- A security vulnerability in Angle Protocol’s frontend was announced, impacting market trust.

- User caution advised following Supremacy founder Yi’s warning.

- Potential impact on liquidity and governance participation if not resolved.

Supremacy founder Yi raised concerns on April 13 about a vulnerability in the stablecoin protocol Angle Protocol’s frontend. Users have been cautioned to avoid any activity with it.

Yi’s message is significant due to potential impacts on market trust and liquidity risks. Historical parallels, such as BadgerDAO, suggest challenges ahead.

Vulnerability Alert: Yi’s Warning on Market Trust and Security Risks

Supremacy founder Yi publicly confirmed a vulnerability in Angle Protocol’s frontend. The alert, primarily broadcast via Twitter, emphasized user safety and potential exploit risks. “There is a vulnerability in the frontend of the stablecoin protocol Angle Protocol; please do not interact with it,” Yi warned. No direct response has been issued by Angle Protocol, increasing user concerns.

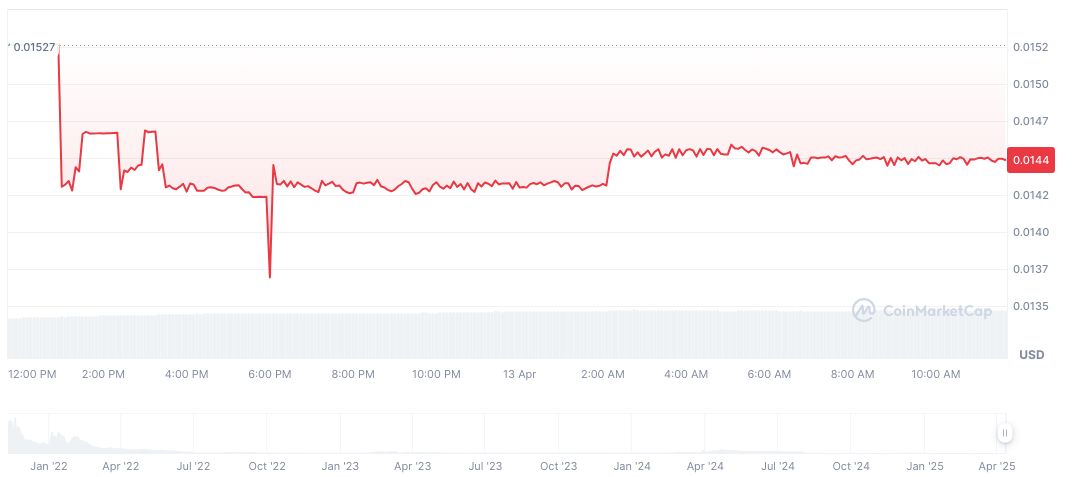

Angle Protocol’s position in the decentralized finance space adds a layer of intrigue due to its unique focus on stablecoins. Investors detected a drop in ANGLE token’s price by 5.09%, reflecting market anxiety. Without an official statement from Angle Protocol, user trust remains compromised.

Cryptocurrency communities typically react to such warnings with heightened caution. Prominent industry figures have yet to engage in dialogue, although Yi’s message may inspire broader security discussions within DeFi circles.

Market Response: ANGLE Price Impact and Regulatory Scrutiny Insights

Did you know? Insert a historical or comparative fact related to this topic.

According to CoinMarketCap, Angle (ANGLE) is priced at $0.01 with a fully diluted market cap of $14.79 million. Over the past 24 hours, trading volume reached $79,062.12, despite a 7.14% decline, demonstrating market volatility. Recent price changes reveal a 1.61% rise over 24 hours, yet a 16.20% drop in 90 days. Data remains crucial for stakeholder analysis.

Insights from Coincu research indicate that unresolved vulnerabilities could prompt regulatory scrutiny, potentially affecting DeFi’s integration within broader financial systems. Investor confidence is heavily contingent upon robust security measures, with governance participation likely to decrease without timely frontend fixes.