Stablecoin Market Poised for $1 Trillion Growth, Says CoinFund

- Stablecoin supply could reach $1 trillion by 2025, CoinFund says.

- Predicted surge may boost overall cryptocurrency market.

- Stablecoin market grew 22 times since 2021.

David Pakman, managing partner at CoinFund, highlighted that the stablecoin supply may surge to $1 trillion by 2025, a key element for increased crypto market growth.

The forecast underscores the burgeoning role of stablecoins within the cryptocurrency market, hinting at potential growth prospects that are still affordable compared to global financial scales.

Stablecoin Market Could Reach $1 Trillion by 2025

Telegraphed predictions from David Pakman indicate that the stablecoin market, currently valued at 2.25 billion, could jump to $1 trillion, prompting significant market consequences. Pakman suggests this growth represents a substantial catalyst for the broader cryptocurrency ecosystem. The increase in stablecoin transactions by more than 22 times since 2021 supports this view.

Pakman articulates that such growth, though large in crypto-specific terms, isn’t radically excessive when viewed against global financial market operations. This perspective ties stablecoin potential to mainstream market scale. The impact is framed not as unprecedented but aligns with historical growth patterns.

Key figures within the industry, including Jeremy Allaire of Circle, emphasize stablecoins’ expanding significance. Allaire predicts widespread recognition of stablecoins as legal electronic money by 2025, facilitating a larger slice of the electronic money market:

“By the end of 2025, stablecoins will be ‘legal electronic money’ almost everywhere, which sets them up to become a larger and larger portion of the $100T+ market for electronic money.”

Stablecoins’ Role in Cryptocurrency and DeFi Evolution

Did you know? Stablecoin supply grew from $138 billion to $225 billion within a year, reflecting a 63% year-on-year increase, demonstrating significant growth prospects parallel to the wider cryptocurrency market.

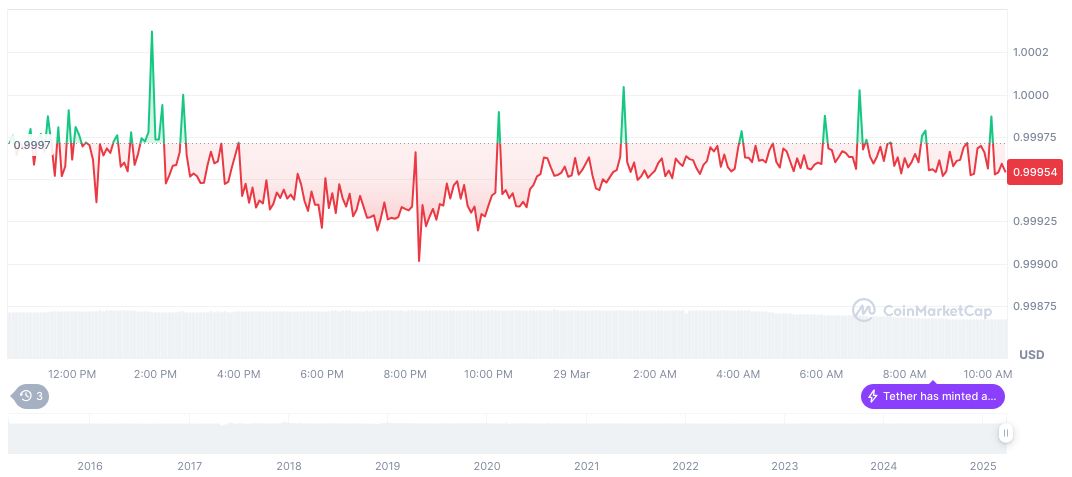

According to CoinMarketCap, Tether USDt, with a market cap of 144.16 billion, remains a dominant player in the stablecoin arena, holding steady at 1.00 USD. Its 24-hour trading volume reached 57.12 billion, marking a 15.61% decrease. Pricing shifts remain minimal, with slight movements marked by a 0.03% rise over the past 24 hours.

Insights from Coincu’s research team highlight potential outcomes wherein expanding stablecoin supply could invite regulatory scrutiny while simultaneously providing technological advancements in DeFi platforms. Data-backed historical growth trends suggest stablecoins could form a cornerstone in future financial transactions.