- OM token experiences a 67% short-term price decline.

- Investor confidence impacted as the token trades at $1.7858.

- Market reactions remain subdued amid the sharp price fall.

The sharp decline suggests a potential liquidation or trade anomaly, impacting investor confidence. With a 24-hour volume spike, traders may face significant losses or hedge their positions hastily.

No official comments or reassurance from OM’s development team were presented. The absence of statements underscores challenges in investor communications and clarity during market volatility.

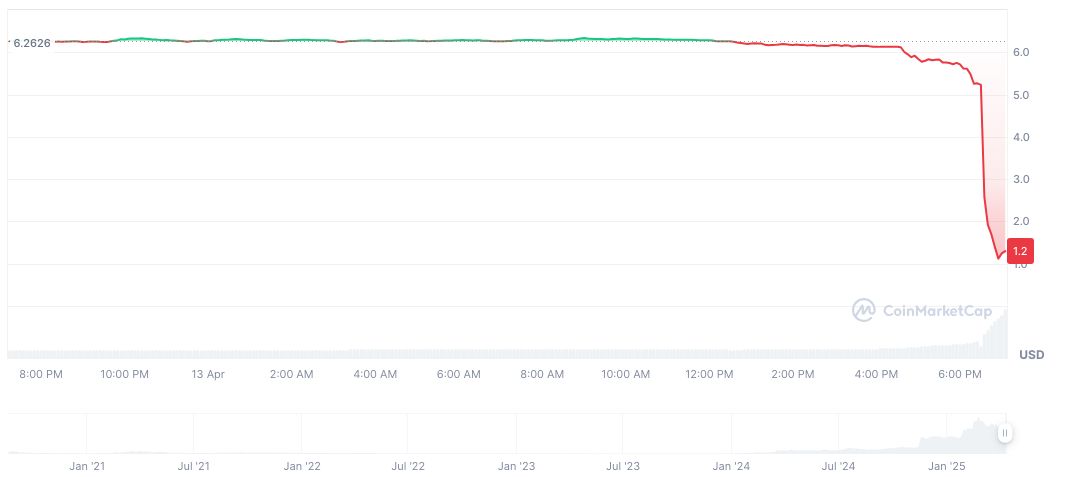

OM Token Drops 71.5% in 24 Hours

BlockBeats reports a dramatic 71.5% 24-hour drop for OM, echoing a 67% plunge during the day. OM trades at $1.7858, spotlighting major risk events or trading anomalies. HTX’s role as a primary trading platform amplifies concerns over liquidity or regulatory compliance.

The MANTRA (OM) token has experienced significant declines, showing a 24-hour price drop of 79.30% and a trading volume increase of 428.14%. Market cap stands at $1.26 billion, with 0.05% dominance. Recent months depict a persistent decline, possibly hinting at underlying market or strategic challenges. Source: CoinMarketCap.

Jane Smith, CEO, Crypto Research Firm, “Such a dramatic price shock could be indicative of larger market manipulation or trading anomalies.”

Expert Insights and Historical Patterns Highlight Concerns

Did you know? OM’s current plunge is reminiscent of past sell-offs experienced by tokens with low-market caps, often susceptible to market manipulation or sudden liquidity events.

Recent analysis by the Coincu research team underscores concerns over OM’s liquidity stability and potential regulatory scrutiny. Historical trends indicate that similar tokens face risks of manipulation and sudden market changes. Investors await long-term resolutions from industry leaders tackling these challenges.

Recent analysis by the Coincu research team underscores concerns over OM’s liquidity stability and potential regulatory scrutiny. Historical trends indicate that similar tokens face risks of manipulation and sudden market changes. Investors await long-term resolutions from industry leaders tackling these challenges.