- Main event: USDC Treasury burns 51 million USDC on Ethereum.

- Stablecoin supply management shows liquidity alignment.

- No immediate public reaction from Circle leadership.

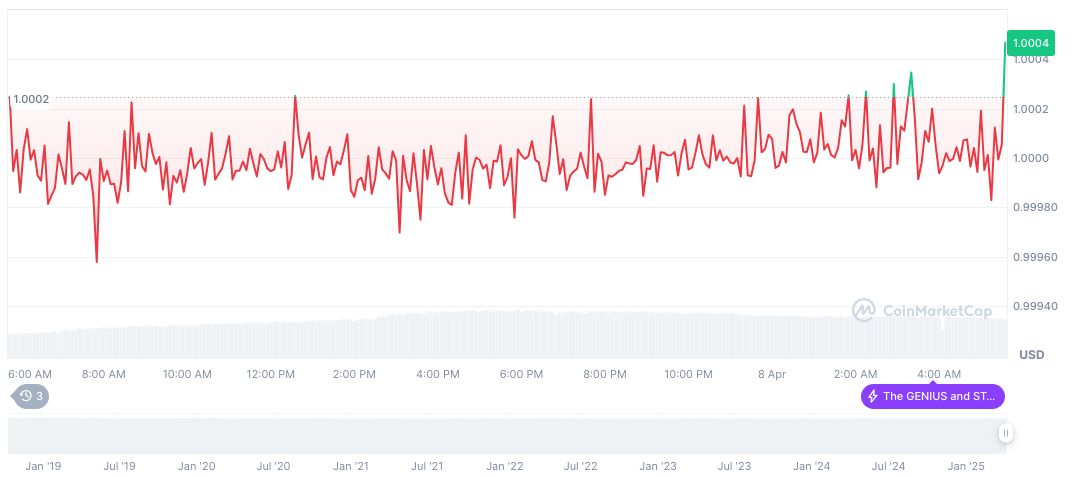

USDC Treasury burned 51 million USDC on Ethereum, impacting stablecoin supply. No depegging noted, reinforcing liquidity strategy.

USDC Treasury destroyed 51 million USDC on Ethereum on April 8, 2025. This move, observed by Whale Alert, aligns with liquidity adjustment practices. This event reflects Circle’s routine supply management strategies without disrupting USDC’s stable value or triggering major market shifts.

USDC Burn: Supply Adjustment and Market Stability

USDC issuer Circle, led by CEO Jeremy Allaire, executed a significant token burn of 51 million USDC on the Ethereum blockchain. Reported on April 8, 2025, this action aligns with Circle’s liquidity management practices, supporting price stability.

The burning reduces USDC’s supply, reinforcing its value stability. Market impact is minimal, with no significant shifts in DeFi usage or demand for alternative stablecoins like USDT. USDC maintains its 1:1 USD peg, unaffected by the burn.

Reactions from the crypto community reflect the routine nature of stablecoin burns. Circle has not released an official statement, and industry leaders have not addressed this specific burn event. The SEC’s stance on stablecoin regulation underlines USDC’s compliance, reinforcing trust in stablecoin stability.

Circle’s management of reserves—90% in U.S. Treasuries and 10% in cash—ensures compliance and user trust. — Jeremy Allaire, Co-Founder and CEO, Circle

Financial Implications and Trading Activity

Did you know? USDC is one of the most widely used stablecoins in the DeFi ecosystem, providing liquidity and stability.

USDC trades at $1.00 with a market cap surpassing formatNumber(60209167512.96, 2). It maintains a market dominance of 2.39%. With 23.48 billion in 24-hour trading volume, USDC exhibits robust market activity. (Data source: CoinMarketCap)

The Coincu research team suggests that while this token burn ensures supply stability, broader financial implications such as liquidity strategy shifts may follow. The action enhances stability in DeFi ecosystems, relying on USDC’s consistent value for risk mitigation. More insights are available through Circle’s report on USDC economic impact.