| Key Points: – Ethereum may not survive the next decade, says Cardano founder Charles Hoskinson, citing deep architectural flaws. – He criticizes Ethereum’s accounting model, virtual machine, and consensus mechanism as outdated and self-inflicted weaknesses. – Layer-2 networks are “parasitic,” draining value from Ethereum without fixing its core scalability issues. – Hoskinson predicts a user migration to alternative ecosystems like Bitcoin DeFi unless Ethereum overhauls its governance and tokenomics. |

Ethereum may not survive the next decade, warns Hoskinson, unless the platform undergoes drastic reforms to its architecture and governance.

Cardano founder Charles Hoskinson, once a co-creator of Ethereum, has delivered a stark warning about Ethereum’s future.

In an AMA held on April 23, he forecast that Ethereum might not last another decade due to structural inefficiencies, governance rigidity, and a growing reliance on parasitic Layer-2 solutions. While acknowledging recent technical proposals like the move to RISC-V, Hoskinson argued that without a full-scale governance and tokenomics overhaul, Ethereum could be eclipsed by more agile competitors.

Ethereum May Not Survive the Next 10–15 Years

Charles Hoskinson pulled no punches in his latest critique of Ethereum, warning that the second-largest blockchain by market cap could collapse within the next decade. Citing a combination of outdated technology and poor governance, Hoskinson compared Ethereum to tech giants of the past like Myspace and Blackberry — early innovators that failed to adapt and were ultimately overtaken.

Hoskinson highlighted three critical flaws in Ethereum’s architecture: a flawed accounting model, an inefficient Ethereum Virtual Machine (EVM), and a suboptimal consensus mechanism. According to him, these issues not only hinder performance but also force Ethereum to rely heavily on Layer-2 solutions, which he believes siphon value rather than add to it.

“They have the wrong accounting model, the wrong virtual machine, and the wrong consensus model. All of these were self-inflicted wounds,” he said.

Layer-2s Called “Parasitic” as Ethereum’s Core Weakens

One of Hoskinson’s most controversial claims was his characterization of Ethereum’s Layer-2 ecosystem — including networks like Arbitrum and Optimism — as “parasitic.” He argued that these scaling solutions drain fees, staking yields, and user activity from the main Ethereum chain without addressing its core scalability problems.

“Layer-2s will continue to suckle out all of the alpha,” Hoskinson warned, predicting that this would lead to internal conflict and a slow erosion of Ethereum’s user base.

He further stated that Ethereum is facing a “hostile divorce” between its core network and Layer-2s, and without a clear path to integration or reform, the platform risks fragmentation and user exodus.

Hoskinson Supports RISC-V But Says It’s Not Enough

Despite his criticism, Hoskinson praised a recent proposal by Ethereum co-founder Vitalik Buterin to replace the EVM with the RISC-V instruction set. He called it a “smart move” that could improve performance while preserving compatibility with key programming languages like Solidity and Vyper.

However, he stressed that technical fixes alone won’t ensure Ethereum’s survival. The deeper issues — namely, governance inefficiencies and a flawed tokenomics structure — must also be addressed.

“Going to RISC-V is good, but the accounting model also has to be revised,” Hoskinson emphasized.

Ethereum at a Crossroads: Upgrades Coming, But So Are Competitors

With the Pectra and Fusaka upgrades scheduled for release later this year, Ethereum developers hope to reduce congestion and improve transaction speed. These enhancements follow the successful rollouts of The Merge (2022) and Dencun (2024), which previously helped the network regain competitiveness.

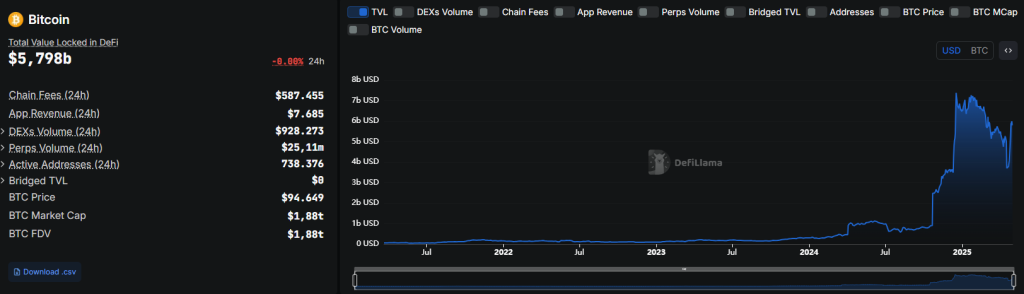

Still, Hoskinson remains skeptical. He believes that without systemic change, Ethereum will lose ground to more adaptive networks, especially Bitcoin’s emerging DeFi ecosystem, which he predicts will soon surpass Ethereum in total value locked (TVL).

Meanwhile, ETH has shown signs of short-term recovery in 2025, rising from $1,500 to $1,743 — a 9.3% gain in the past week. However, the broader outlook remains uncertain, with high gas fees, regulatory pressures, and declining institutional interest all weighing on Ethereum’s long-term trajectory.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |