- Greeks.live analyst Adam notes cautious trader sentiment towards $81K puts.

- Funding rate for Bitcoin has turned negative.

- Increased volatility with DVOL indicator rising sharply.

Bitcoin traders are displaying a bearish stance as they focus on put options at $81,000. This comes amid heightened market uncertainty marked by a negative funding rate.

The move signals caution from traders, aligning with a spike in volatility metrics and unsettled market sentiments.

Bitcoin Traders Maintain Bearish Stance Amid Market Volatility

Bitcoin’s funding rate turning negative has captured traders’ attention. The focus on $81,000 put options suggests potential bearish sentiment in the market. Traders are preparing for varied expiration dates for these put options, indicating diverse strategies at play.

This preference for put options could underline market apprehension due to rising volatility. The sentiment may hint at traders anticipating further downward movements, reflecting uncertainty and precaution in current trading approaches.

“The Bitcoin funding rate on major exchanges has turned slightly negative, which historically can indicate a potential price bottom.” — Matthew Sigel, Head of Digital Assets Research, VanEck

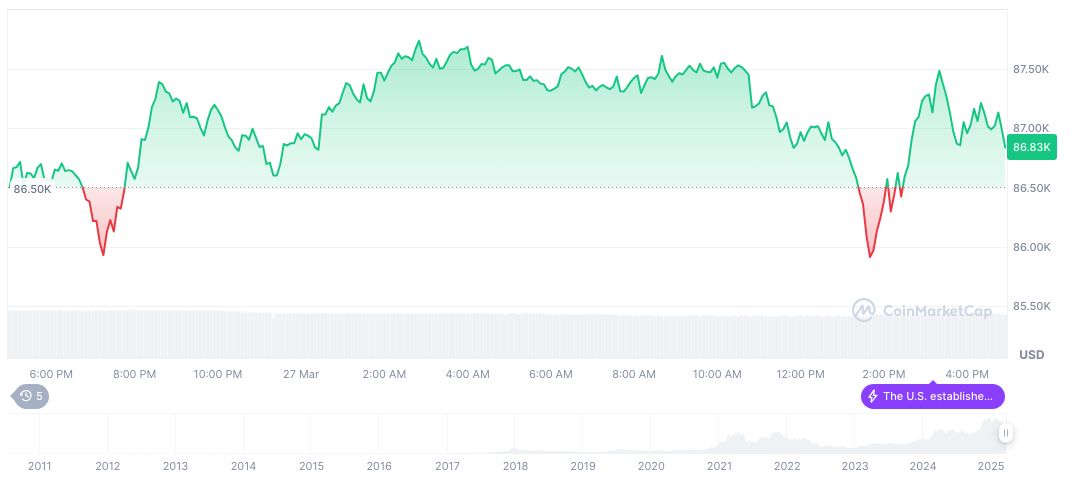

Bitcoin’s Market Metrics: Historical Price Movements

Did you know? Traders’ heightened focus on specific put options during volatile periods often reflects broader strategic betting on potential price drops. Historical trends show such spikes in options trading can precede major price shifts.

Bitcoin (BTC) currently trades at $85,163.27, with a market cap of $1.69 trillion and a 24-hour trading volume up by 20.17% at $30.63 billion. The dominant cryptocurrency sees a mixed price movement with slight gains over seven days but a drop of 13.87% over 60 days, according to CoinMarketCap.

Coincu research suggests that the negative funding and aggressive options trading could signal market corrections or adjustments. Historical data shows similar patterns preceding notable market turns, making it essential for stakeholders to remain vigilant against possible shifts in market dynamics.