- U.S. Treasury Secretary Yellen highlights unsustainable China tariffs.

- Potential major tariff deal signaled.

- Market uncertainty influenced by U.S. tariff policies.

U.S. Treasury’s Yellen declares current China tariffs unsustainable, hints at future negotiations for reduction.

Janet Yellen visited Buenos Aires, discussing tariffs and economic policies with Argentine President Fernández.

Yellen’s Economic Strategy Amid China Tariff Talks

During her visit to Buenos Aires, Janet Yellen met with President Alberto Fernández to discuss bilateral trade and fiscal challenges. Yellen emphasized the unsustainability of current U.S. tariffs on China, signaling a need for serious renegotiation.

Potential shifts in U.S. trade policy could see tariff rates reduced, aiming to ease consumer burdens and inflation. Yellen indicated that rapid negotiations might be necessary with allied countries to equalize trade agreements.

“High tariffs could adversely affect consumer spending and inflation,” highlighting potential shifts in U.S. trade policy during her visit to Argentina.

Tariff Changes and Digital Market Influences

Did you know? Past tariff decisions, including those from the Trump era, have deeply affected U.S.-China trade relations, impacting traditional and emerging markets alike.

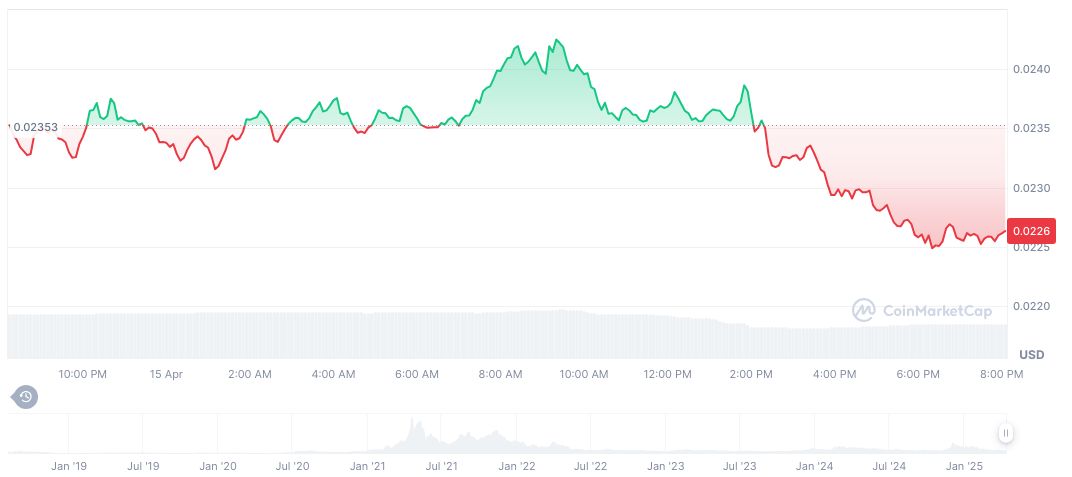

According to CoinMarketCap, VeChain (VET) is priced at $0.02 with a market cap of $1.95 billion. Recent decreases include a 3.83% lower price over 24 hours, while 7-day gains stand at 15.55%, showcasing volatility.

The Coincu research team notes that potential tariff reductions could bolster cross-border economic interoperability, affecting global trade networks. Historical trends suggest a decrease in tariffs might stimulate market confidence and favor tech-driven supply chain solutions.