Key Points:

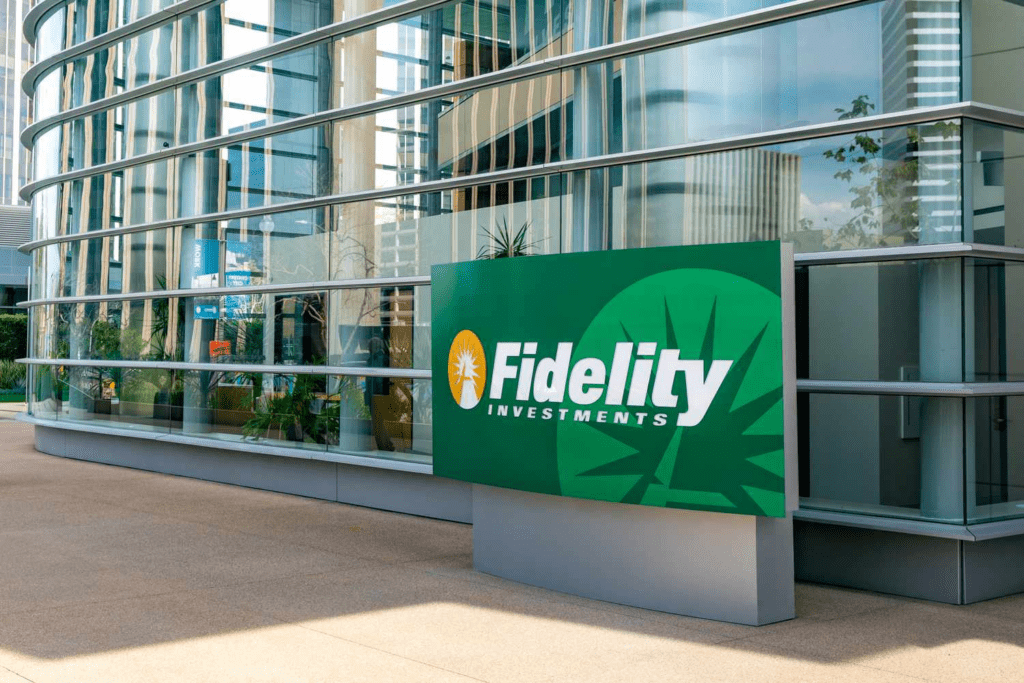

- Fidelity expands into EU market following the approval of the MiCA in Brussels, offering more clarity for investing in cryptocurrencies.

- The company has been at the forefront of Bitcoin development and recently updated its application with Bitcoin ETFs.

- It has also embarked on an aggressive expansion, including hiring, and encouraging employees to invest in cryptocurrencies.

Accoridng to DL News, Manuel Nordeste, Vice President of Digital Assets at Fidelity Investments, a renowned American asset management company overseeing $4.5 trillion in assets, has disclosed plans to extend its reach into the European Union (EU) following the approval of the Markets in Crypto-Assets Law (MiCA) by Brussels this year.

Fidelity Expands Into EU Entry Amid MiCA Approval

MiCA‘s approval offers increased clarity for major financial firms, empowering them to explore opportunities in Bitcoin, Ethereum, and similar digital assets. Fidelity expands into EU to help expand the company’s crypto market.

Fidelity, led by CEO Abigail Johnson, has been a proactive player in shaping Bitcoin as a new asset class, commencing Bitcoin mining operations in 2014 and even accepting digital currency as a means of payment in its Boston employee cafeteria.

Cryptocurrency ETF Developments in Regulatory Limbo

In recent developments, Fidelity has updated its application to focus on mitigating the inherent risks associated with Bitcoin Exchange-Traded Funds (ETFs). While both BlackRock and Fidelity have sought permission from the US Securities and Exchange Commission (SEC) to operate Bitcoin ETFs, regulatory approval remains pending.

Throughout this year, Fidelity has embarked on an aggressive hiring spree, encouraged US employees to invest in cryptocurrencies through retirement plans, and forged partnerships to launch a digital asset marketplace named EDX, alongside Charles Schwab and Citadel Securities.

Fidelity expands into EU and underscores its commitment to navigating the evolving landscape of digital assets and the upcoming EU market entry after MiCA’s implementation.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.