Celsius has fully paid off its debt to MakerDAO, unlocking about $456 million worth of wrapped Bitcoin. It is suffering from a potential $1 billion loss on its MakerDAO lending strategy.

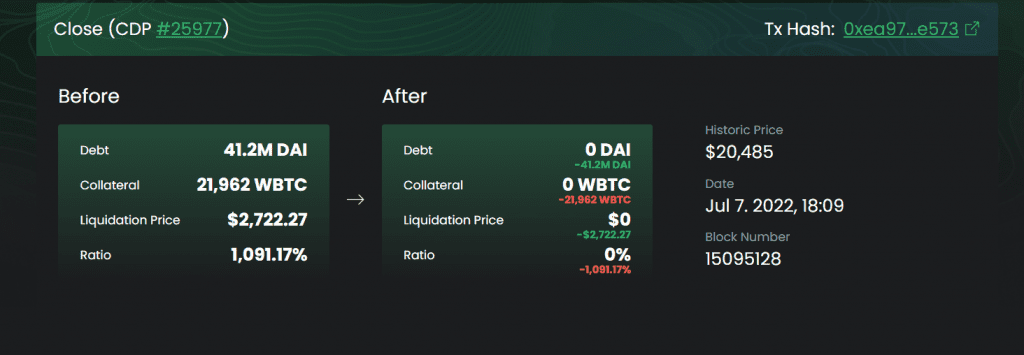

It looks like Celsius has finally paid off its debt to MakerDAO. Etherscan data shows that a wallet identified as belonging to the struggling crypto lending company fully repaid a $41 million debt in DAI today to free its collateral of 21,962 wBTC (worth around $456 million at press time). The wallet closed the MakerDAO vault shortly after paying off the debt.

When users submit collateral, a DeFi system called MakerDAO allows them to mint the DAI stablecoin. By utilizing chances discovered on DeFi protocols like MakerDAO, Celsius is a so-called “CeDeFi” platform that serves as a middleman for clients. Following the collapse of Terra, the market downturn, and the failure of the cryptocurrency hedge fund Three Arrows Capital, Celsiu and a number of other significant crypto lenders have experienced severe liquidity problems recently.

By the time complete reimbursement was made, the Celsius wallet was no longer seriously in danger of being liquidated (Bitcoin would have needed to reach roughly $2,722 to cause a liquidation), although data from DeFi Explore reveals that on May 12, a $700 Bitcoin move could have done it. After May 12, Celsius added wBTC and DAI many times to raise the collateralization ratio and avoid a liquidation.

Celsius’s difficulties

Over time, the vault’s overall worth increased by $1.8 billion, while the total value taken out was roughly $757 million. This is because Bitcoin’s price has fallen since Celsiu opened the vault, and because Celsius was compelled to maintain repaying DAI in order to prevent a liquidation. If Celsiu sold its wBTC holdings right now, it would incur a loss on its MakerDAO lending plan of roughly $1 billion. It’s interesting to note that quickly after being unlocked, Celsius sent 24,462.6 wBTC to the cryptocurrency market FTX.

Last month, Celsius controversially ordered a halt to customer withdrawals so that it could “better position itself to honor, over time, its withdrawal obligations.” Since then, it has hired consultants to assist it in managing a potential bankruptcy. The Securities and Exchange Commission, as well as officials from four different U.S. states, are currently looking into it.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join CoinCu Telegram to keep track of news: https://t.me/coincunews

Follow CoinCu Youtube Channel | Follow CoinCu Facebook page

Annie

CoinCu News

![Best Presale Coins To Buy Now: ZKP, Bitcoin Hyper, Remittix, NexChain, & DeepSnitch [Expert Analysis]](https://coincu.com/wp-content/uploads/2026/01/image-51-300x169.jpeg)