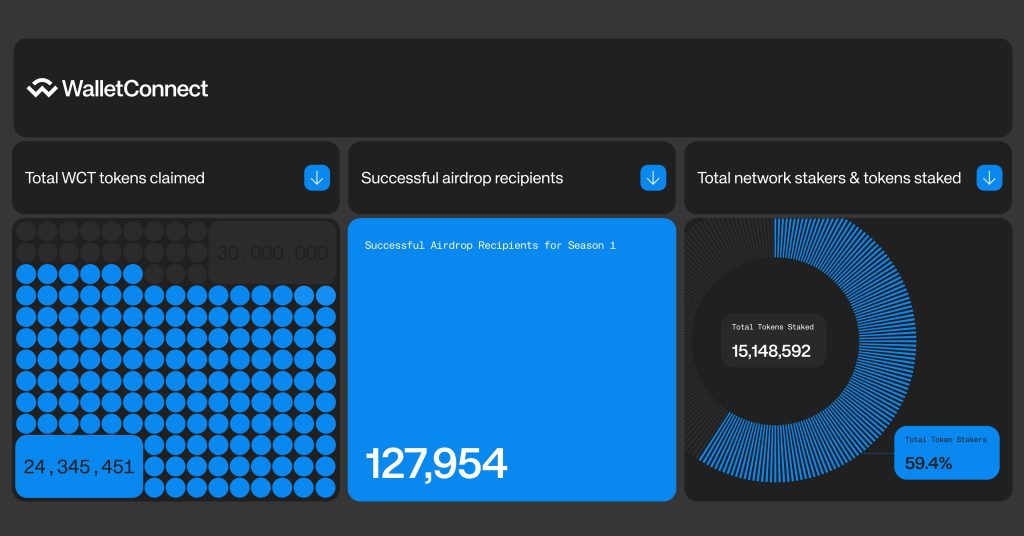

| Key Points: – 24M $WCT airdropped to 125K users, 60% staked within weeks. – 127M+ $WCT staked across 286K+ wallets powers governance and rewards. – UX Council vote passed with 96.1% approval from 5,755 $WCT voters. |

Launched in November 2024, WalletConnect’s Season 1 airdrop rewarded 125,000+ users, developers, and contributors with 24 million WCT, of which over 60% was staked within weeks.

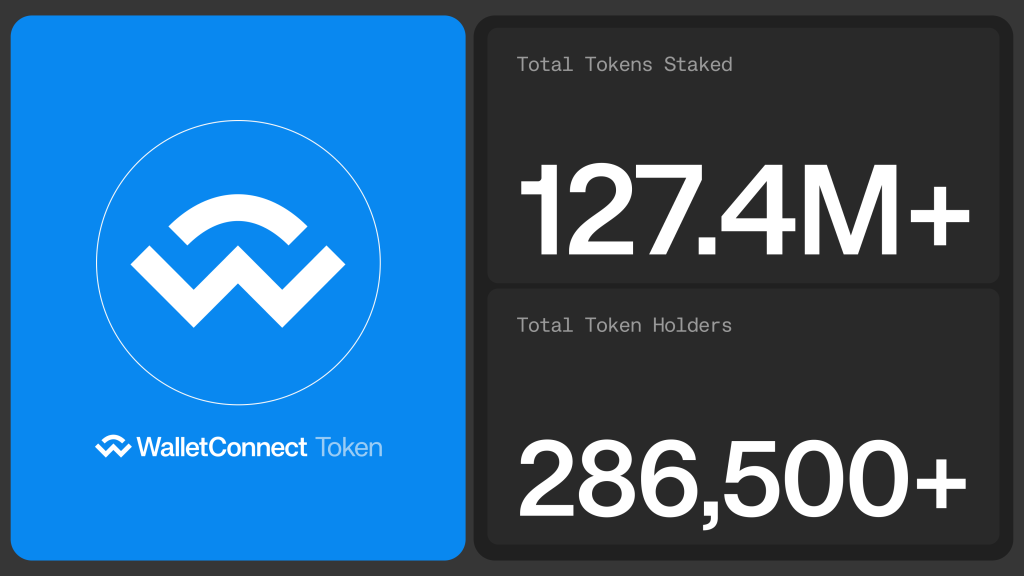

Staking, which is required for voting, submitting proposals, and receiving rewards, has surpassed 127M WCT across 286,500+ wallets. February’s UX Council vote marked a governance milestone, with 96.1% approval from 5,755 voters shaping product feedback and upgrades.

Interactive campaigns with Ledger, OKX, and other partners continue to drive engagement as WalletConnect progresses through its multi-phase DAO roadmap, transitioning protocol control to its growing global community.

Season 1 Airdrop: Scoring, Claiming, and Eligibility

In November 2024, the WalletConnect Foundation initiated Season 1 of the WCT airdrop, marking the protocol’s first major community distribution of governance tokens.

The distribution followed a merit-based model, targeting various contributors:

- Users who had previously connected wallets using WalletConnect

- Wallet and application developers generating transaction volume

- Open-source contributors via GitHub and Gitcoin

- Verified early supporters, filtered for Sybil resistance

Airdrop Summary:

- 125,000+ claimants

- 24 million+ WCT distributed

- Over 60% of claimed tokens staked within several weeks

- Claim deadline: January 3, 2025

This distribution established the foundation for decentralized governance, aligning token distribution with long-term engagement.

WalletConnect Staking System Explained

Staking is a central feature in WalletConnect, serving multiple functions: network security, reward distribution, and governance participation.

Staking Mechanism:

- Durations: 1 to 104 weeks (2 years max)

- Longer lock-ups yield higher rewards

- 7-day unbonding period upon expiration

- Optional auto-locking for uninterrupted staking

As of March 2025:

- 127.4 million WCT staked

- Over 286,500 individual WCT holders

- Staking is required for submitting or voting on governance proposals, as well as receiving ecosystem rewards

This structure fosters long-term alignment between stakeholders and the WalletConnect protocol.

UX Council Vote & Snapshot Participation

In February 2025, the WalletConnect community engaged in a major governance event: voting on the establishment of a User Experience (UX) Council.

Voting Results:

- 5,755 voters participated

- 2,051,393 stake-weighted votes cast

- 96.1% voted YES, approving the Council

The UX Council is now responsible for defining product standards, shaping upgrades, and facilitating feedback collection.

Governance activities are coordinated through:

- Snapshot for token-weighted voting

- Discourse for proposal discussions

- WCT staking as a prerequisite for participation

Questing Campaigns with Ledger, OKX, and More

To incentivize ongoing engagement, WalletConnect launched multiple interactive campaigns targeting both new and returning users:

- Ledger collaboration: Airdropped WCT to Ledger users

- OKX Cryptopedia S30 Quests: Distributed tokens for completing app tasks

- Community quests: Recurring events rewarding power users for sustained activity

These campaigns aim to:

- Broaden user participation

- Drive interaction with integrated dApps

- Ensure WCT reaches real, active participants

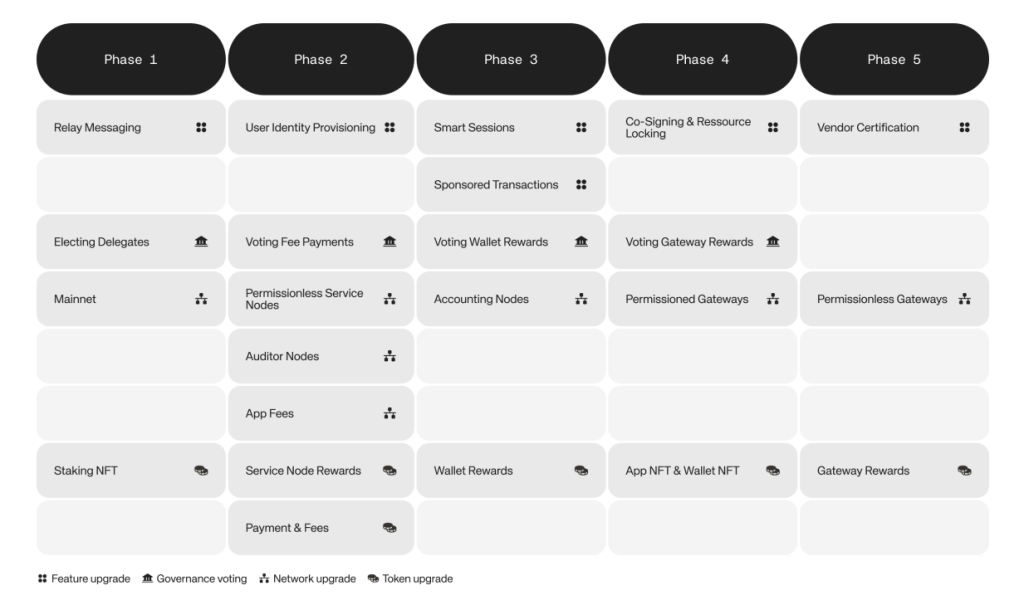

The Road to DAO: Governance Phases and Community Role

WalletConnect is in the midst of a multi-phase roadmap to transition control from the Foundation to a fully decentralized DAO structure.

Governance Roadmap:

- Phase 1 – Foundation and Reown manage operations

- Phase 2 – Establishment of Councils (UX, Tech, Partnerships)

- Phase 3 – Community begins submitting proposals

- Phase 4 – Council-led technical decisions

- Phase 5 – Full control over budget, upgrades, elections

Progression between phases is determined by on-chain governance. By staking WCT, holders gain direct voting rights over:

- Protocol upgrades

- Reward distributions

- Fee structures

- Strategic development decisions

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |