Key Points:

- BLZ and LPT token futures experienced massive trading volume spikes, setting new highs.

- BLZ’s 42% surge leads to a short squeeze; LPT’s negative rates and 50% price rise cause market shifts.

- BLZ powers dApp storage in Bluzelle; LPT facilitates payments and network reinforcement in Livepeer’s streaming platform.

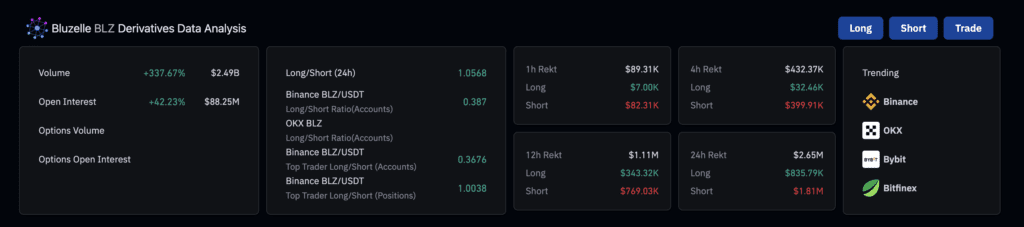

In the span of 24 hours, the trading volume for BLZ token futures exceeded a remarkable $2.5 billion, accompanied by an unprecedented open interest surpassing $88 million.

Remarkably, these figures set new all-time highs. Both Binance and Bitget reported an annualized negative fee rate of 2,700% for BLZ, underscoring the fervor surrounding the token. Within the same 24-hour period, the value of the token surged by an impressive 42%, prompting a notable short squeeze in the market.

BLZ serves as the fundamental token for the Bluzelle platform, offering specialized database storage services for decentralized applications (dApps). Bluzelle distinguishes between two tokens: BLZ, an ERC-20 token available for trading on exchanges, and BNT, an internal token ineligible for exchange transactions.

Meanwhile, LPT futures experienced a striking dip in rates, with Binance, OKX, and Bybit exhibiting annualized negative rates exceeding 2,000%. Following a rapid price surge of over 50% just yesterday, LPT underwent a short squeeze, generating further market fluctuations. Impressively, LPT perpetual contracts on Binance amassed over $4 billion in trading volume, surpassing even BTC and securing the top position.

Livepeer, which facilitates decentralized video streaming, utilizes LPT as a means of payment for livestreams on its platform. Much like AIOZ, Livepeer serves as a vital infrastructure for this domain. Stakeholders in LPT contribute to network reinforcement, enhanced security, and overall functionality. These developments collectively underline the tokens’ roles within their respective ecosystems, prompting significant market shifts.

In this dynamic landscape, traders and investors are keeping a keen eye on the evolving trajectories of BLZ and LPT tokens.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.