Ethereum Transaction Fees Hit 4-Year Low, Will Price Recover?

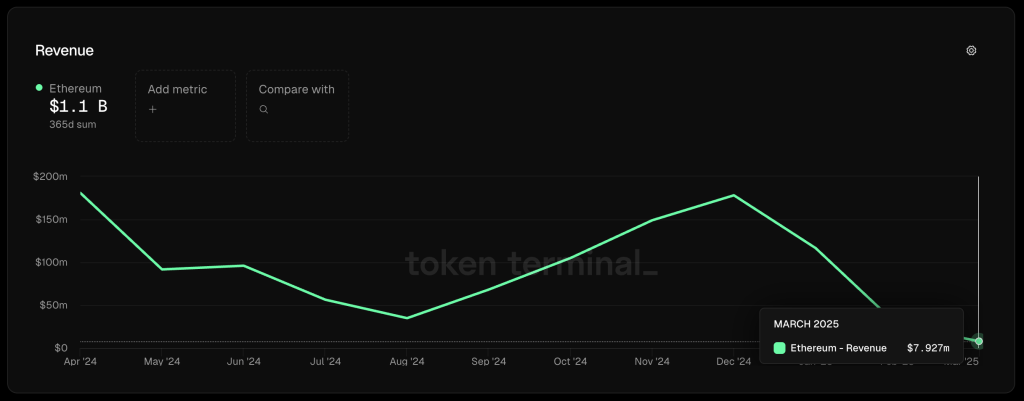

| Key Points: – Ethereum transaction fees have dropped to a four-year low due to reduced network activity, with its value falling more than 46% within a year. – Ethereum’s monthly revenue plunged from $116.6 million in January to below $8 million in March, while its price has struggled to stay above $2,000. |

Ethereum is no longer the dominant force for holders, having fallen over 46% over the past year. Another sad fact to consider is that Ethereum transaction fees have now dropped to a four-year low.

The drop in transaction fees is consistent with a decline in network activity, but could also be a boon for short-term traders.

Layer 2 Growth and EIP-4844 Cut Costs but Hurt Ethereum’s Earnings

The network’s revenue has also experienced a sharp decline in 2025. In January, Ethereum recorded $116.6 million in monthly revenue, but by February, this figure had plummeted to $27.1 million. As of March, earnings had fallen further, registering below $8 million.

In addition to the sharp drop in Ethereum transaction fees, the token also showed poor performance as it experienced one quarter of severe price declines, something that is very rare when the crypto market experiences bull runs after the Bitcoin halving. Based on the data in the table below, we can see that ETH’s February drop was nearly 32%, which discouraged holders.

One of the key drivers behind lower Ethereum transaction fees is the growing adoption of Layer 2 solutions, which handle transactions off-chain before settling on Ethereum’s mainnet.

Additionally, the implementation of EIP-4844 has significantly reduced the cost of posting data to the blockchain, further decreasing the fees collected from Layer 2 activity. While this upgrade improves affordability for users, it has also diminished Ethereum’s mainnet revenue.

Ethereum Transaction Fees Struggles Deepen with Price Decline

On the price front, Ethereum has struggled to maintain stability above $2,000 and recently dipped below $1,800. The cryptocurrency is currently consolidating around the $1,850 support level.

For a sustained recovery, Ethereum needs to surpass the $2,000 resistance mark and maintain momentum. However, if selling pressure persists, further declines could be on the horizon.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |