Market Overview (Sep 4 – Sep 10): Trends to watch in the market, participation of large organizations, and more

Key Points

- Last week’s highlights included Vitalik Buterin’s Twitter hack, Coinbase offering crypto lending services, and Ripple’s acquisition of Fortress Trust Company…

- Predictions for the market overview in the near future include the upcoming halving phase of Bitcoin, increasing participation of large entities in the market, and the potential approval of a spot ETF.

- The current market overview forecast shows low trading volume, but also presents an opportunity for redistribution of goods back to creators and potential for a new cycle to form.

Discover the latest trends and news in the cryptocurrency market overview. From recent hacks to major acquisitions, stay informed with this weekly update.

Last week’s highlights big news

In the world of cryptocurrency, news and updates can have a significant impact on investors and traders alike. Here are some highlights from last week:

Vitalik Buterin, the creator of Ethereum, had his Twitter account hacked. The attacker posted a fake article urging people to follow and mint free NFTs, resulting in a loss of $691,000 worth of crypto and NFTs. While Buterin quickly regained control of his account and deleted the fraudulent post, this incident serves as a reminder of the importance of staying vigilant against scams and hacks in the crypto space.

Mirae Asset Securities, a subsidiary of the financial conglomerate Mirae Asset, has partnered with Polygon Labs to build infrastructure for security token platforms. This collaboration aims to support the issuing and distributing of tokenized securities, highlighting the increasing interest and investment in blockchain-based financial products.

In a recent policy update, Google has allowed NFT game advertising that is not related to gambling. This is seen as a significant step in opening up the world of blockchain and NFTs to a wider audience.

Coinbase, one of the largest cryptocurrency exchanges in the world, is now offering crypto lending services to its US customers. This move aims to fill the gap left by other lending services that have recently filed for bankruptcy.

Grayscale‘s legal team has sent a letter to the SEC calling for approval of the submission of NYSE Arca’s Rule 19b-4, which would allow Grayscale’s Bitcoin Trust to operate as an ETF. This development could have significant implications for the crypto industry, as the approval of an ETF could make Bitcoin more accessible to a wider range of investors.

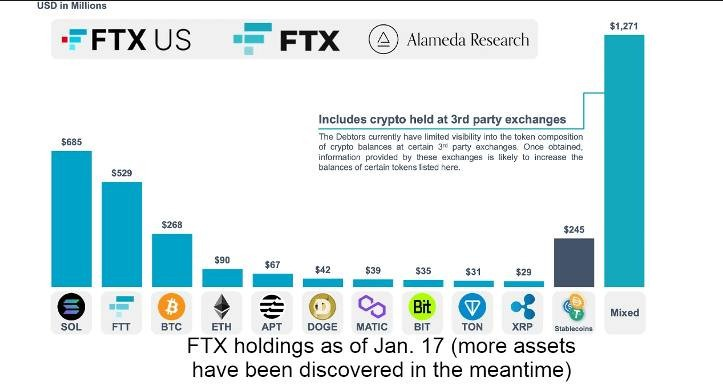

FTX, a cryptocurrency derivatives exchange, is currently awaiting court approval to liquidate its assets. The decision is expected to be made next week, on September 13. FTX had $3.4 billion worth of cryptocurrencies as of April this year, and that number has since increased. The proposed plan is to sell assets worth up to $200 million per week.

Why FTX decided to sell its assets as opposed to merely giving its customers their cryptocurrency back is unclear. It is possible, though, that since the exchange’s bankruptcy filing in November of last year, the value of the cryptocurrency it holds has soared.

This situation raises questions about the security of cryptocurrency exchanges and the potential risks associated with storing cryptocurrencies on centralized platforms. The FTX case highlights the importance of doing due diligence and choosing reputable exchanges when trading or holding cryptocurrencies.

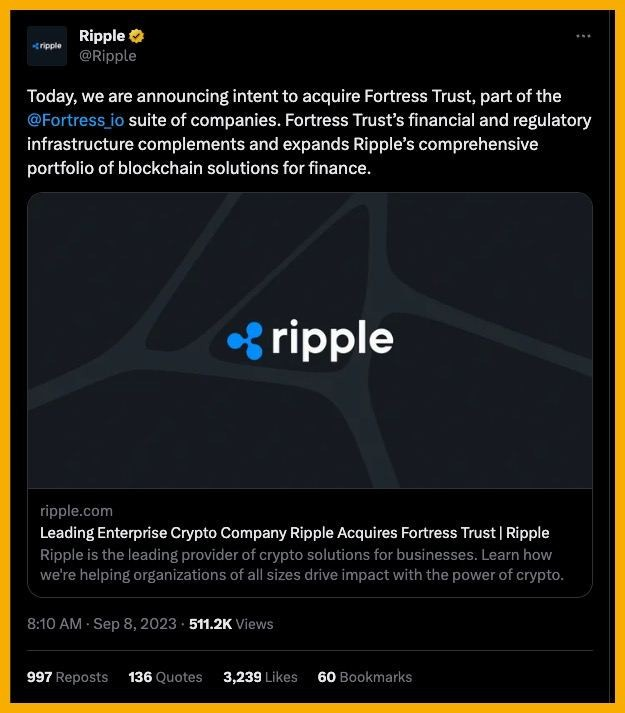

Ripple has recently acquired Fortress Trust Company. This acquisition is a strategic move for Ripple as it aims to expand its services for businesses. The newly acquired company, Fortress Trust, holds a Trust license in Nevada, which allows it to hold assets for its clients.

By acquiring Fortress Trust, Ripple is now able to offer a wider range of services to its clients. Ripple’s portfolio now comprises more than 30 licenses across the United States, making it one of the leading providers of financial settlement solutions in the country.

Ripple’s expansion plans not only include increasing its service offerings but also expanding its reach globally. The company has been making strategic moves to establish itself as a major player in the financial industry and this acquisition is just one of many steps in that direction.

This week’s prediction

The cryptocurrency market is constantly evolving and changing, making it difficult to predict its future. However, there are a few trends that suggest where the market is headed in the near future.

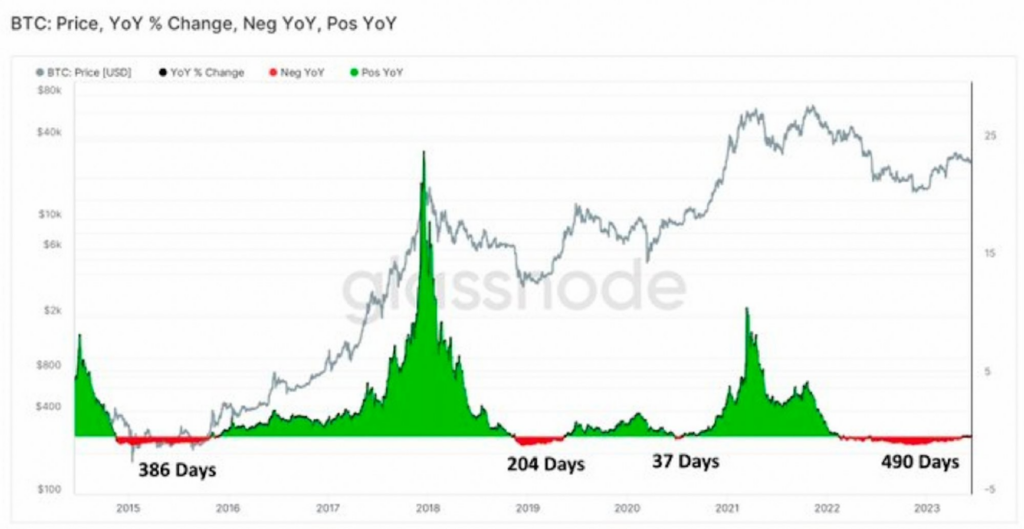

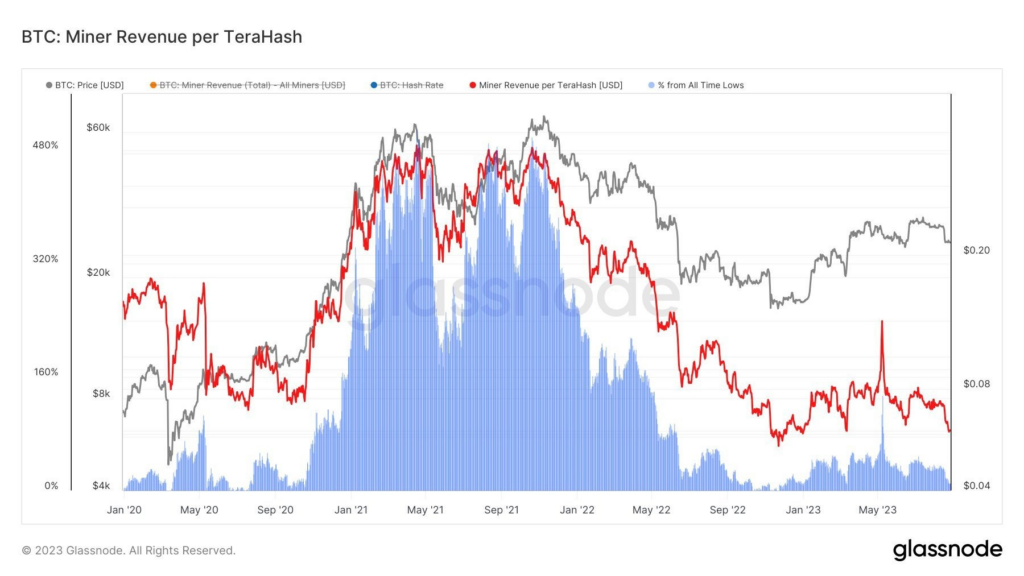

One of the most significant upcoming events is the having phase of Bitcoin (BTC) in Q1 of next year. This is when the miner’s reward will be reduced by half, which is expected to help reduce inflation and increase the value of BTC. This event is likely to have a significant impact on the cryptocurrency market.

Another trend to watch is the participation of many large entities in the cryptocurrency market, such as governments, banks, and asset management funds worth billions. This indicates that the next cycle will be a very large one in scale, not just a fledgling market.

In addition, the approval of the spot ETF is expected to be a huge boost for the entire market, opening the door to attract huge capital flows from traditional sources. Many experts believe that the approval of the ETF is certain, it’s just a matter of time. Cryptocurrency is showing its strength by continuously winning against SEC in recent lawsuits.

Furthermore, the US presidential election in 2024 is expected to have a positive impact on the cryptocurrency market. Many candidates and politicians this year have a positive view and use crypto as the centerpiece of their campaigns.

Finally, it’s worth noting that the cryptocurrency market in September, in most previous years, has mostly declined before entering a strong rebound in October and November. Even though there will still be a rate hike from FED in September, it’s believed that whether they decide to increase or maintain the rate, it will still cause the price to move in a short range before the news is absorbed. Then, there will have to be another rate hike in November, which means the market will have about two months to breathe.

Overall, the market overview is poised for significant growth in the near future. While there are still uncertainties, the trends described here suggest that there is great potential for investors and enthusiasts alike.

Market overview forecast

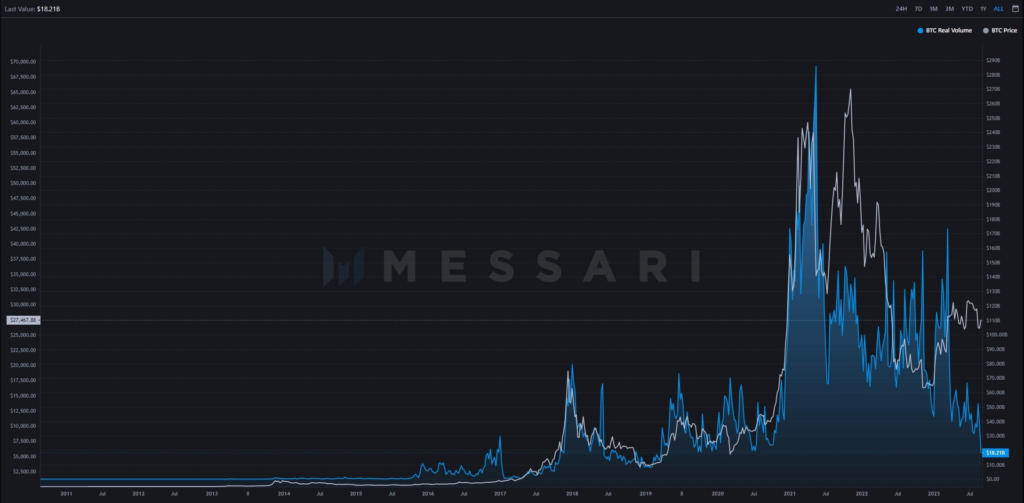

The current trading volume in the market is extremely low, almost returning to the 2019 bottom of the previous cycle. This indicates that many people are becoming discouraged and giving up. However, in danger there is always an opportunity. At this time, weaker goods will be handed over and redistributed back to the creators. Once enough goods have been collected, a new cycle will form.

The cryptocurrency market has been experiencing a lengthy period of compression and accumulation, lasting nearly two years. However, this can be likened to a spring that, when compressed strongly, has the potential for an even greater force of release. Despite the current low trading volume and the discouragement felt by many, this period of weakness offers an opportunity to redistribute goods back to creators and pave the way for a new cycle.

Recently, miners’ profits have declined, and there is a clear correlation between this and the BTC price chart. As the market works to grow, it’s important to ensure that miners are able to continue their operations and receive fair compensation for their work. By prioritizing the rights of miners, the cryptocurrency industry can continue to thrive and offer benefits to users around the world.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to DYOR before investing.