- Citi is exploring stablecoin issuance amid potential regulatory changes.

- Exploration could reshape digital asset strategy.

- Potential regulatory changes may affect existing stablecoins like USDT.

Jinshi reported on July 15 that Citigroup (Citi) is exploring the possibility of issuing stablecoins, as confirmed by Citi’s CEO. This exploration signifies potential shifts in Citi’s digital assets strategy and may influence market dynamics amid evolving regulations.

Citi’s Stablecoin Plans: Industry Shifts and Market Implications

Citi’s consideration of stablecoin issuance highlights its engagement with future financial trends. Ronit Ghose, Citi’s Global Head of Future of Finance, emphasized the significant changes driven by regulatory developments. The exploration suggests major banks’ readiness to incorporate innovations like stablecoins if conditions allow.

Potential impacts include shifts in digital asset markets and monetary landscapes. According to Citi’s reports, stablecoin supply could reach between 1.6 trillion and 3.7 trillion by 2030, assuming regulatory frameworks support this growth. Such changes could impact stablecoin benchmarks like USDT and USDC. Citi’s predictions describe stablecoins expanding beyond crypto trading into the mainstream economy.

Market reactions reflect interest in how Citi’s actions could legitimize financial institutions’ roles in digital assets. Ronit Ghose remarked, “It feels like we’re at the takeoff point of something really quite big happening in stablecoins, given the impending legislation.”

Stablecoin Adoption: Historical Insights and Future Projections

Did you know? A critical turning point in stablecoin legitimacy was JPM Coin’s introduction, setting a precedent for institutional stablecoin adoption.

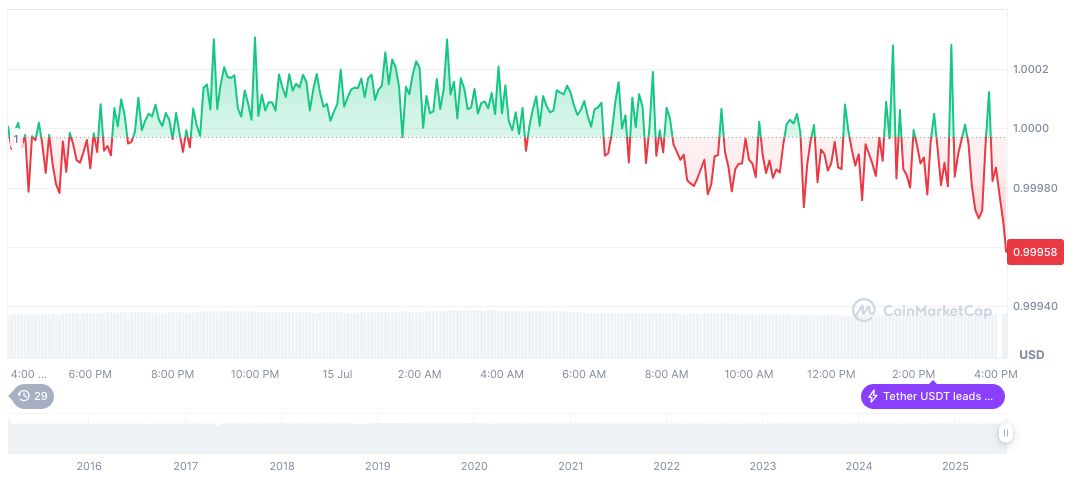

Tether USDt (USDT) remains pivotal in the crypto market. Trading at $1.00, it holds a market cap of 159,849,125,452 and a market dominance of 4.35%, according to CoinMarketCap. The 24-hour trading volume is 137,494,863,765, showing a 3.79% change.

Coincu research indicates Citi’s stablecoin adoption could accelerate digital finance shifts. Regulatory approval would likely increase stablecoin usage and encourage further institutional participation. Historical trends suggest banks issuing stablecoins could significantly affect global financial markets by 2030. For more insights on Citi’s discussions regarding the future of digital assets, consider their exploration of these financial innovations.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |