Key Points:

- Recently, a U.S. federal judge noted that Dapper Labs’ NBA Top Shot’s “Moments NFT” satisfies the criteria to be called securities after using the Howey test.

- According to the most recent decision by the U.S. District Court, the NBA Top Shot NFT may satisfy the Howey test’s concept of security.

- Besides NBA Top Shot, other NFT initiatives and executives have also been investigated and convicted.

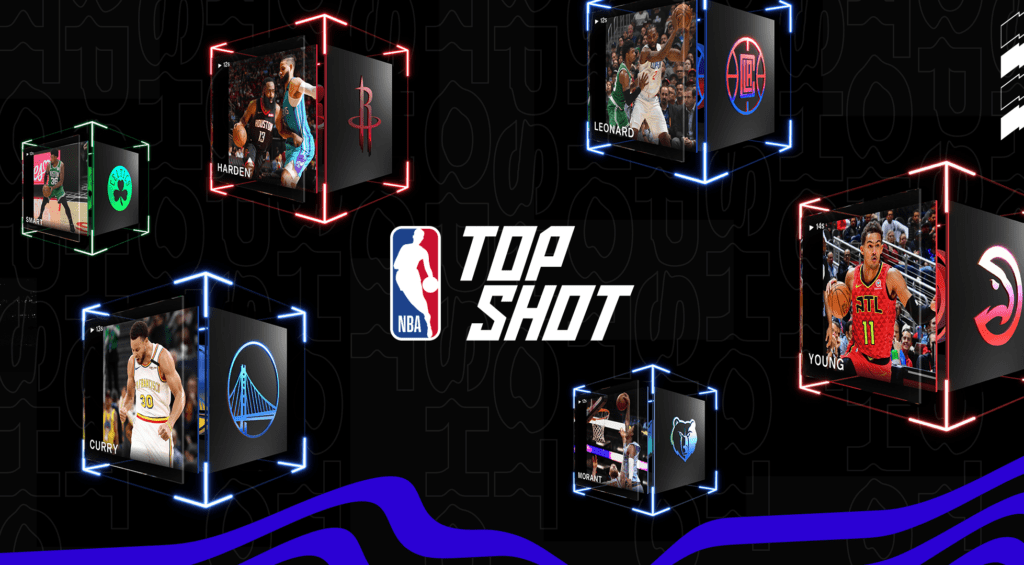

After the U.S. regulators waved a regulatory stick to encrypted businesses such as pledges and stablecoins, NFT projects are also facing the “soul torture” of securities certification. Recently, a U.S. federal judge pointed out after applying the Howey test that Dapper Labs’ NBA Top Shot’s “Moments NFT” meets the requirements to be considered securities. Currently, Dapper Labs has not commented on the matter.

U.S. federal judge may rule NBA Top Shot is a security

The latest ruling by the U.S. District Court found that the NBA Top Shot NFT may meet the definition of security after applying the Howey test. U.S. Federal Judge Victor Marrero accused the company of violating Sections 5 and 12 of the Securities Act by selling NBA Top Shot “Highlights NFTs” without the standard registration and disclosures applicable to other investment contracts, according to court documents.

According to the ruling, while Dapper Labs’ token FLOW is not necessarily secure in itself, it is “necessary for the scheme in question as a whole.” The plaintiffs claim that without FLOW tokens, any transaction on the FLOW blockchain cannot be verified. In fact, Flow’s adoption of the POS mechanism requires FLOW to power it and incentivize miners to verify transactions.

Victor Marrero cited the U.S. Securities and Exchange Commission (SEC) lawsuit against Kik Interactive and Telegram and the U.S. Department of Justice case against Maksim Zaslavskiy as reference cases, arguing that Dapper Labs controls the Flow blockchain and the “wonderful moment NFT” in the transaction. The sales and transactions of the platform and the funds raised in this part are used to develop and maintain the value of FLOW.

At the same time, in terms of whether there are interest expectations, Marrero believes that Dapper Labs used emoticons (such as rockets, money bags, etc.) on some tweets promoting NFT, implying that these assets will increase in value. However, he also pointed out that the ruling only applies to “excellent moment NFTs” and may not apply to other NFTs. Not all NFTs offered or sold by companies constitute securities, and judgments need to be made on a case-by-case basis.

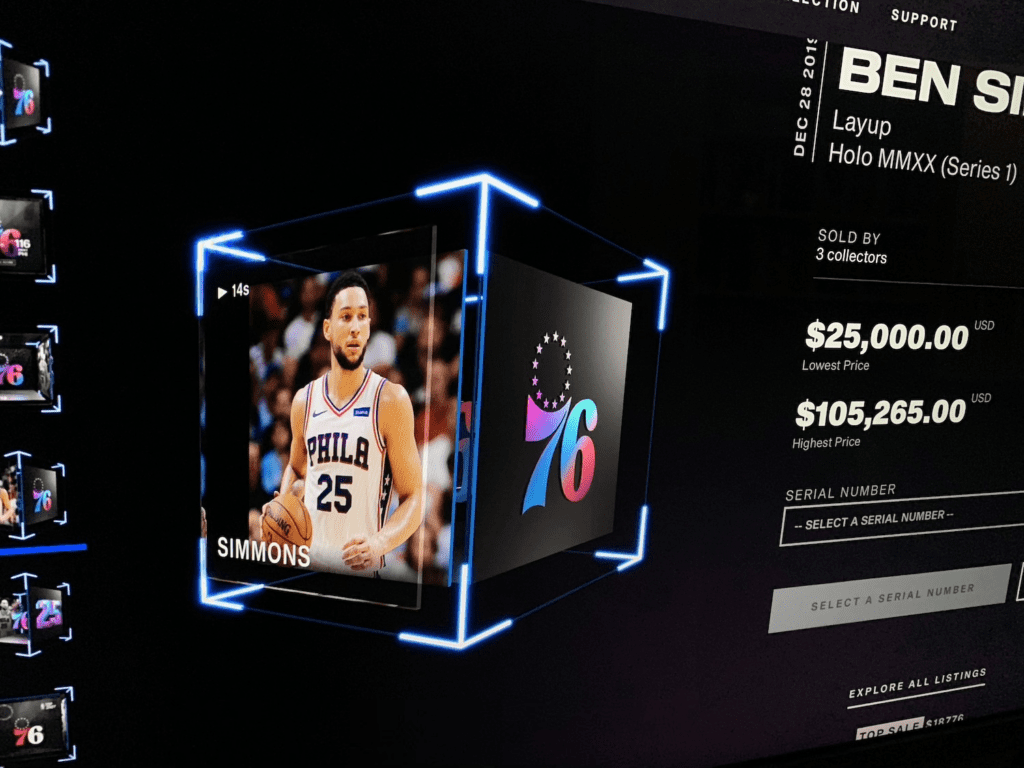

In fact, this ruling stems from the lawsuit filed in New York by Dapper Labs and CEO Roham Gharegozlou in May 2021. At that time, an NBA Top Shot user named “Jeeun Friel” sued Dapper Labs and Roham Gharegozlou, alleging that the NFT he sold was essentially unregistered security, and the plaintiff accused Dapper Labs that should register with the US Securities and Exchange Commission, but the latter does not do so.

Separately, the plaintiffs allege that the company used NBA Top Shot to deliberately prevent collectors from withdrawing their funds “for months” to artificially prop up the platform’s market value. Of course, these accusations are based only on the plaintiff’s “personal knowledge.”

Although Roham Gharegozlou dismissed the lawsuit and argued that its NFT is not a security because its value does not come from any external investment, the judge did not agree with this statement, which also means that this ruling may open the door for Dapper Labs’ class action lawsuit. Currently, Dapper Labs has three weeks to respond to the lawsuit.

As a popular NFT project, NBA Top Shot has not only been officially authorized by the NBA but also endorsed by many legendary stars and has also won a super high amount of financing. According to Cryptoslam data, as of February 25, the total transaction volume of NBA Top Shot exceeded $1.05 billion, and the number of buyers exceeded 449,000.

Once NBA Top Shot becomes the first NFT project to be successfully sued for “selling unregistered securities,” it will have a major impact on the industry.

The pace of the NFT regulatory review accelerates

As the scale of the NFT market grows day by day, and the coverage of user groups becomes wider and wider, its risk has been paid more and more attention to, but the current supervision is still in the exploratory stage. Well, in addition to NBA Top Shot, there are quite a few NFT projects/executives who have been investigated and prosecuted. For example:

Yuga Labs

In October 2022, the US SEC launched an investigation into whether some of Yuga Labs’ NFT series are similar to stocks and need to follow the same disclosure rules, whether ApeCoin (APE) is a security, and whether its distribution violates federal laws. However, Yuga Labs has not been accused of wrongdoing, and the SEC’s investigation does not mean that the company will be sued.

OpenSea

In August 2022, Damian Williams, the U.S. Attorney for the Southern District of New York, and Michael J. Driscoll, Assistant Director of the New York Field Office of the FBI, announced the indictment of Nate Chastain, the former head of product at OpenSea, for wire fraud and money laundering related to the NFT insider trading scheme, through Use confidential information about which NFTs will be displayed on the OpenSea homepage for personal financial gain.

However, the U.S. Department of Justice filed wire fraud charges against him due to uncertainty about whether NFTs constituted securities. If convicted of wire fraud and money laundering, Chastain carries a maximum penalty of 20 years in prison on each count.

In addition, Justin Bieber, Snoop Dogg, Stephen Curry, Kevin Hart, Madonna, and other celebrities have also been sued for promoting Bored Ape Yacht Club. The increase in NFT-related prosecutions means that NFT has been accelerated to be included in the scope of supervision by US regulators.

In fact, as early as March last year, the SEC began to examine whether NFT creators and encrypted exchanges that provide NFT transactions violate regulatory requirements and has issued subpoenas to certain NFT creators and cryptocurrency trading platforms, focusing on investigating fragmentation NFT. SEC Commissioner Hester Peirce also warned that regulatory ambiguity means that NFT projects must be “very careful.”

And today, New York State Attorney General Letitia James sued the crypto exchange CoinEx, claiming that it sold commodities and securities without being registered in New York State. Judging from the accusation of this non-top exchange that originated in China, even if it is a non-US project, if there are US investors, it will inevitably be regulated by the US long-arm jurisdiction.

This also means that with the tightening of supervision, all NFT creators in the future must consider whether they “comply with regulatory requirements” before project issuance, and for existing NFT projects, they need to consider how to improve the level of business compliance to reduce the risk of being sued.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Harold

Coincu News