- Leadership tensions rise as Trump pressures Powell on interest rates.

- Equity markets and cryptocurrencies face heightened volatility.

- Recent tariff changes compound market instability.

Jerome Powell’s role as Federal Reserve Chairman faces scrutiny from President Donald Trump, who is publicly urging Powell to resign. Trump’s comments reflect growing political tensions with economic implications.

Powell’s stance on maintaining interest rates for stability clashes with Trump’s urging for rate cuts. These calls coincide with market volatility attributed to tariff adjustments and political dynamics.

Trump Escalates Criticism Amid Fed Independence Concerns

President Trump has escalated his discontent with Federal Reserve Chairman Jerome Powell, suggesting his resignation through a Truth Social post. Powell’s tenure stability reflects the legal framework safeguarding Fed leadership, as he approaches the end of his term in May 2026. Further agitation has been voiced by Treasury Secretary Scott Bessent in private discussions regarding market risks linked to political pressure on Powell, aligning with White House concerns.

The call for Powell’s resignation comes amidst ongoing market instability spurred by political pressure and tariff-induced volatility. Treasury concerns highlight potential repercussions on investor sentiment if Fed independence is perceived as compromised, impacting the U.S.’s standing in global finance.

This would be a PERFECT time for Fed Chairman Jerome Powell to cut Interest Rates. He is always ‘late,’ but he could now change his image, and quickly … CUT INTEREST RATES, JEROME, AND STOP PLAYING POLITICS!

Market Volatility Mirrors Past Political Conflicts

Did you know? U.S. equities and crypto markets previously saw similar volatility during Trump’s first term when pressure on Powell intensified, affecting investor confidence.

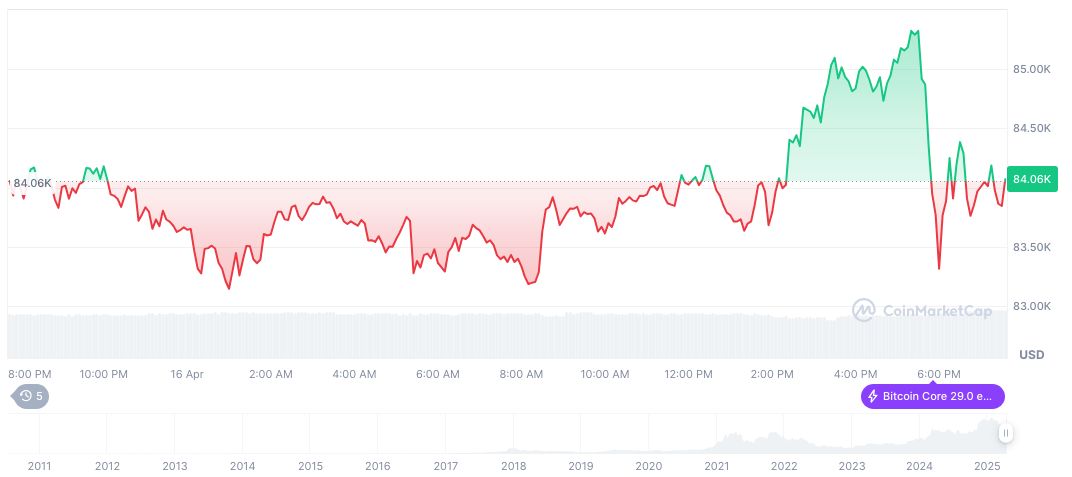

According to CoinMarketCap, Bitcoin stands at $84,427.42, with a market cap of formatNumber(1676106823682.21, 2), covering 63.31% market dominance. In 24 hours, it saw a -0.16% price shift, while over 90 days, a -18.93% drop has occurred. Trading volumes are down by -1.65%.

The Coincu research team identifies political and macroeconomic dynamics as key drivers behind current volatility. They foresee longer-term stabilization, contingent on clear regulatory outcomes and tariff resolutions. Historical trends suggest potential for recovery, guided by fiscal policy adaptations and international trade adjustments.