- Codex completes $15.8 million funding round led by Dragonfly Capital.

- Dragonfly’s investment highlights strong institutional backing.

- Focus on stablecoins aims to improve enterprise blockchain adoption.

Codex’s seed round, led by Dragonfly Capital, secured $15.8 million, underscoring strong support for enterprise-oriented stablecoin technology. Dragonfly committed approximately $14 million, showcasing its confidence in Codex’s potential to integrate stablecoins into real-world corporate frameworks.

The investment aims to drive Codex’s development of a stablecoin-centric Layer 2 blockchain utilizing Optimism‘s stack. This structure promises stable fees and confidentiality, emphasizing business scalability. The network anticipates attracting significant Total Value Locked (TVL).

Stablecoin Technology Poised for Enterprise Growth

Reactions from industry stakeholders affirm Codex’s strategy, focusing on stablecoin ecosystem expansion. Momo Ong, Codex co-founder, highlighted the importance of addressing business adoption hurdles. Haseeb Qureshi, co-founder of Dragonfly Capital, emphasized the innovation Codex brings to enterprise-scale blockchain applications.

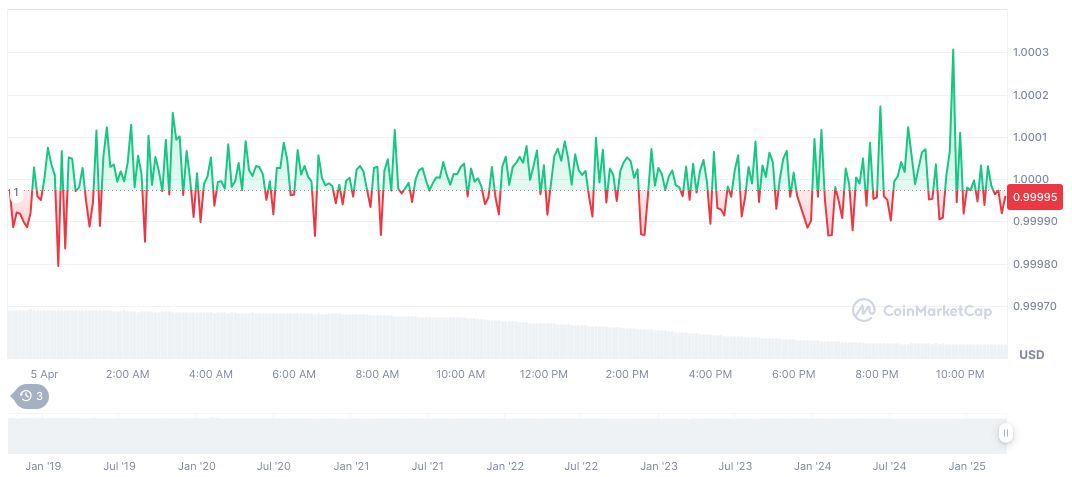

USDC remains stable at $1.00 with a market cap of $60.53 billion, sustaining a market dominance of 2.27%, as per CoinMarketCap. Its 24-hour trading volume stands at $4.49 billion, marking a 69.35% decrease, reflective of market trends.

“What is preventing mainstream adoption? UX friction. Incompatibility with existing company workflows. Trust and reliability. Cost. Regulations… We set out to build Codex — a stablecoin ecosystem fit for business use.” — Momo Ong, Co-founder, Codex

Industry Insights

Did you know? Circle raised $400 million in 2022, demonstrating robust investment in stablecoin initiatives, setting a significant precedent for Codex’s funding.

Industry experts posit that Codex’s engagement with Dragonfly and other investors strengthens its regulatory stance and aligns with blockchain growth strategies. The Codex ecosystem, by leveraging robust privacy and compliance features, aims to foster increased trust in stablecoin applications for businesses.

Experts believe that the focus on stablecoins will significantly enhance enterprise blockchain adoption, paving the way for broader acceptance and integration into existing business models.