- U.S. core CPI decreased to 2.8% in March 2025, below expectations.

- Lowest core CPI increase since March 2021.

- Potential impact on Federal Reserve’s rate hike decisions.

The U.S. Bureau of Labor Statistics reported that the core Consumer Price Index (CPI) annual rate for March 2025 decreased to 2.8%, below the market expectation of 3.0%. This marks the lowest increase since March 2021.

Economists suggest the drop in core CPI could lead the Federal Reserve to reconsider future rate hikes, potentially affecting economic growth strategies.

U.S. Core Inflation Hits Lowest Since 2021

The U.S. core CPI for March 2025 declined further to 2.8% annually, and 0.1% monthly, surprising the market. Published by the Bureau of Labor Statistics, this reflects the lowest core CPI since March 2021, indicating a slowdown in inflation trends.

The decline in core inflation may prompt the Federal Reserve to pause interest rate hikes. Key affected sectors included energy prices, which saw a significant 6.3% drop month-over-month. This change is expected to influence monetary policy considerations.

Market reactions to the CPI report included a decline in Treasury bond yields, highlighting reduced inflationary pressures. Stock futures suggested a cautious investor stance, hinting at a precautious market sentiment amid these developments.

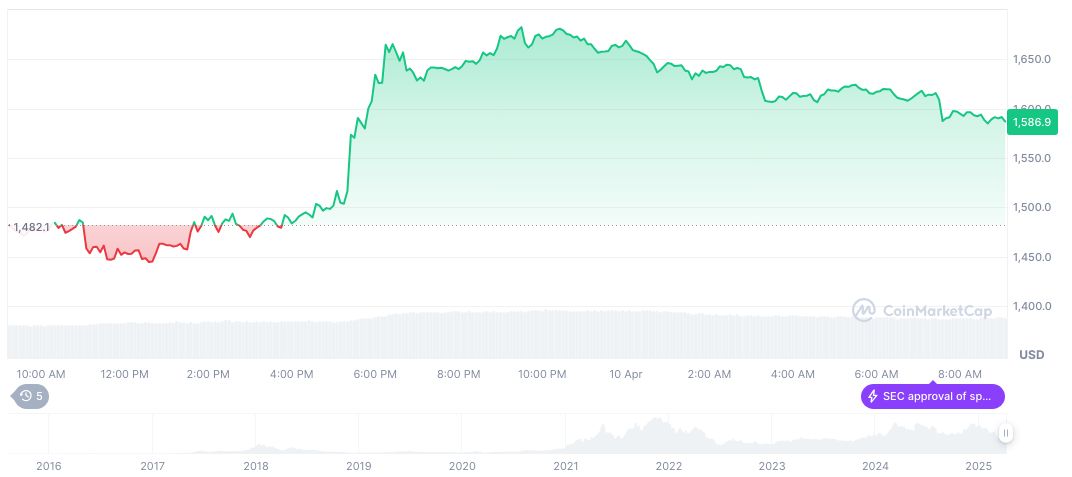

Ethereum Faces Market Pressure Amid Inflation News

Did you know? The last comparable slowdown in core CPI was in March 2021, coinciding with a dovish monetary policy shift by the Federal Reserve, potentially impacting current economic strategies similarly.

Ethereum (ETH) reportedly traded at $1,530.21 with a market cap of $184.67 billion, currently holding a 7.28% market dominance, based on data from CoinMarketCap. The 24-hour trading volume reached $21.18 billion, signaling a 47.37% drop. Ethereum’s price declined by 8.72% in the past 24 hours, reflecting broader market declines.

Insights from Coincu research suggest potential stabilization in bond markets alongside reduced inflationary pressures. This environment may provide relief for inflation-sensitive assets. The possibility exists for technological advances to facilitate further adaptations in financial markets, given historical trends and current data conditions. Ethereum’s price declined by 8.72% in the past 24 hours, reflecting broader market declines.