- Upbit records $17.19 billion trading volume surge.

- The XRP/KRW pair accounts for 22.84% of Upbit’s total volume.

- Ripple’s adoption efforts in Asia align with growing altcoin popularity in South Korea.

In the past 24 hours, South Korea’s cryptocurrency exchange Upbit reported a trading volume of $17.19 billion, largely driven by the XRP/KRW pair.

This reflects the rising interest in alternative cryptocurrencies within South Korea, marking significant market activity in the region.

XRP/KRW Pair Dominates Upbit’s $17.19 Billion Surge

Upbit’s recent trading activity indicates a spike in market enthusiasm, particularly for the XRP/KRW pair, which comprised 22.84% of the total volume. South Korean investors continue to display strong interest in altcoins, with XRP emerging as a favorite. This movement aligns with Ripple’s targeted efforts to enhance adoption in Asia.

The surge in Upbit’s trading is characterized by growing local demand for alternative digital assets like XRP and FIL. Filecoin’s new KRW trading pair, launched on April 4, has gained traction. This interest highlights South Korea’s retail-driven cryptocurrency market dynamics.

“XRP’s popularity is driven by Ripple’s ongoing efforts to increase its adoption in Asia, particularly in South Korea.” — Upbit Trading Insights, Analyst, Upbit

South Korea’s Role in Ripple’s Asian Market Strategy

Did you know? The XRP/KRW pair consistently leads in volume on Upbit, emphasizing South Korea’s pivotal role in Ripple’s Asian market strategy.

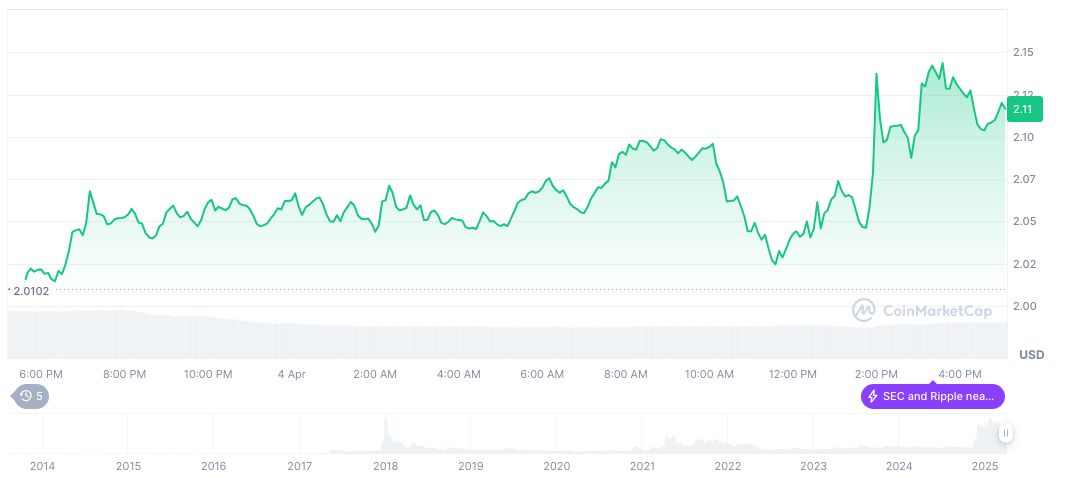

XRP is currently trading at $2.13, with market cap reaching a robust $124.35 billion according to CoinMarketCap. Despite a high market dominance of 4.64%, price trends reflect recent volatility, with a 15.25% decline over the last 30 days. A circulating supply of 58.27 billion XRP underpins these figures.

Insights from Coincu show that South Korea’s vibrant trading culture supports retail-driven growth. Experts suggest ongoing regulatory advancements may bolster the exchange landscape, enhancing technological infrastructure and cross-regional cryptocurrency adoption within key Asian markets.