- OKX prepares reports following 90% crash in OM token value.

- CEO Xu labels crash a major scandal.

- Forced liquidations trigger $5.5 billion market value loss.

OKX’s CEO labels the OM token flash crash a significant event for the crypto industry, promising detailed reports. The incident wiped out $5.5 billion from the market.

This event is crucial as it highlights issues of transparency and market stability, prompting reactions from major stakeholders.

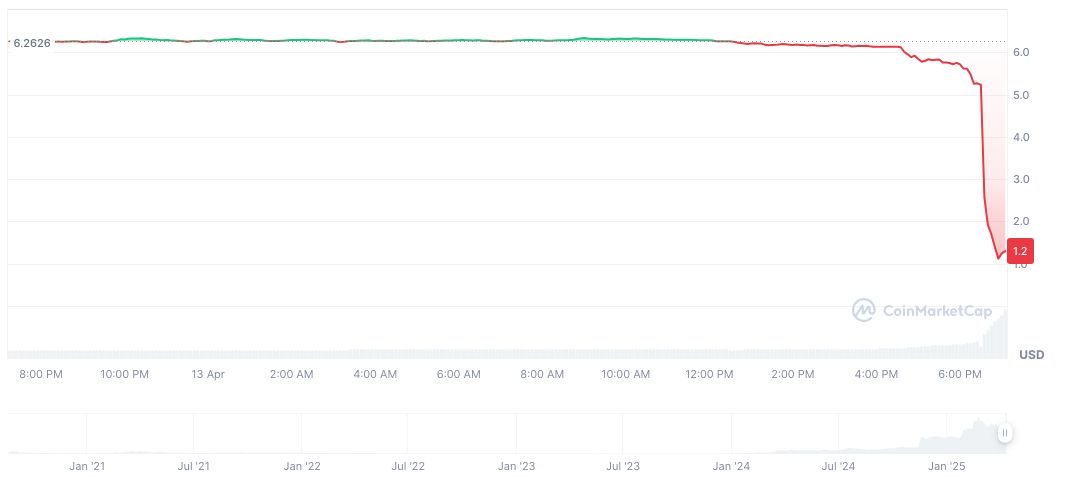

OM Token Faces 90% Value Decline Amid Scandal

The OM token crash occurred rapidly, with its value plummeting by 90%. OKX CEO Star Xu labeled the event a “major scandal” and vowed to prepare detailed reports verifying the incident’s cause. Here’s Star OKX’s tweet about recent market movements mentioning the situation. Although John Patrick Mullin, CEO of MANTRA DAO, identified forced liquidations by centralized exchanges as a catalyst, he denied any internal sales.

Funding entities, including Laser Digital, clarified their lack of involvement, emphasizing long-term investment strategies. The crash affected related DeFi markets, causing significant losses. Market responses from platforms like Binance included updates to risk controls.

“The timing and depth of the collapse suggest that account positions were closed abruptly without adequate warning or notification, during low liquidity periods, indicating negligence or deliberate market positioning by exchanges.” — John Patrick Mullin, CEO, MANTRA DAO

Market Cap Loss of $5.5 Billion Spurs Calls for Regulation

Did you know? In January 2024, OKX’s native token, OKB, suffered a 50% flash crash due to liquidations, leading to user compensation and revised controls.

The sudden drop in MANTRA (OM) token price resulted in an 88.73% decline over 24 hours, with a trading volume surge of 3470.05%. This crash erased $5.5 billion from OM’s market cap, now at $673.32 million as reported by CoinMarketCap.

Coincu analysts predict tighter regulatory scrutiny of exchange practices and potential shifts in the technological aspects of tokens. This situation could lead to enhanced measures suppressing volatility and ensuring investor confidence.