Key Points:

- Cryptocurrency investors pouring money into bitcoin exchange-traded products at a record pace since BlackRock filed for a spot-based ETF on June 15.

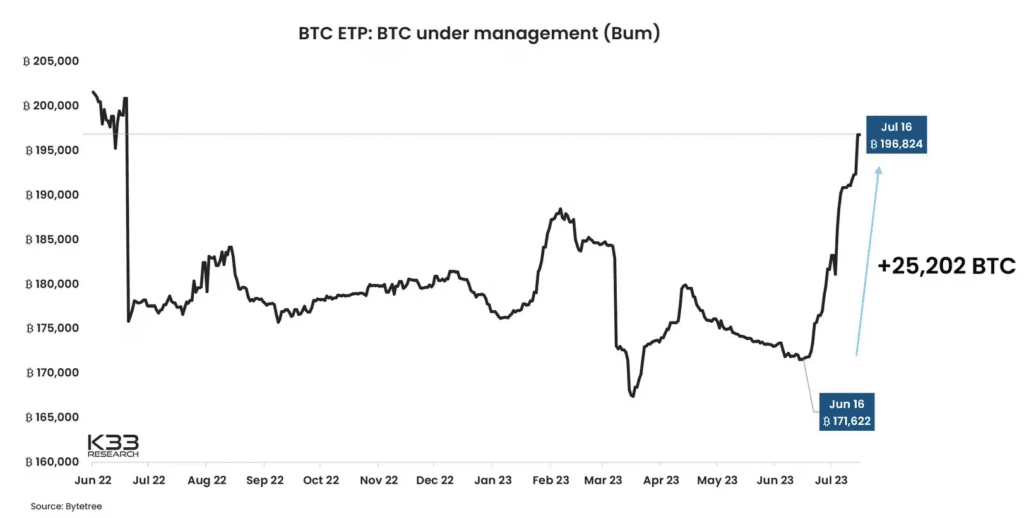

- K33 Research reports BTC-equivalent exposure of ETPs worldwide increased by 25,202 BTC ($757M) to 196,824 BTC in 4 weeks to July 16, the second-highest monthly net inflow in history of ETPs.

- Europe offers a range of ETPs, leading many investors to look to Europe for exposure to the cryptocurrency market.

According to recent data from K33 Research, investors in the cryptocurrency market have been pouring money into bitcoin exchange-traded products at a record pace.

This trend has been ongoing since BlackRock filed for a spot-based ETF on June 15, which seems to have sparked renewed interest in the cryptocurrency market.

K33 Research’s data shows that the BTC-equivalent exposure of ETPs listed worldwide has increased by an impressive 25,202 BTC ($757 million) to 196,824 BTC in just four weeks to July 16. This marks the second-highest monthly net inflow in the history of ETPs, only surpassed by inflows seen following the launch of ProShares’ futures-based ETF and other futures-based ETFs in October 2021.

The total BTC-equivalent exposure is now at the highest it has been since June 2022, which suggests that investor confidence in bitcoin and other cryptocurrencies is on the rise.

For those who may not be familiar, ETPs are a broad category of listed products that track some sort of underlying financial asset. Exchange Traded Funds (ETFs), on the other hand, are a particular subset of ETPs that typically hold a variety of financial products within a specific theme.

While the Securities and Exchange Commission (SEC) has made it difficult to list crypto-based ETFs in the United States, Europe has a plethora of ETPs available from a range of issuers. This has led many investors to look to Europe as a way to gain exposure to the cryptocurrency market.

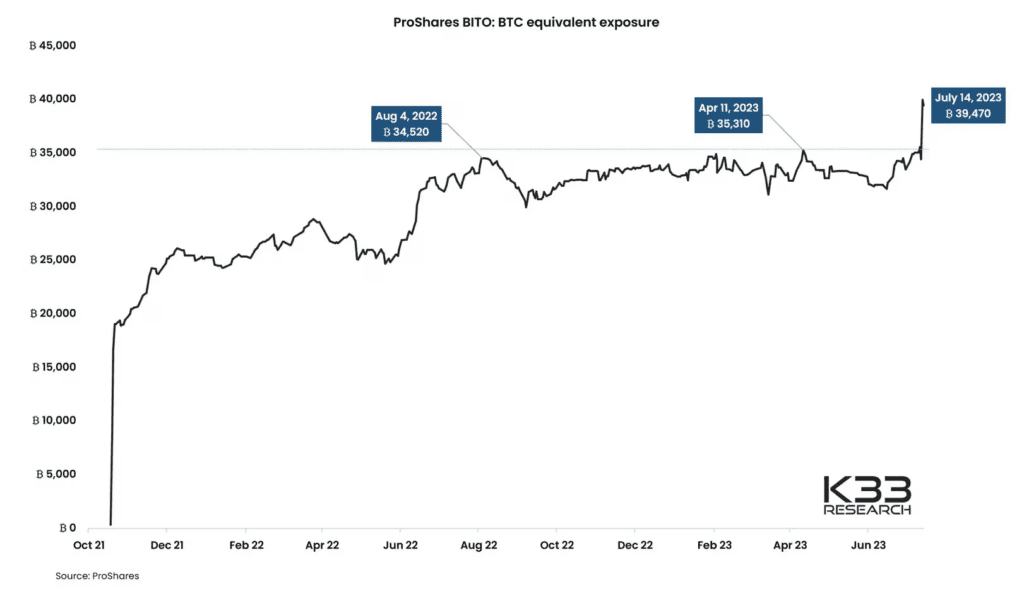

Vetle Lunde, an analyst at K33 Research, also noted that BITO, a regulated product that provides investors with bitcoin-linked returns, has hit an all-time high of bitcoin-equivalent exposure of 4,425 BTC. This is particularly noteworthy because BITO’s overall BTC exposure has structurally been flat from June 2022 until the past week when the market saw its first notable range breakout. Many experts believe that BITO spikes tend to occur near local market tops, which could be a sign that the market is getting ready for a major shift in the coming weeks or months.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.