| Key Points: – KernelDAO secures over $2B TVL through restaking tools – Kernel powers shared security for 30+ BNB Chain projects – Backed by $40M fund with support from Nomura and SCB |

Launched in 2024, KernelDAO delivers a restaking infrastructure that enhances crypto-economic security and capital efficiency across Layer 1 and Layer 2 networks.

Its Kernel module anchors pooled security for 30+ BNB Chain projects; Kelp ranks as Ethereum’s second-largest liquid restaking protocol with over 400,000 users and integrations across major DeFi and L2s; and Gain provides non-custodial yield vaults with strategies tied to ETH, Berachain, Movement Labs, and more.

Backed by a $40M Ecosystem Fund and key partners like Nomura’s Laser Digital, KernelDAO is positioning itself as a foundational restaking layer in the modular blockchain stack.

What Is KernelDAO?

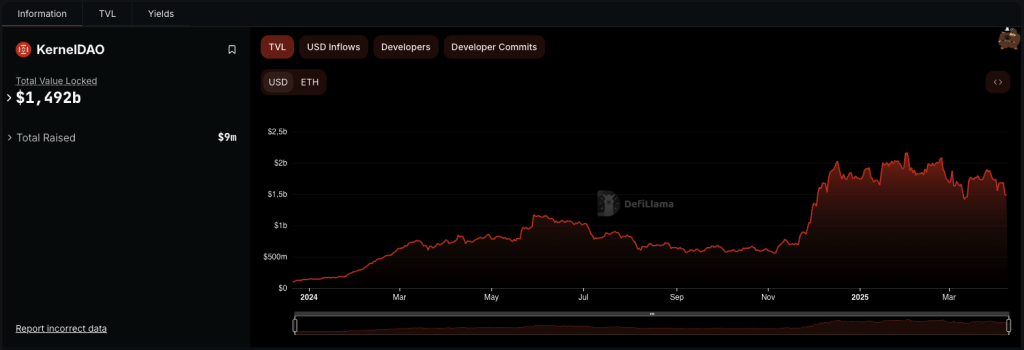

KernelDAO has recorded more than $2 billion in total value locked (TVL) within one year of Ethereum’s restaking functionality becoming operational. The protocol provides a restaking infrastructure designed to promote shared security and capital efficiency across Layer 1 and Layer 2 networks.

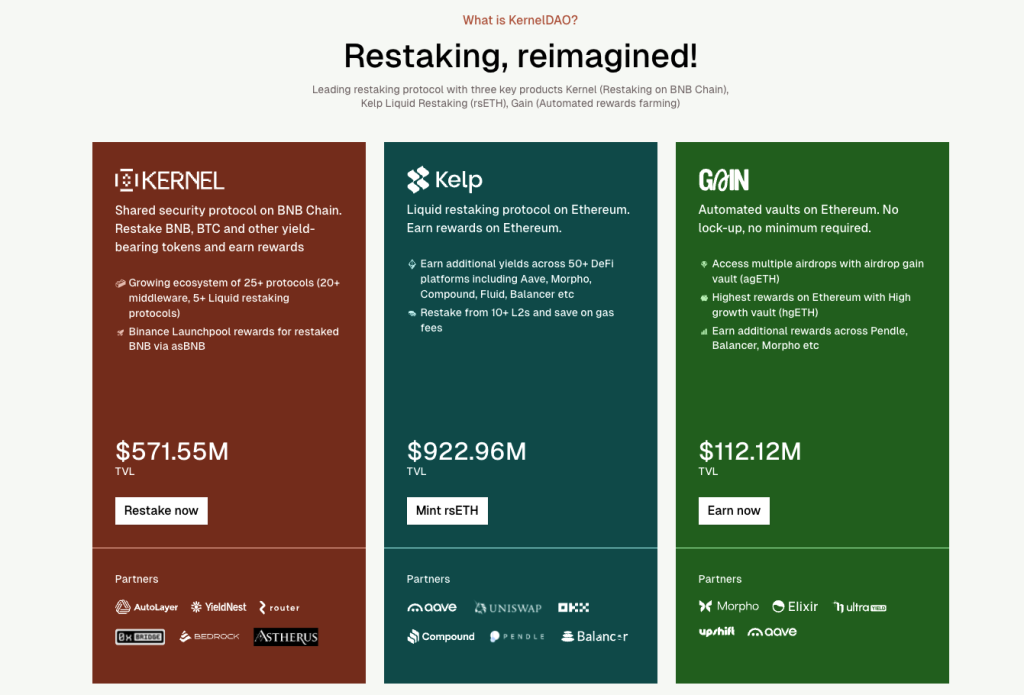

The restaking platform aims to reduce crypto-economic security costs by as much as 10x, delivering value through three primary components:

- Kernel: Supports restaking on BNB Chain with assets like BNB and BTC.

- Kelp: Offers liquid restaking on Ethereum via the rsETH token.

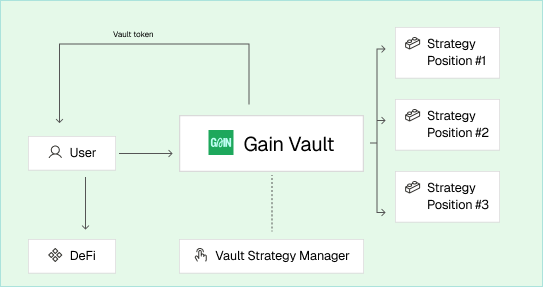

- Gain: Features non-custodial vaults with automated yield strategies in decentralized and centralized finance sectors.

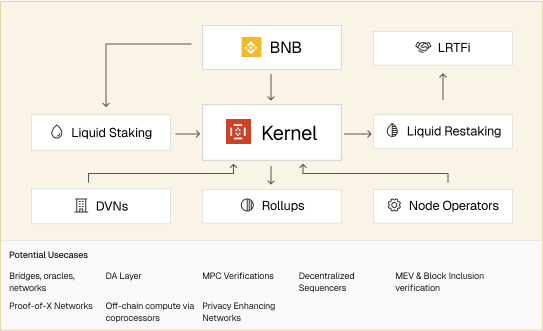

Kernel – Shared Security on BNB Chain

Launched in December 2024, Kernel operates as the shared security backbone of the BNB Chain. It enables restaking of BNB, BTC, and other assets to support Distributed Validator Networks (DVNs). The platform reported over $660 million in TVL within weeks and currently supports 30+ projects.

Key elements include:

- Pooled security for multiple applications.

- Delegation options with slashing protection.

- Middleware compatibility, including ZK systems, oracles, and AI.

- Audits conducted by SigmaPrime, ChainSecurity, and Bailsec.

Projects involved include Mira, Aizel, Electron, Kalypso, and Router Protocol. A $40 million Ecosystem Fund has also been introduced with support from Laser Digital (Nomura), SCB Limited, and others.

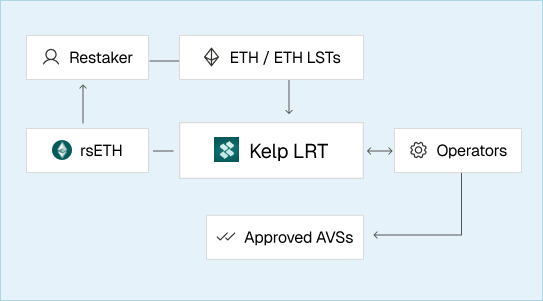

Kelp – Ethereum’s Leading Liquid Restaking Protocol

Kelp has positioned itself as Ethereum’s second-largest liquid restaking protocol with more than $2 billion in TVL and over 400,000 restakers. It allows ETH holders to mint rsETH, which is usable in decentralized finance platforms.

Highlights include:

- Integration with platforms such as Aave, Morpho, and Compound.

- Active on L2s including Arbitrum, Base, and Optimism.

- Designed for composability and efficient risk exposure.

Kelp facilitates borrowing, lending, and trading without forfeiting staking rewards.

Gain – Non-Custodial Yield Vaults With Strategy Automation

Gain comprises smart contract-based vaults enabling users to deploy assets into structured yield strategies. The vaults accumulated $150 million in TVL shortly after launch.

Current offerings:

- Airdrop Gain: Exposure to Layer 2 incentive programs.

- High Gain: Managed ETH strategies.

- Grizzly Gain: Connected to Berachain.

- Move Gain: Linked to Movement Labs.

Future plans include expansion into BTC-based finance and real-world asset (RWA) integration by 2025.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |