| Key Points: – XRP ETF Approval gains momentum with superior liquidity and leveraged ETF launch. – SEC acknowledges multiple XRP spot ETF filings, with key decision due May 22. – Ripple’s legal resolution with the SEC removes a major regulatory hurdle. – Solana, Litecoin remain contenders but trail XRP in market depth and positioning. |

XRP ETF Approval appears more likely than for other altcoins, thanks to top-tier liquidity and a leveraged ETF launch boosting investor confidence.

Regulatory momentum for altcoin ETFs has accelerated in 2025, with XRP emerging as a standout due to its liquidity and cleared legal status. Analysts say the outcome of its pending SEC decision could shape the trajectory for altcoin-based ETFs more broadly.

XRP ETF Approval Gains Edge with Market Liquidity and Leveraged Product

According to a recent report by crypto analytics firm Kaiko, XRP has emerged as the frontrunner among altcoins vying for spot ETF approval in the U.S. Following the success of Bitcoin and Ethereum ETFs, the spotlight is now shifting to XRP – and Kaiko analysts point to two critical advantages: exceptional market liquidity and the launch of Teucrium’s 2x leveraged XRP ETF (XXRP).

The Teucrium’s 2x leveraged XRP ETF (XXRP), launched earlier this month, provides investors with twice the daily return of XRP by using futures and swap agreements.

Remarkably, this makes XRP one of the first assets to have a leveraged ETF before a spot product – a rarity noted by Bloomberg ETF analyst Eric Balchunas. The presence of this riskier financial product strengthens the case for XRP ETF approval, suggesting the spot version poses comparatively less risk.

Legal Clarity and Exchange Activity Fuel Investor Confidence

XRP’s growing dominance isn’t just driven by financial innovation. The resolution of Ripple’s long-standing legal battle with the U.S. Securities and Exchange Commission (SEC) has significantly improved its regulatory standing. Ripple CEO Brad Garlinghouse recently confirmed that while a negotiated resolution is still pending, the main legal confrontation has concluded.

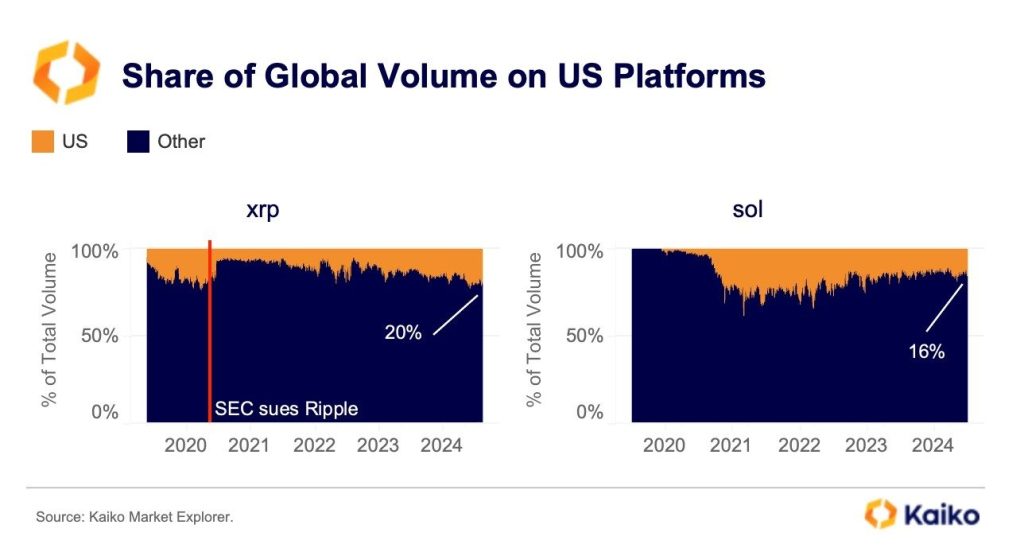

This legal clarity has led to a rebound in XRP trading on U.S. exchanges, with its spot volume reaching the highest levels since the lawsuit began in 2021. In contrast, Solana – a major contender in the altcoin ETF race – has seen its U.S. market share shrink to just 16%, down from 25–30% in 2022.

SEC Filings and Market Depth Highlight XRP’s Leading Position

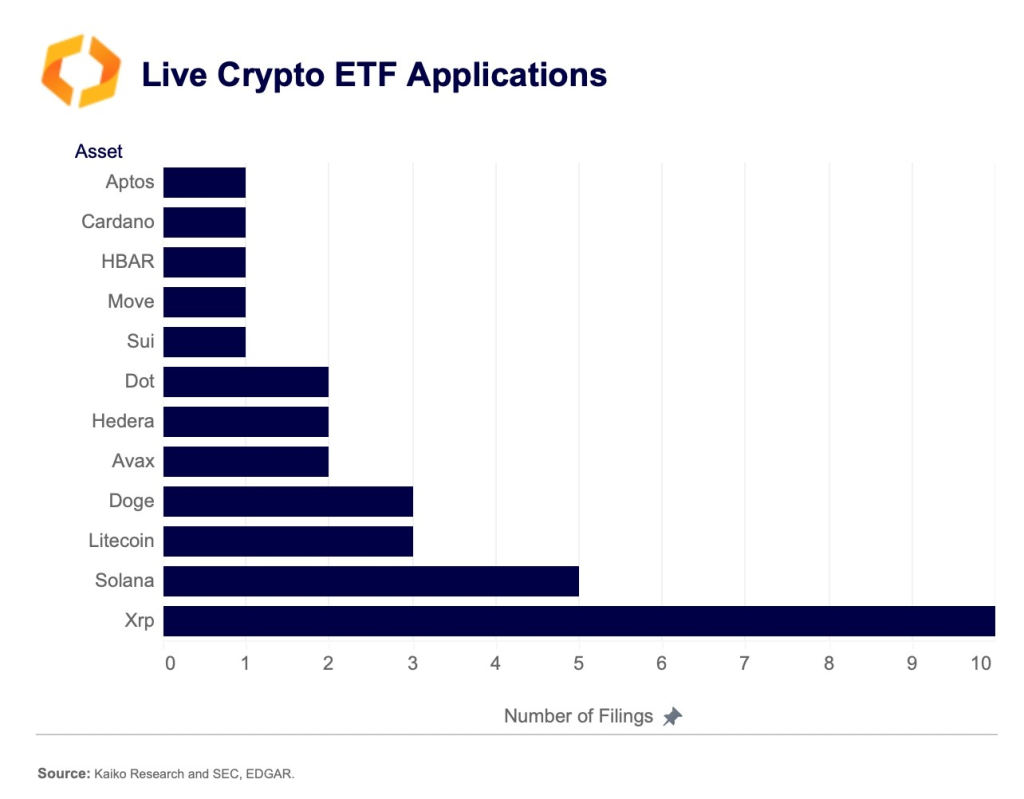

Kaiko’s data shows that XRP leads all other altcoins with 10 active spot ETF filings, followed by Solana, Litecoin, and Dogecoin. Its average 1% market depth – a measure of liquidity – is the highest among altcoins, which is vital for building efficient ETF structures. Analysts argue that this positions XRP well ahead in the regulatory queue for XRP ETF approval.

Although XRP lacks a CME futures market like Solana and most of its volume is offshore, its surging liquidity on American platforms could offset these concerns. The next milestone comes on May 22, when the SEC must respond to Grayscale’s XRP ETF application — a decision that could set the tone for future approvals.

Uncertainty Remains Despite Strong Fundamentals

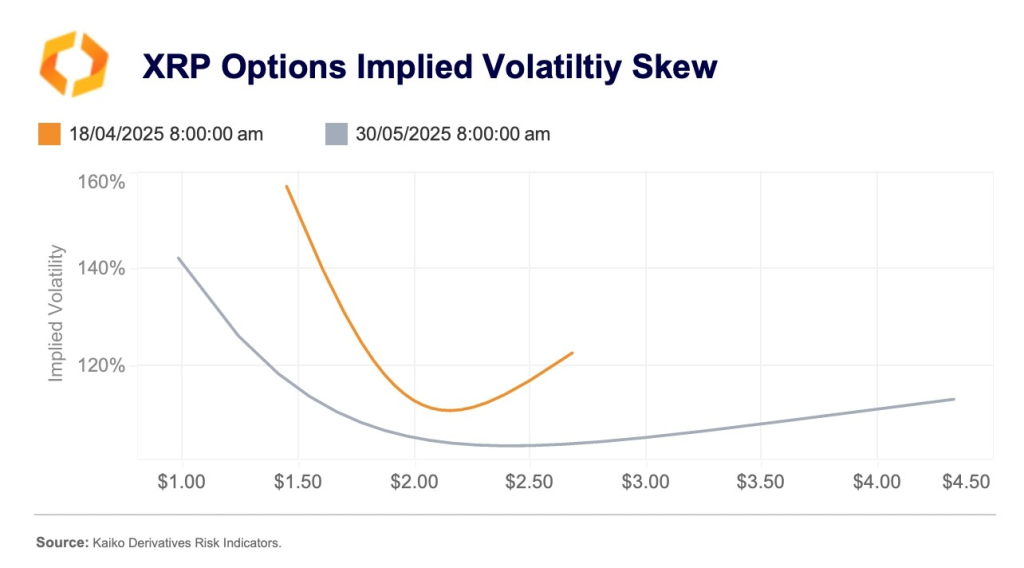

Despite strong progress, market sentiment around XRP remains mixed. Deribit’s options market shows a bearish skew, indicating continued demand for downside protection. Analysts suggest this may be tied to broader macroeconomic instability, such as U.S.-China trade tensions, rather than doubts about XRP ETF approval specifically.

Meanwhile, Canada is expected to approve Solana and potentially XRP ETFs, often serving as a bellwether for U.S. regulatory direction. Still, XRP’s favorable fundamentals, improved legal standing, and institutional interest, with firms like Grayscale, Bitwise, and VanEck filing applications, give it a strong lead in the race for the next spot ETF approval in the U.S.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |