- SEC proposes a sandbox for innovative blockchain projects.

- Freedom for exchanges to innovate with tokenized securities.

- Potential increase in crypto market activity and volume.

Mark Uyeda, acting chair of the SEC, revealed plans to establish a regulatory sandbox for digital assets, enabling exchanges like Coinbase to explore new avenues, including tokenized securities trading.

The initiative could redefine blockchain innovation in the U.S., offering exchanges a chance to trial new models with reduced regulatory burdens.

SEC’s New Regulatory Sandbox to Foster Blockchain Innovation

Mark Uyeda of the SEC disclosed a regulatory sandbox approach during a recent roundtable, encouraging blockchain advancements by easing restrictions on crypto exchanges. This setup promises a “time-limited, conditional exemption relief framework” to innovate in tokenized securities trading. Industry stalwarts, including Coinbase and Uniswap Labs, participated in discussions supporting this move.

A key change with this approach is the relaxation of regulatory constraints, fostering an open environment for creating and testing digital asset solutions. By offering exemption relief, the SEC aims to boost technological growth and stimulate market participation without fear of premature enforcement actions.

Industry reactions have been overwhelmingly positive, with stakeholders appreciating the SEC’s attempt at creating a supportive setting for innovation. Mark Uyeda emphasized the importance of innovation by stating, “I encourage market participants developing new ways to trade securities using blockchain technology to provide input on what exemptions may be applicable.” Hester Peirce, SEC Commissioner, reaffirmed the need for a “clear, sensible, and fair path”.

U.S. Market Poised for Growth Amid SEC Sandbox Plans

Did you know? The UK tested similar digital securities sandboxes, paralleling the SEC’s initiative, offering insights into potential U.S. market outcomes.

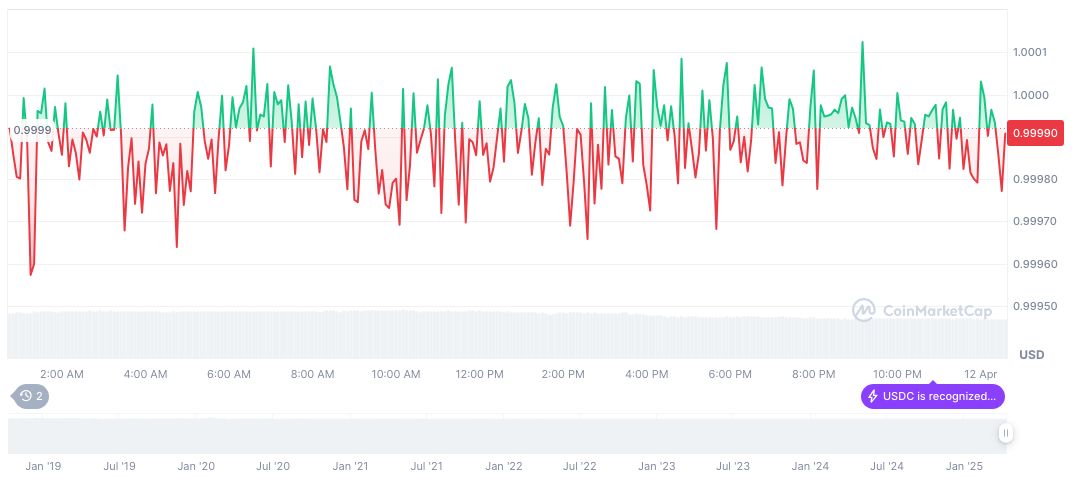

USDC, currently valued at $1.00, holds a market cap of $60.07 billion and a market dominance of 2.28%, according to CoinMarketCap data on April 12, 2025. Trading volume fell by 15.61% to $11.016 billion. In the past 90 days, USDC saw a price change of 0.01%.

Coincu analysts suggest that regulatory sandboxes could accelerate DeFi integration of tokenized securities, increasing liquidity and expanding governance token use. These actions may strengthen the U.S. position as a leader in blockchain innovations if successful.