market, which has impacted investment products across the sector. While the company did not specify additional reasons for the closure, the move reflects shifting investor sentiment and market trends affecting crypto-related financial products.

Investors holding positions in ARKC and ARKY have until March 27 to trade their shares before the liquidation process begins. Afterward, remaining shareholders will receive final payouts based on the funds’ net asset value at the time of liquidation.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |