Key Points:

- Crypto markets brace for turbulence as BTC and ETH options worth $4.9B and $2.3B expire soon, adding to market uncertainty and volatility.

- Put Call Ratios and max pain points indicate a higher proportion of put options and potential influence on prices towards $26.5k for BTC and $1.7k for ETH.

- Over 40% of options are expected to expire for delivery, leading to a significant release of margin and downward pressure on prices, creating a bearish sentiment among investors.

Bitcoin (BTC) and Ethereum (ETH) options, the cryptocurrency markets are bracing for potential turbulence.

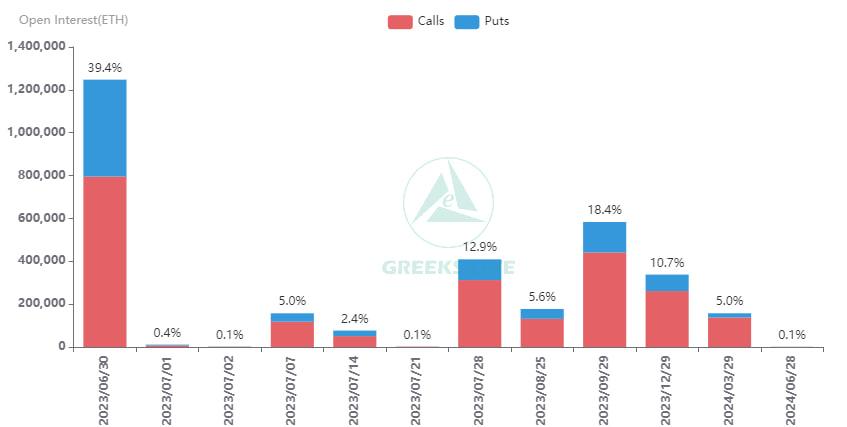

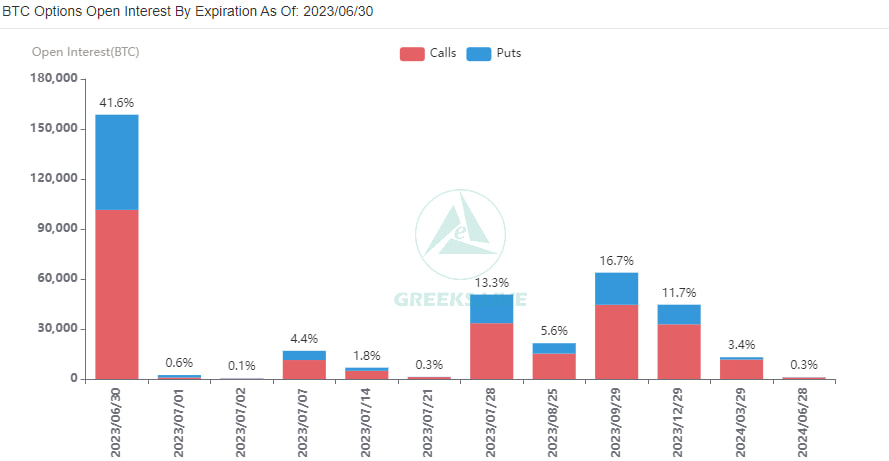

A total of 159,000 BTC options, valued at approximately $4.9 billion, and 1.25 million ETH options, worth around $2.3 billion, are on the verge of expiration, bringing uncertainty and volatility to the already dynamic crypto landscape.

Among the factors contributing to the market’s unease are the Put Call Ratios and max pain points associated with these options. The BTC options have a Put Call Ratio of 0.56, indicating a slightly higher proportion of put options compared to call options. Meanwhile, the max pain point for BTC stands at $26,500, suggesting that market participants may seek to drive the price closer to that level at expiration to cause the most financial pain to option holders.

ETH options carry a Put Call Ratio of 0.57, hinting at a similar scenario to that of BTC. The max pain point for ETH is set at $1,700, potentially attracting market forces that aim to influence the price in that direction, further exacerbating the volatility.

Compounding the situation is the fact that over 40% of these options are expected to expire for delivery rather than being settled in cash. This means that the underlying assets (BTC and ETH) will need to be delivered to the option holders upon expiration, leading to a significant release of margin. The sudden influx of these assets into the market could trigger a downward pressure on prices, creating a bearish sentiment among investors.

The anticipated effect of these expiring options has raised concerns about the potential impact on the broader cryptocurrency market. Traders and investors are closely monitoring the developments, bracing themselves for potential price swings and evaluating the implications on their portfolios. The release of margin and the subsequent depression of options prices could also result in heightened market volatility, as traders seek to capitalize on the opportunities presented by these shifts.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Join us to keep track of news: https://linktr.ee/coincu

Annie

Coincu New