Key Points:

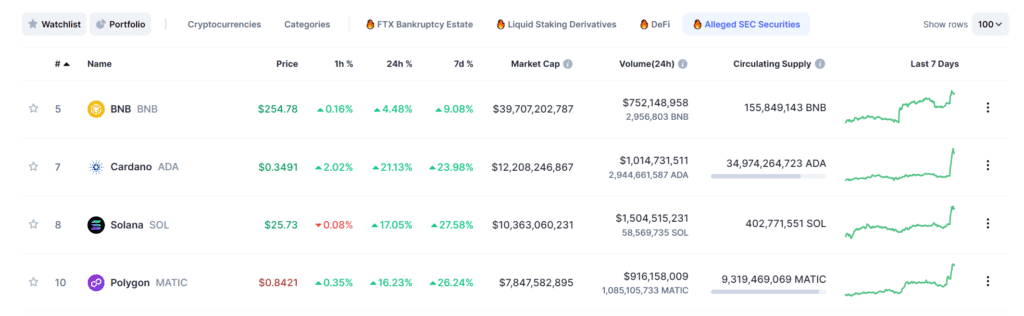

- The tokens affected by the SEC securities allegations are SOL, MATIC, and ADA, which surged more than 20%.

- The impetus came from Thursday’s ruling that Ripple’s XRP token is not a security.

- The outcome of the SEC’s lawsuit against Ripple is creating a ripple effect over the entire previous SEC allegation.

Cryptocurrencies that the US Securities and Exchange Commission (SEC) deemed unregistered securities in lawsuits against Coinbase and Binance last month (SOL, ADA, MATIC) surged on news of the court’s favorable ruling regarding Ripple’s XRP.

Tokens, including Solana (SOL), Polygon (MATIC), and Cardano (ADA), are all around 16-21% higher in the last 24h. Specifically, after the ruling was widely announced, ADA increased by 21%, SOL increased by 17%, and MATIC increased by 16%.

In the egregious US Securities and Exchange Commission (SEC) lawsuit filed in 2020 against blockchain platform Ripple, a US District Court Judge in the Southern District of New York ruled decided Wednesday that the sale of Ripple’s XRP tokens on exchanges and through algorithms does not constitute a contract investment.

While it was not an outright victory for Ripple – the judge also ruled that the institutional token sale violated federal securities laws. In addition, a series of exchanges, such as Coinbase, Kraken, Gemini, etc., also announced the re-listing of the token, causing the XRP price to skyrocket by more than 70% in the past 24 hours.

On the SEC’s side, the agency has also made an official comment on accepting the court’s rulings. However, the agency said it would still consider the verdict because the court held that the sale of XRP tokens on exchanges and through the algorithm does not constitute an investment contract. However, selling XRP to institutions is still considered an offering of securities and a violation of Section 5 of the Securities Act.

“We are pleased that the court found that XRP tokens were offered and sold by Ripple as investment contracts in violation of the securities laws in certain circumstances.”

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.