- Standard Chartered and OKX initiate a strategic asset mirror project to bridge traditional and digital finance.

- Jointly launched in Dubai, focuses on institutional investor security.

- Enhances capital efficiency and reduces counterparty risk.

Standard Chartered Bank and OKX launched a global pledge asset mirror project on April 10 in Dubai, allowing institutional clients to use digital currencies and tokenized funds as pledged assets.

This collaboration aims to enhance capital efficiency by reducing counterparty risk, crucial for institutional confidence in the rapidly evolving digital asset market.

Partnership Boost: Institutional Security and Efficiency

Standard Chartered Bank and OKX have initiated an innovative project to cater to institutional clients using digital currencies as collateral. This initiative aims to reduce counterparty risk and enhance capital efficiency. Brevan Howard Digital is an early participant in this joint venture. This development leverages institutional-grade security and efficiency by integrating tokenized financial instruments. Institutional clients stand to benefit from improved capital efficacy, made possible by Dubai’s regulatory framework combining global banking standards and digital asset innovation. Stakeholders in the industry, including Margaret Harwood-Jones of Standard Chartered, highlight the importance of security and efficiency in digital asset management: “This marks significant progress for sophisticated investors.” Furthermore, Margaret Harwood-Jones emphasized:

Interest from major financial entities like Franklin Templeton underlines the potential for digitized finance in traditional markets.

“This collaboration represents a significant step forward in providing institutional clients with the confidence and efficiency they need”

Brevan Howard’s Role in Digital Finance Shift

Did you know? The involvement of Brevan Howard Digital highlights the growing trend of traditional financial giants, like Brevan Howard, tapping into crypto-assets. This trend marks a significant shift in how such assets are perceived by mainstream finance.

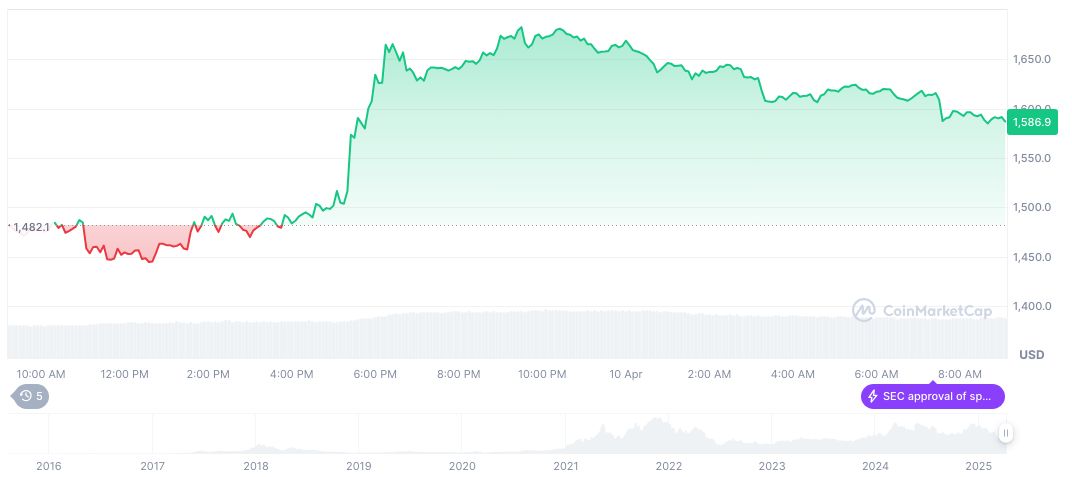

Ethereum (ETH) holds a market cap of $191,644,936,996, maintaining a 7.41% market dominance, with recent trading volume reaching $31.82 billion. Over the past 24 hours, ETH’s price increased by 8.42% as of the latest update on April 10, 2025, according to CoinMarketCap.

The Coincu research team anticipates increased industry interest in joint ventures like this, promoting wider adoption of tokenized assets. Regulatory compliance remains key for cross-border financial integration, and active collaboration will likely address current inefficiencies.