Key Points:

- The crypto community is eagerly awaiting an official response after Hope Lend was breached, but as of now, their official Twitter account remains silent, without any updates or reassurances.

- Hope Lend was breached by a hacker who exploited a vulnerability related to WBTC decimals and rounding. This vulnerability is similar to the one exploited in a previous breach of Wise Lending

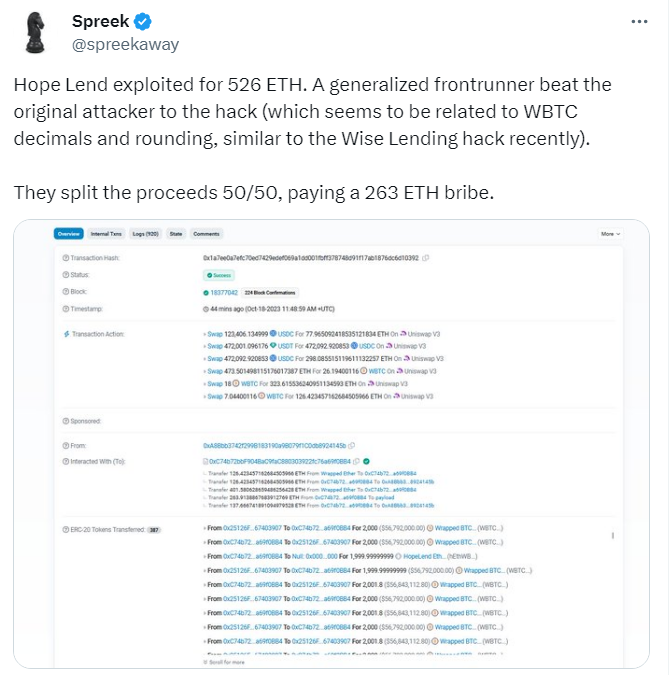

- Another party known as a “generalized frontrunner” outpaced the initial hacker and seized the stolen funds. They even offered a bribe to the original attacker.

The DeFi realm has suffered a major setback as Hope Lend, the lending protocol under Hope.money, experienced a security breach resulting in the theft of 526 ETH.

A vulnerability in Hope Lend was breached, leading to the theft of funds

According to crypto analyst Spreek, this incident is not a simple theft; Hope Lend was breached, apparently due to a vulnerability related to WBTC decimals and rounding. This strategy resembles a similar approach seen in a recent Wise Lending breach.

In a surprising twist, before the initial hacker could exploit the loophole, another party known as a “generalized frontrunner” managed to outpace them and seize the stolen funds. After the successful heist, the frontrunner made an unconventional choice to share the stolen funds, offering a ‘bribe’ of 263 ETH to the original attacker.

Identified Ethereum Addresses and Silent Response

The Ethereum addresses of both wrongdoers have been identified. The original attacker is associated with the address 0x1f23eb80f0c16758e4a55d48097c343bd20be56f, while the succeeding frontrunner goes by the address 0xa8bbb3742f299b183190a9b079f1c0db8924145b.

This news has created ripples in the crypto community, with many eagerly awaiting an official response. However, as of now, Hope Lend’s official Twitter account has remained noticeably silent, without any updates or reassurances regarding the situation.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.