- The $OM token plummeted due to forced liquidations.

- Centralized exchange activities heightened panic sales.

- Need for improved regulations and market safeguards.

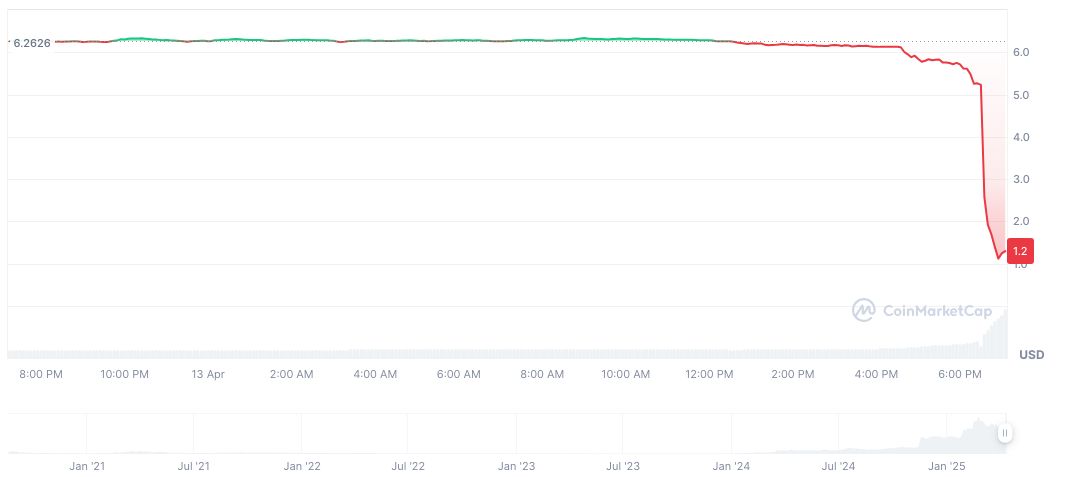

The MANTRA token, $OM, saw a significant value drop on April 14, 2025, falling by 90% due to forced liquidations during low liquidity periods.

The incident highlights vulnerabilities in DeFi markets, emphasizing liquidity risks and the systemic issues facing decentralized finance.

$OM Token Suffers Due to Leveraged Liquidations

Large leveraged positions were force-liquidated, causing the $OM token to drop rapidly. The management team, led by John Patrick Mullin, emphasized that neither MANTRA nor its investors engaged in token sales. “The crash was triggered by forced liquidations on centralized exchanges during low-liquidity hours and denied that the team or investors sold tokens,” said Mullin.

Shorooq Partners, a major investor, reiterated its commitment to MANTRA and its vision for real-world asset tokenization. Large transfers of $OM to centralized exchanges days before the crash amplified market pressure. Trading volume spiked from $70 million to $700 million, signaling panic sales.

Community concerns were evident, with discussions on forums like Telegram becoming temporarily inaccessible, leading to further distrust.

Official statements denied insider sales, and key figures have promised improved transparency and security measures.

Historical Parallels and Market Expert Analysis

Did you know? The $OM token’s sharp 90% decline mirrors the Terra LUNA crash, showing similar liquidity and collateralization issues.

According to CoinMarketCap, as of April 14, 2025, the MANTRA ($OM) token plummeted to $0.72, exhibiting an 88.56% 24-hour price drop. The market cap fell to formatNumber(697465504, 2) with a 24-hour trading volume of formatNumber(2498122191, 2), a 3399.86% surge.

Experts at Coincu suggest the crash necessitates improved market safeguards. They urge stronger regulations to prevent future manipulations, emphasizing the critical need for robust safeguards in decentralized finance sectors.