Continuing the series about candles, in this article we will introduce everyone to one of the important factors that I use to trade that is Resistance and Support zone. When trading some of us are always trying to find the bottom and top to be able to trade optimally, but this is not necessarily the best way. Because all technical methods are just predictions, and predictions cannot be 100% certain. Instead of guessing the bottom and top, based on these two zones, we can confirm the potential reversal zone. Let’s more details with Coincu.

What is the Resistance and Support zone?

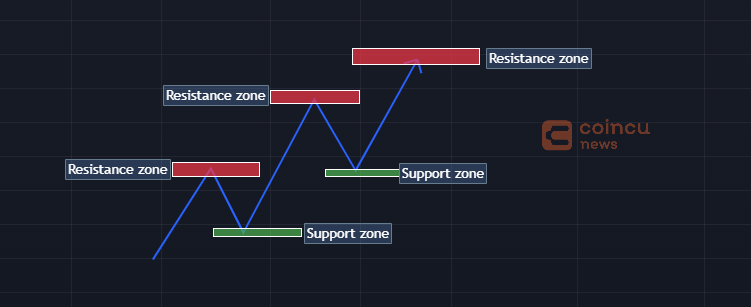

Resistance: There is resistance to stop the growth up the price, where in the past bears have prevailed or it could be a peak or an area that has been break. When the market goes up and corrects down again, resistance is the highest area it reached before it corrected down.

Support: There is a demand to buy the bulls prevail. When the market recovers, the lowest point it reaches before starting to rise again becomes support zone. As the market moves, these support and resistance levels continue to be created. Once a trend breaches support or resistance levels, the market moves in a particular direction, and new levels are formed.

How to Find Support and Resistance Zone?

Moving on practically applying the concepts. Essentially, we are trying to find the price level at which the currency’s price faces correction. Some indicators that help us with finding support and resistance lines are:

1. Trendline Indicator

A popular strategy is to fit a trendline across the price chart for a currency within specific time frames. In an ascending triangle formation, a trendline fitted to the high points marks the resistance while another trendline drawn across the low points reflects support – This is cross trendline.

Another way to determine the resistance and support zone from the trendline is the horizontal trendline. Connecting peak to peak and trough to trough we will have horizontal trendline.

2. Moving Average

A simple strategy that weighs in on the past trends of the currency and produces the average prices for a specified timeframe. Moving averages for different time frames like MA34 and MA89 can be used to find short-term and long-term support and resistance zones.

3. Fibonacci Retracement and Extension Levels

This is an advanced technique used to find areas of support and resistance using the Fibonacci retracement tool. Using the price history to form a sequence, Fibonacci retracement produces ratios for significant price points that can be leveraged to find support and resistance.

4. Channel

If we draw a line parallel to the uptrend line or the downtrend line, we will create a channel. This price channel helps to identify buying and selling points. Both the top and bottom of the price channel represent potential areas of support and resistance.

There are 3 types of channels:

- Uptrend channel

- Down channel

- Horizontal channel

How to trade with Support and Resistance zone

Trade when the price bounces

This method will be based on the price bounce back after hitting support or resistance zone. Many traders make the mistake of placing pending orders right at the support or resistance area and waiting for their trade to succeed. Of course it can be successful in some cases but this type of trading is about acknowledging that these support and resistance areas will hold without knowing if the price will reach them or not. That would be a risk.

To secure a trade, it is best to wait for a bounce from these zones before order. This will avoid the risk that the price will break the support and resistance areas. This case is to avoid to an order when the price has not shown any signs of turn.

Trade when the price breaks

Support/resistance breaks happen all the time on the financial markets. It is easy to find bullish / bearish opportunities using breaks. These opportunities are multiplied by the fact that they can happen on all units of time. At the break in theory, a support/resistance break is validated when the price closes below/above the level. However, the break must be clean and made on a long full candlestick (or with a long body) which marks an increase in the volumes (due to triggering numerous buy/sell stops).

Benefits Trading with Support and Resistance

- Help to formulate a better trading strategy: Crypto trading is famous for its notoriously high volatility. Beginner investors may incur significant losses initially without a strategic approach. The use of these levels allows traders to create a trading plan or strategy to counter-react the market volatility for greater profits. And to make the most logical decisions based on facts.

- Identify market trends: The ability to identify market trends is critical for any crypto trader. Support and resistance levels provide some insights into the ongoing market trends. For traders partaking in crypto futures trading, entering at the right time could mean significant profit potential.

- Provide critical entry and exit points: Traders use support and resistance indicators to identify the ideal entry and exit points. It helps an individual critically identify an opportunity to enter and exit a trade with a positive note. Traders also use long-term DMs (100-day, 200-day) for opening long positions.

- Risk management: It can act as robust risk management tools. For instance, a trader with a long position can open a stop-loss just below the support level, which will help the trader prevent significant losses in a downward rally. The same holds for a trader with a short position near the resistance level.

Verdict

Remember that support and resistance is not a line or a number, but an area. This will help you filter out false, noisy signals. It should also be remembered that if price breaks resistance, this resistance can become support, conversely, if price breaks support, then support can become resistance. Hopefully the above information will help you better understand the nature of trading as well as how to trade with resistance and support zone.

If you have any questions, comments, suggestions, or ideas about the project, please email ventures@coincu.com.

DISCLAIMER: The Information on this website is provided as general market commentary, and does not constitute investment advice. We encourage you to do your own research before investing.

Alan

Coincu Ventures