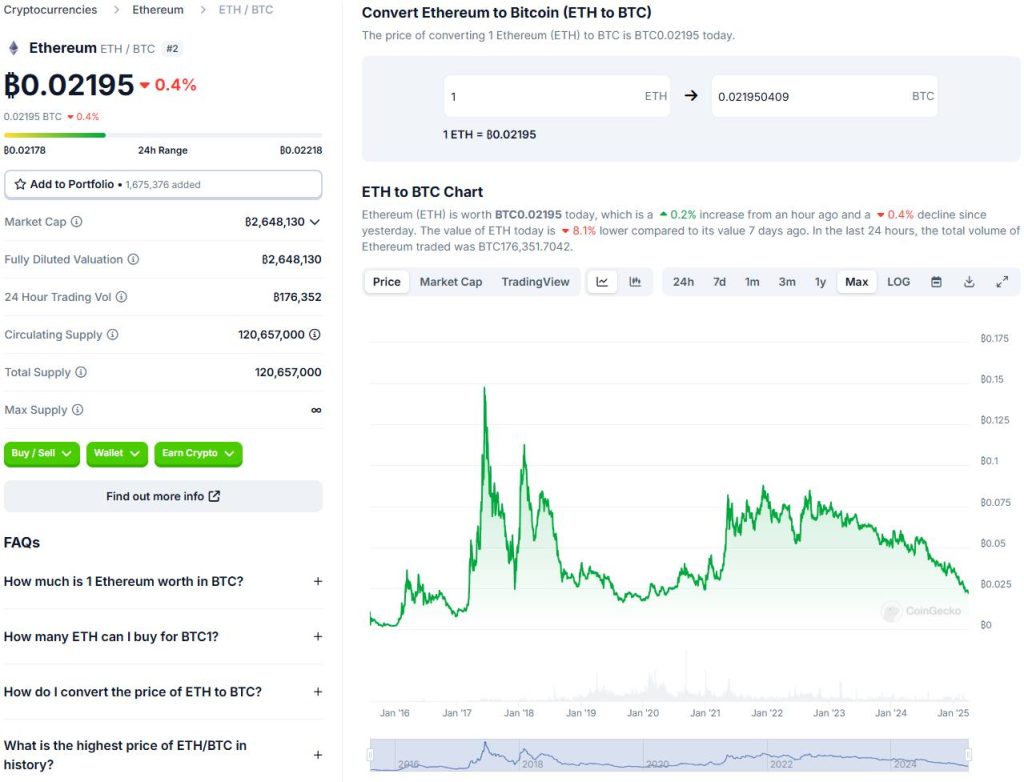

| Key Points: – ETH/BTC Ratio has dropped to its lowest level since May 2020, reflecting Ethereum’s significant underperformance against Bitcoin in 2025. – Ethereum has declined 39% against Bitcoin year-to-date, failing to capitalize on post-halving market trends. – Solana (SOL) continues to outperform Ethereum, with the SOL/ETH Ratio up 24% despite SOL’s own market correction. – Capital is shifting away from Ethereum due to macroeconomic pressures, increasing Bitcoin dominance, and investor preference for more resilient assets. |

The ETH/BTC ratio dropped to a five-year low in Q1 2025, as Ethereum failed to capitalize on Bitcoin’s halving rally, raising concerns across crypto exchanges and trading desks.

This divergence signals a broader shift in capital allocation across digital assets. As institutional investors recalibrate exposure post-halving, Ethereum’s market share is under pressure amid rising competition and macroeconomic uncertainty.

ETH/BTC Ratio Plunges to Five-Year Low

The ETH/BTC Ratio has plummeted to 0.02195, marking its lowest point since May 2020. Ethereum has lost 39% of its value against Bitcoin in 2025, failing to maintain the historical post-halving momentum. This is the first time in a decade that Ethereum has weakened relative to Bitcoin within 12 months of a halving event.

The recent Bitcoin halving on April 20, 2024, reduced mining rewards to 3.125 BTC per block, yet Ethereum has failed to benefit from the event’s bullish market effects.

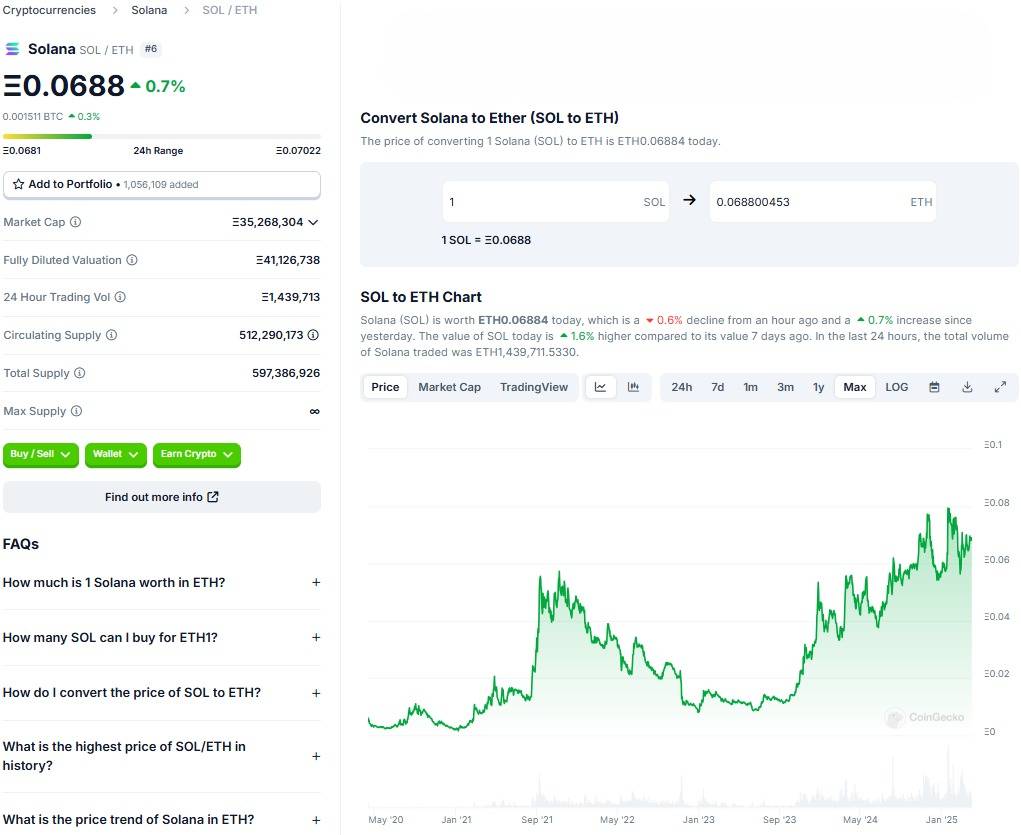

Solana Outshines Ethereum in Layer-1 Competition

While Ethereum continues to struggle, Solana (SOL) has gained ground. The SOL/ETH Ratio has surged 24% year-to-date, reaching 0.07007, despite SOL declining 35% in 2025. This indicates that investors are shifting capital towards alternative Layer-1 solutions, favoring Solana’s scalability and efficiency over Ethereum’s ecosystem.

Ethereum’s weakness is not just a result of internal struggles but also broader macroeconomic pressures:

- Trade war risks and tariffs imposed by the Trump administration are steering investors towards liquid, lower-risk assets.

- High bond yields and persistent inflation are increasing demand for traditional safe havens like gold while also positioning Bitcoin as the dominant crypto hedge.

Bitcoin Dominance Rises as ETH Loses Ground

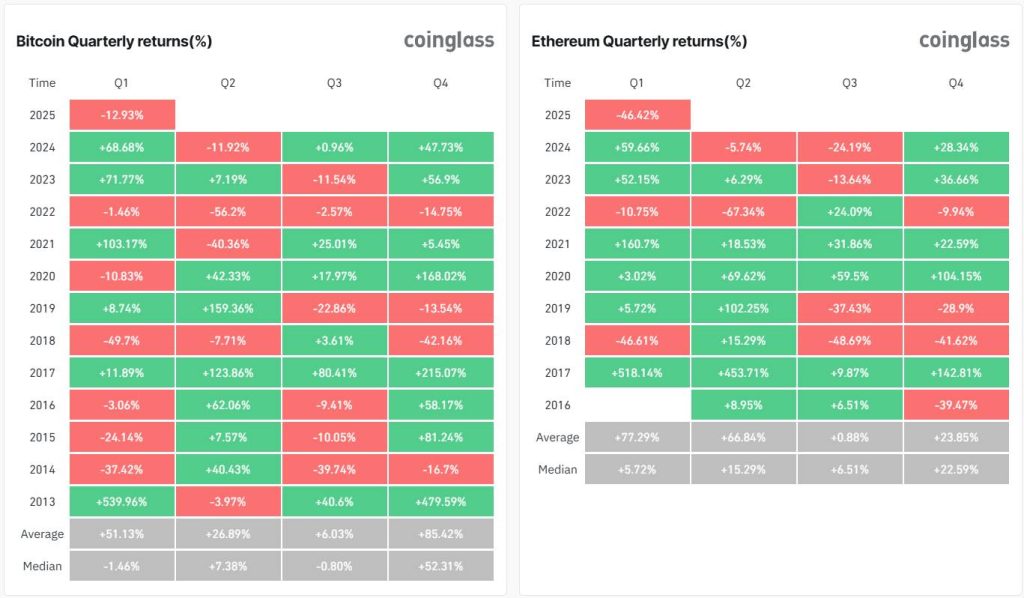

Market data from CoinGlass highlights that Q1 2025 marked Ethereum’s weakest performance against Bitcoin in years. The last comparable downturn was in Q3 2018, when the ETH/BTC Ratio collapsed to 0.0164, representing a 48% drop in one quarter.

Meanwhile, Bitcoin Dominance (BTC.D) has surged past 62%, its highest level since early 2021, maintaining a long-term uptrend since 2023. As investors prioritize Bitcoin over Ethereum, ETH may face continued selling pressure in the near term.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |