Key Points:

- Bitcoin’s price is currently hovering around the crucial $30,000 mark and facing speculation about its future direction.

- Recent remarks by Fed Chairman Jerome Powell regarding tightening inflation through interest rate rises have made BTC hesitant.

- Market analysts are optimistic about BlackRock’s registration for a spot Bitcoin Spot ETF and anticipate SEC approval.

Bitcoin’s price, the main cryptocurrency, is now at a crossroads as it defends the important $30,000 mark. Recent events in the cryptocurrency industry have heightened speculation over Bitcoin’s future trajectory.

In the latest news, Fed Chairman Jerome Powell said that the Fed’s next rate rise would be used to tighten inflation to 2%.

Powell maintained the Fed’s consensus for more interest rate rises this year during a two-day conversation with fellow central bank leaders at the European Central Bank Conference on Central Banking 2023 in Sintra, Portugal.

As a consequence, Bitcoin looked reluctant, erasing the previous day’s gains to avoid a further assault on annual highs of around $31,000.

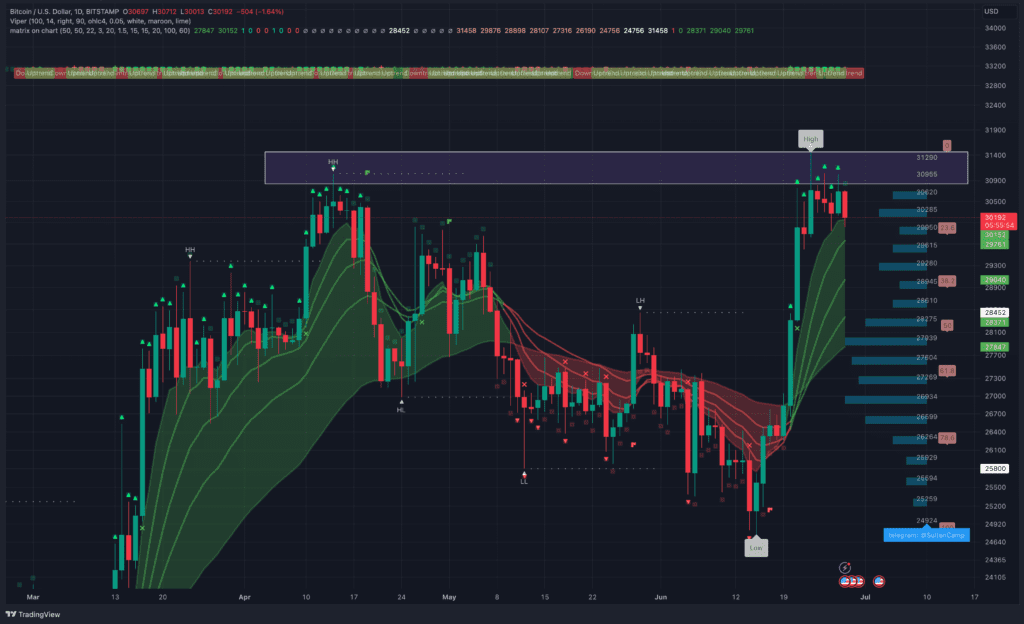

Bitcoin’s price has remained stable despite a 25% increase since June 15. After its recent rise, Bitcoin has established a new high of $31,400, surpassing the previous local high of $30,960.

BTC is currently priced at $30,192, with a 24-hour trading volume of $14.2 billion. It has witnessed a slight downtick of less than 1.8% during this timeframe.

The price of BTC is also approaching the Fib 23.6% level, and this is also the $30,000 round price zone. This shows that this price is being defended very well by the bulls, if there is a break below the $29,800 price area and a strong move up, it shows that the bulls are still waiting patiently.

In addition, the good resistance level is also the peak it created recently, which is very solid. A breakout above the $31,400 price area is the money for BTC to rally to new highs this year.

Moreover, the fact that BlackRock went ahead and registered for the spot BTC Exchange Traded Fund seems to be having a good impact on Bitcoin at this time.

Market analysts are unanimous in their belief that BlackRock will triumph this time. The US SEC is anticipated to approve the application since its concerns have been resolved to a large extent. This decision might be very beneficial to the crypto business, helping it recoup from recent losses.

The US SEC has been rejecting applications for spot Bitcoin ETFs, citing the danger of market fraud and manipulation. The commission, however, only permitted ETFs based on Bitcoin futures contracts to function in the market.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Harold

Coincu News