- Circle’s IPO filing with the SEC involves JPMorgan Chase, valuation decreases.

- Circle targets $4B-$5B valuation, considerable drop from prior attempt.

- Circle’s IPO could shift market dynamics and regulatory landscape.

Circle, a stablecoin issuer, has filed for an initial public offering with the U.S. Securities and Exchange Commission, aiming to list on the New York Stock Exchange as “CRCL”.

This move is significant as Circle seeks a reduced $4-$5 billion valuation compared to past efforts, amidst regulatory shifts.

Circle’s SEC Filing Aims for $4-$5 Billion Valuation

Circle, led by CEO Jeremy Allaire, officially submitted its S-1 filing to the SEC. The company’s IPO will be underwritten by JPMorgan Chase and Citi, with shares listed on the New York Stock Exchange as “CRCL”. This filing follows its previously unsuccessful 2021 SPAC merger attempt, halted by regulatory challenges and market disruptions like FTX’s collapse.

The filing indicates a decrease in projected valuation from its past $9 billion, reflecting market adjustments. Recent regulatory progress in the U.S. concerning stablecoins could affect Circle’s business strategies as new legislative frameworks develop.

“As we move forward with our IPO plans, we are excited about the valuation and growth potential of our platform.” — Jeremy Allaire, Co-founder and CEO, Circle

USDC Metrics and Potential Market Impact

Did you know? Circle’s attempt to go public previously faltered amid market disturbances linked to crypto exchange failures, highlighting a turbulent path for stablecoin legislation.

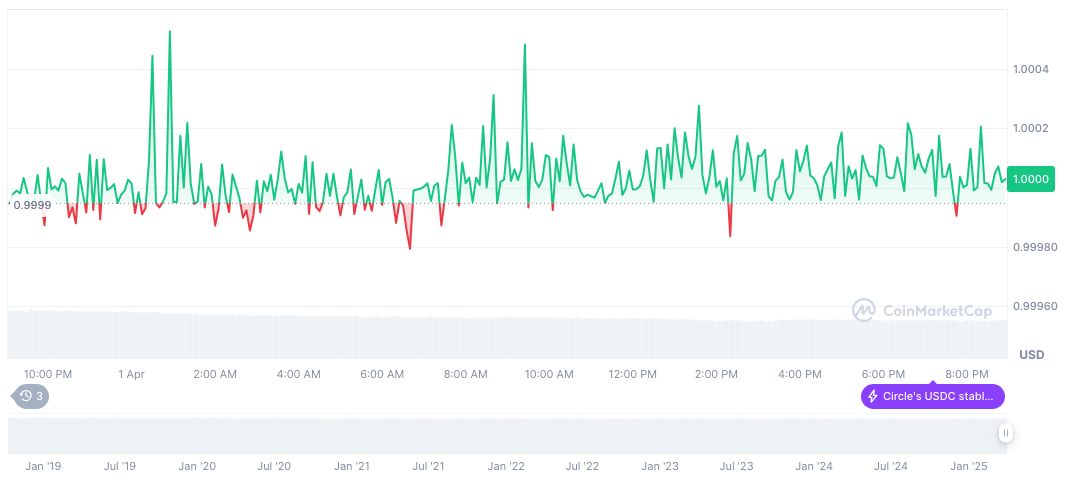

USDC currently trades at $1.00, with a market cap of formatNumber(60125465007, 2) billion, maintaining a 2.19% market dominance. The stablecoin’s 24-hour trading volume totals formatNumber(8914779520, 2) billion, showing a formatNumber(-21.68, 2)% decline. Circulating supply stands at formatNumber(60123869638, 2) units according to CoinMarketCap.

The Coincu research team suggests that Circle’s IPO could prompt financial shifts, especially if new stablecoin laws pass. Regulatory clarity might foster industry confidence, potentially altering the cryptocurrency landscape. The experts note the importance of monitoring legislative developments and market trends impacting stablecoin operations.