- Main event, leadership changes, market impact, financial shifts, or expert insights.

- U.S. Treasury Basant hints at future wealth shifts.

- Potentially transformative impacts on ordinary individuals.

U.S. Treasury Shift: Basant Suggests Future Wealth for Ordinary People

Walter Bloomberg reported that U.S. Treasury Secretary Basant announced at a recent financial gathering that the forthcoming years could see an economic shift towards ordinary citizens gaining wealth.

U.S. Treasury’s Bold Vision for Wealth Distribution

Treasury Secretary Basant’s recent declaration at a public event regarding future wealth distribution hints at policy shifts within financial sectors. The assertion has attracted attention from analysts forecasting socio-economic changes. While specific plans remain undisclosed, the statement implies possible systemic adjustments benefiting wider economic participants.

Expectations for socio-economic changes could reshape perspectives on wealth distribution. While some analysts speculate on potential tax or monetary adjustments, others highlight past inefficiencies, questioning the feasibility without clearer strategic frameworks. Discussions around income equality and market inclusivity continue, reflecting varied stances on anticipated transitions.

Market participants remain vigilant, assessing potential monetary strategies for ordinary citizens’ wealth expansion. Initial reactions include cautious optimism from individual investors, emphasizing increased accessibility and reduced financial barriers. However, experts urge clarity on implementation strategies to bolster credibility and ensure effectiveness across economic layers.

Crypto Markets and Regulatory Concerns Amid Wealth Shift

Did you know? Around 40 years ago, economic policies primarily favored corporate growth. Basant’s remarks propose a transformative approach, potentially leveraging historical data to support broader wealth distribution, marking a significant shift in U.S. financial strategies.

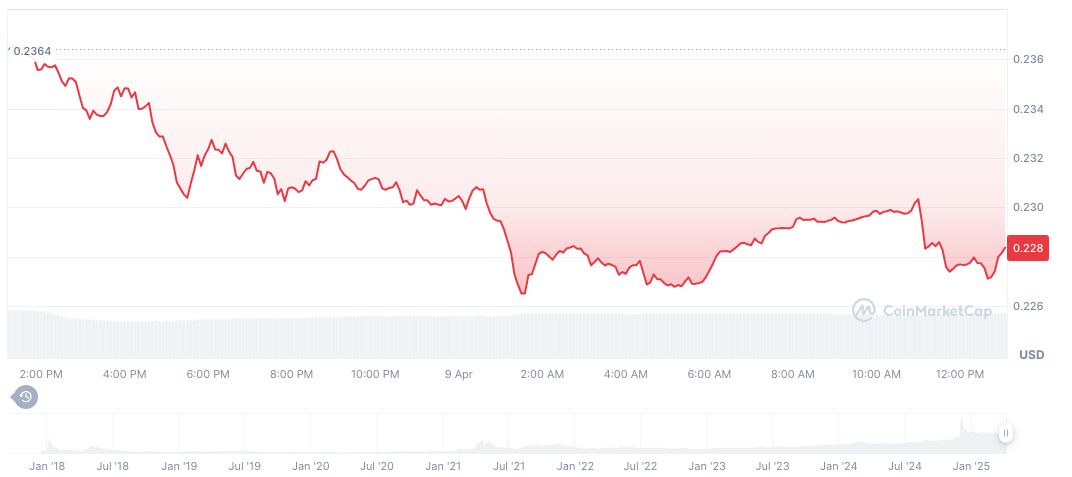

According to CoinMarketCap, TRON (TRX) currently trades at $0.23, maintaining a market cap near $21.68 billion, representing 0.89% of market share. Recent performance reflects declines, with a 3.43% reduction in the last 24 hours. Trading volumes approach $716.67 million, showing a 6.41% drop. These figures offer an insight into the ongoing market adjustments and trends.

Coincu’s researchers suggest that wider wealth access could boost crypto markets, promoting greater participation and diversification. Historical trends underscore the potential for enhanced liquidity and adoption, yet urge regulatory clarity to ensure maximization of socio-economic benefits.

“Our focus on AEON Pay aims to simplify the mass adoption of cryptocurrency payments, addressing both usability and scalability.” — Eddie Li, CEO, AEON ChainCatcher

Bold strategies involving decentralized finance and public receptivity promise technological integration and market evolution.