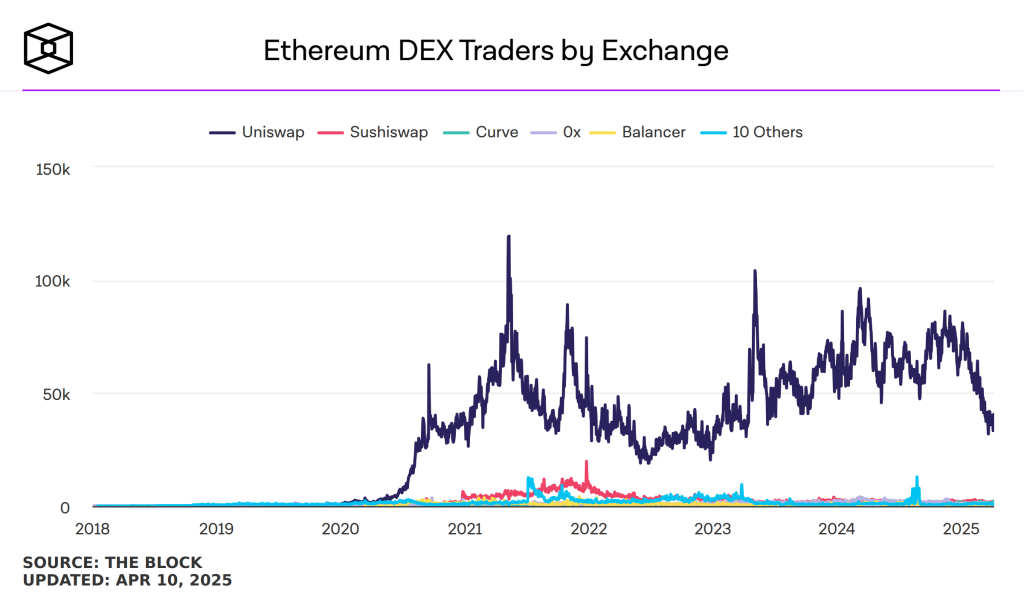

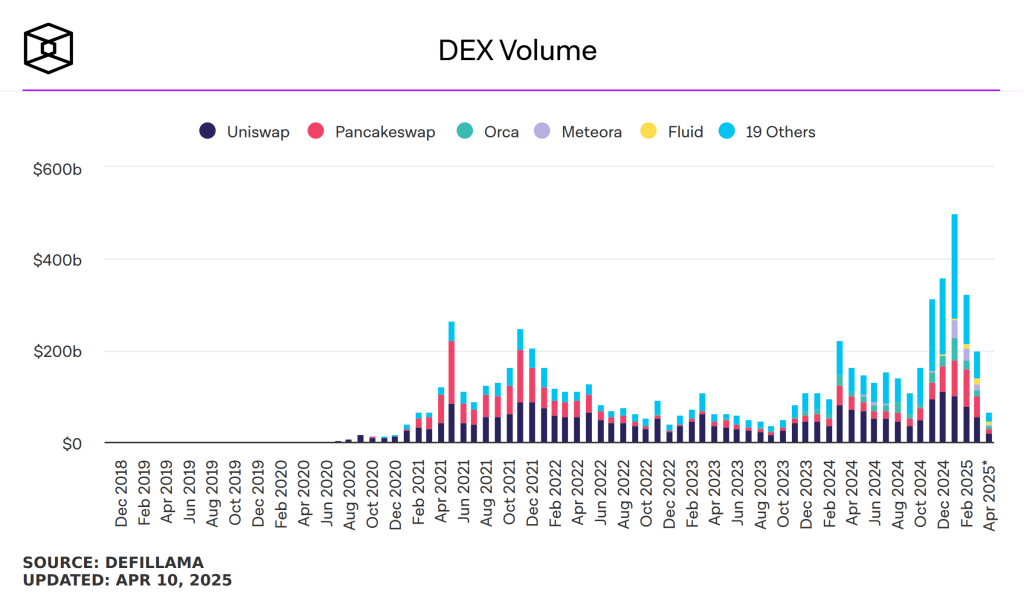

| Key Points: – Ethereum’s DEX volume declines: Trading volume on Ethereum-based decentralized exchanges (DEXs) has dropped 50% since December 2024, reflecting reduced market activity. – User participation falls: Daily active wallets on Ethereum DEXs have decreased to 40,000, marking a 12-month low from the December peak of 95,000 wallets. – Traders seek cost-efficient alternatives: High transaction fees push traders towards Layer 2 solutions like Base, which offer lower costs and faster transactions |

Ethereum’s DEX volume has dropped 50% since December 2024 as traders migrate to Layer 2 solutions due to high fees and declining on-chain liquidity.

The drop highlights growing pressure on Ethereum’s DEX ecosystem as market participation weakens and cost efficiency takes precedence. The shift toward Layer 2s could redefine Ethereum’s dominance in the DeFi landscape.

These trends coincide with a broader decline in crypto activity, driven by investor caution and on-chain inefficiencies.

Ethereum’s DEX Volume Faces Sharp Decline

Ethereum’s decentralized exchange (DEX) ecosystem is experiencing a significant contraction. Trading volume has plummeted to $57 billion in March 2025—a stark 50% drop from the December 2024 peak of $112 billion.

Simultaneously, user engagement has followed suit. The number of unique trading wallets has fallen to 40,000, reaching its lowest point in a year. This decline highlights reduced market enthusiasm and a shift in trader behavior.

Despite the downturn, Uniswap remains the dominant Ethereum DEX, overshadowing competitors like SushiSwap, which now records only 2,000 daily active wallets. However, even Uniswap is experiencing declining activity as traders seek alternatives.

Layer 2 solutions such as Base are emerging as attractive substitutes, offering lower transaction fees and faster execution. This shift indicates that traders are not abandoning decentralized finance (DeFi) but are prioritizing cost efficiency.

Market Slowdown and Rising Costs Impact Activity

The slump in Ethereum’s DEX volume aligns with a broader cooling of the crypto market. Bitcoin (BTC) and Ethereum (ETH) have struggled under macroeconomic uncertainty, leading to reduced speculative interest.

Unlike past cycles, where heightened volatility drove DEX trading, the current downtrend has resulted in capital outflows from on-chain platforms. High gas fees on Ethereum further exacerbate the issue, discouraging frequent trading.

Ethereum’s DEX volume decline underscores a changing market landscape. While Ethereum still holds a strong presence in DeFi, the rise of Layer 2 platforms suggests a growing preference for more efficient trading environments.

Moving forward, Ethereum’s ability to address scalability and fee concerns will be critical in determining whether its DEX ecosystem can maintain long-term dominance.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |