The Federal Reserve’s fundamental aims in monetary policy are price stability over time, as well as “maximum” sustainable economic production and employment. Pricing stability—avoiding excessive inflation rates or deflation over time—is critical because changing prices confuse the economy’s price signals and may lead to resource misallocation.

The Federal Reserve regularly examines and analyzes available inflation statistics in order to assess how well it is meeting its price stability mission. Economists often examine “core inflation,” which is typically defined as a specified measure of inflation that excludes the more volatile categories of food and energy costs.

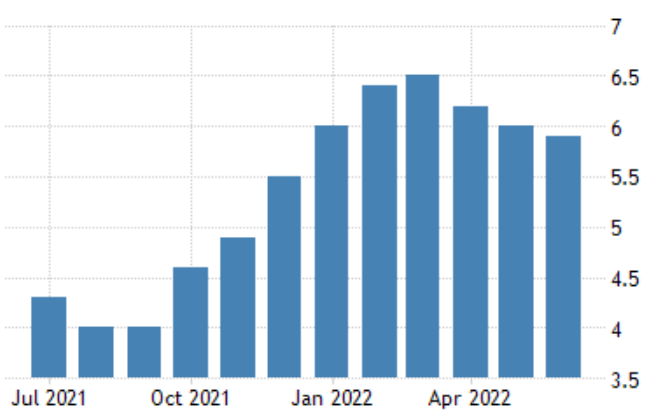

Year on year, the core inflation rate in June 2022 was 5.9 percent. That implies that, with the exception of food and energy, prices have increased by 5.9 percent since June 2021. The rate fell marginally from 6.0 percent in May, although it was 0.2 percent more than experts predicted.

What Exactly is Core Inflation?

Core inflation is a measure of inflation that accounts for increases in the prices of goods and services that do not include food and energy. Core inflation evaluates long-run inflation and eliminates things like food and energy since their prices fluctuate often owing to high volatility. This inflation simply takes into consideration fluctuations in the prices of goods and services.

In simple words, inflation is when you make a small loan apply due to the fact that the prices of goods and services that you use increase, while your income remains at the same level.

Why Are Food and Energy Prices Excluded?

Food and energy costs are excluded from this computation because they are too volatile or change too much. Food and energy are basics, so demand for them remains stable even as prices grow.

For example, although petrol costs may increase in tandem with the price of oil, you will still need to fill up the tank in order to drive your vehicle. Similarly, you will not put off purchasing food just because shop costs are increasing.

Furthermore, oil and gas are commodities that may be bought and sold on exchanges. Food is also exchanged, such as wheat, maize, and pork.

Energy and food commodity speculation cause price volatility, resulting in huge fluctuations in inflation numbers. A drought, for example, may have a significant impact on agricultural prices. The impacts on inflation may be transitory, implying that the market eventually corrects itself and returns to a balanced condition. As a consequence, food and energy costs are not included in the computation of core inflation.

What is the Significance of Core Inflation?

In general, core inflation is seen as a measure of an economy’s long-term inflation. Core inflation is often calculated using the consumer price index (CPI) and the core personal consumption expenditures index (PCE). Food and energy products, which are usually susceptible to price fluctuation, are removed from the computation. Prices of products and services fluctuate the least since there are a few key elements that influence them.

The Following Points Emphasize the Significance of Core Inflation:

- Core inflation is a measure of an economy’s long-term inflation.

- This inflation demonstrates the connection between consumer income and the costs of goods and services. In the sense that as the prices of goods and services rise, consumers’ buying power falls since the value of their income is less than the rise in prices of goods and services.

- Core inflation offers an accurate representation of an economy’s inflation dynamics.

How to Calculate the Core Inflation Rate

In 2012, a new measure of core inflation was introduced; it is similar to the old measure in that the Federal Reserve chose to use the PCE index rather than the CPI index. The Federal Reserve stated that, unlike the consumer price index, the inflation trends presented by the core personal consumption expenditures index (PCE) are less impacted by short-term price movements (CPI).

The core Consumer Price Index (CPI) and the core Personal Consumption Expenditures (PCE) price indexes are used to calculate the core inflation rate.

The CPI is published by the Bureau of Labor Statistics (BLS). The index is created by surveying the cost of 80,000 consumer products. It gathers this pricing data from thousands of retailers and service providers. It selects the sorts of companies visited by 14,500 households.

As you would expect, this requires some major figure crunching, but it provides a fairly accurate representation of pricing fluctuations. It is, however, not as comprehensive as the PCE price index.

The PCE price index provides a more accurate picture of underlying inflation patterns than the core CPI. Because of the manner, in which it’s measured, it’s less volatile.

The PCE pricing index is published by the BEA. The Bureau of Labor Statistics monitors price changes using GDP statistics. The monthly Retail Survey data is then included and adjusted to consumer prices using the CPI. The BEA computes its PCE figures using a separate algorithm, which smoothes out any data inconsistencies.

Conclusion

Inflation occurs when the prices of goods and services continue to rise over time. If your income does not grow at the same pace as prices, you will lose purchasing power as prices rise. When it comes to your salary, inflation has no effect on your level of life.

Inflation has a modest but damaging impact on economic development. It’s subtle because you may not notice it right away if it’s just a 1% or 2% rise. At that pace, it has the potential to be beneficial. Economists believe people will stock up on items now because they anticipate price increases in the future. This encourages economic development by increasing demand.

Finally, inflation is a significant motivator to invest. You need a return on investment (ROI) that is higher than the current rate of inflation to protect and expand your buying power. When you keep your money in a bank account as cash, you’re unlikely to get high enough returns to keep up with inflation. However, historically, investment has helped individuals increase their money by around 7% per year on average—even after accounting for inflation.