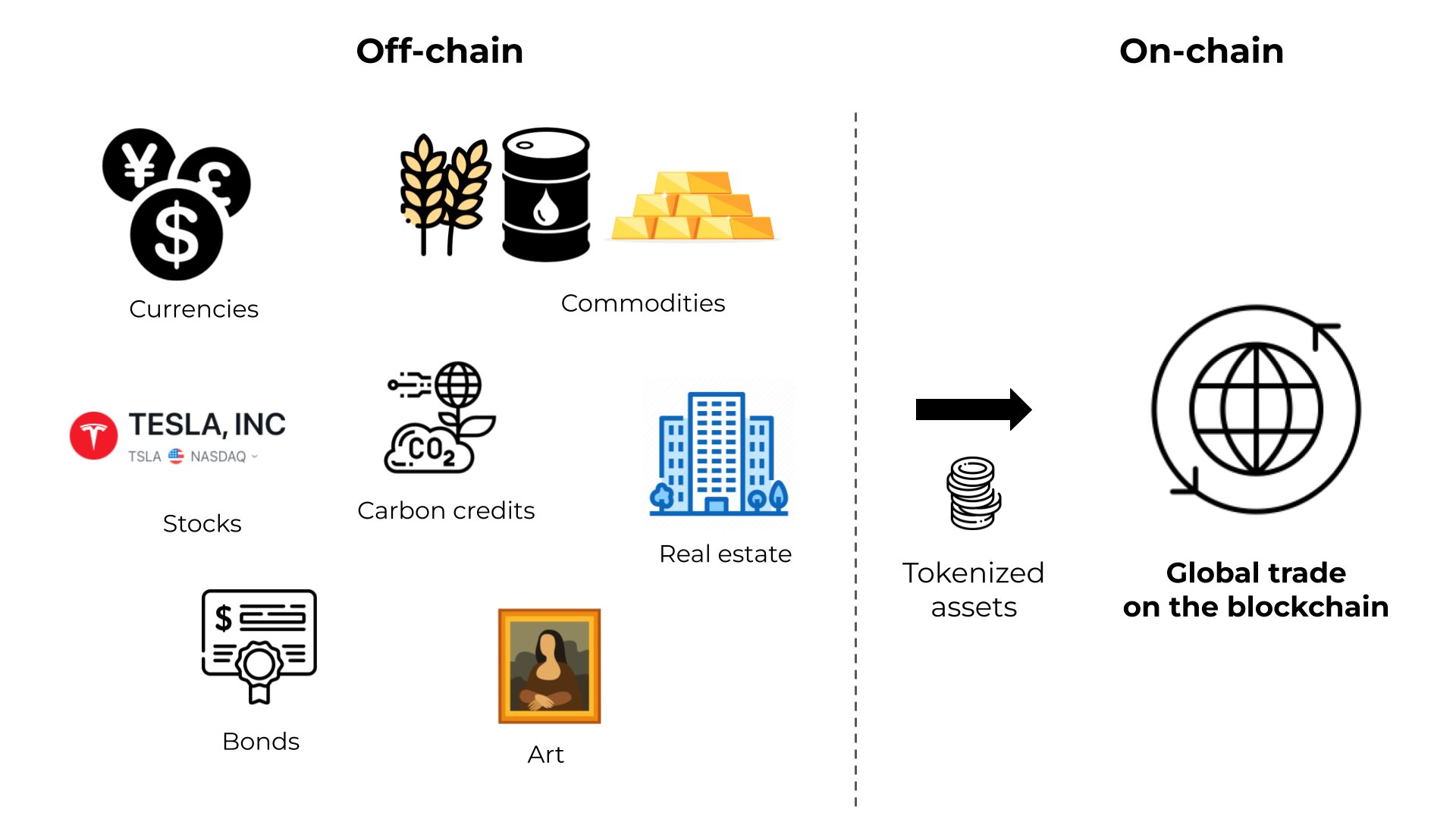

Real-world assets (RWAs) stand as a captivating application of blockchain technology, enabling the tokenization of diverse valuable items, spanning the realms of physical, digital, and data-based assets.

This innovative approach extends from art, real estate, and commodities to personal data and stocks, transforming these assets into digital representations through token issuance on the blockchain. The process of tokenizing RWAs revolutionizes ownership transfers, revenue sharing, and liquidity for assets that were once challenging to trade or lacked commercial viability. Consequently, tokenization emerges as a powerful tool with the potential to reshape traditional asset classes and financial markets.

What Are Real-World Assets?

Real-world assets encompass assets of various types—physical, digital, or data-based—whose value originates from sources external to the blockchain. Tokenizing RWAs involves creating digital twins that reside on a blockchain. Among the pioneers in this realm, stablecoins represent an original form of real-world assets. Tied to fiat currencies like the US dollar or euro, stablecoins offer a stable and liquid alternative to traditional currencies.

Expanding beyond conventional money, the scope of tokenizable financial assets includes insurance, shares, securities, treasuries, equities, and indices. The range of tangible assets eligible for on-chain representation is extensive, spanning precious metals, raw materials, agricultural products, real estate, artwork, and music licensing. Tokenization serves as a catalyst for enhanced transparency, heightened liquidity, and increased accessibility to real-world assets.

Moreover, fractionalization, a process of dividing assets into fractions, facilitates broader ownership by allowing numerous individuals to own portions of high-value assets. This democratization of asset ownership not only fosters engagement but also empowers smaller investors, contributing to a more widespread distribution of wealth. In effect, tokenization reshapes the dynamics of asset ownership and investment, introducing new dimensions of inclusivity and participation.

How do Real-World Assets work?

Real-world assets (RWAs) function through a transformative process known as tokenization within the realm of blockchain technology. RWAs encompass a wide array of assets, whether physical, digital, or data-based, with their intrinsic value originating outside the blockchain. Here’s a breakdown of how Real-World Assets work:

- The core principle involves tokenizing these real-world assets, essentially creating a digital representation, or “token,” on a blockchain.

- Through this process, assets ranging from physical commodities to intellectual property and data can be mirrored in a secure and decentralized digital form.

- Stablecoins stand as early examples of tokenized real-world assets. Tethered to fiat currencies like the US dollar or euro, stablecoins offer stability and liquidity in the digital realm.

- Beyond stablecoins, a broad spectrum of financial instruments can undergo tokenization, including insurance, shares, securities, treasuries, equities, and indices.

- Tangible assets such as precious metals, raw materials, agricultural products, real estate, artwork, and even music licensing can also benefit from the advantages of tokenization.

- Tokenizing real-world assets enhances transparency, providing a clear and immutable record of ownership and transactions on the blockchain.

- It increases liquidity by enabling fractional ownership, allowing multiple investors to own fractions of high-value assets.

- Fractionalization is a pivotal aspect, where assets can be divided into fractions, making high-value assets accessible to a broader range of investors.

- This democratization of ownership fosters engagement, empowers smaller investors, and contributes to a more equitable distribution of wealth.

- The functionality of Real-World Assets and their tokenization has a transformative impact on traditional financial paradigms, introducing innovative solutions and reshaping investment dynamics on a global scale

Benefits of tokenizing Real-World Assets

The benefits of real-world assets (RWAs) and their tokenization through blockchain technology extend across various dimensions, transforming traditional financial paradigms. Here are some key advantages:

- Tokenization of real-world assets facilitates fractional ownership, allowing investors to own and trade fractions of high-value assets. This increases liquidity, making traditionally illiquid assets more accessible and tradable.

- Blockchain technology ensures transparency by providing an immutable and secure ledger of ownership and transactions. This transparency builds trust and reduces the risk of fraud or manipulation.

- Fractionalization democratizes ownership, enabling a broader range of investors to participate in asset markets. Even individuals with limited capital can invest in fractions of high-value assets.

- Tokenization breaks down geographical barriers, allowing investors from around the world to access and invest in a diverse range of real-world assets. This global accessibility enhances market efficiency and broadens investment opportunities.

- Digital tokens representing real-world assets streamline the transfer of ownership. This efficiency reduces administrative complexities, paperwork, and the time involved in traditional asset transfers.

- Tokenization opens up new avenues for diversification as investors can easily spread their portfolios across various asset classes, including real estate, commodities, and intellectual property.

- The use of smart contracts in tokenized assets automates various processes such as revenue distribution, dividends, and contractual obligations. This reduces the need for intermediaries and enhances operational efficiency.

- Tokenization reduces transactional friction and costs associated with intermediaries, paperwork, and administrative overhead. This cost-effectiveness benefits both issuers and investors.

- Blockchain’s decentralized and cryptographic nature enhances the security of asset ownership. Additionally, tokenization can offer built-in features, such as programmable compliance, helping to mitigate risks and ensure regulatory adherence.

- The tokenization of real-world assets encourages innovation in financial products and investment strategies. New instruments and models emerge, creating a dynamic and evolving financial landscape.

The benefits of real-world assets and their tokenization underscore the transformative potential of blockchain technology in reshaping financial markets, fostering inclusivity, and providing new opportunities for investors and issuers alike.

Types of Real-World Assets

Real-world assets encompass a diverse range of tangible and intangible items, representing intrinsic value beyond the digital realm. Here are various types of real-world assets:

- Physical properties such as residential, commercial, and industrial real estate can be tokenized, allowing for fractional ownership and increased liquidity in real estate markets.

- Precious metals (gold, silver), agricultural products (wheat, coffee), and other raw materials can be tokenized, providing investors with exposure to commodity markets.

- Traditional financial assets like stocks, bonds, and securities can undergo tokenization, enabling efficient trading and broader market access.

- Tokenization allows art pieces, collectibles, and other valuable assets in the art world to be represented digitally, offering a new way for investors to engage in this market.

- Patents, trademarks, copyrights, and other forms of intellectual property can be tokenized, allowing creators and inventors to monetize their intellectual assets.

- Tokenization extends to the music industry, where rights to songs and music compositions can be represented as digital tokens, providing new revenue streams for artists.

- Ownership stakes in private companies can be tokenized, democratizing access to private equity investments and enhancing liquidity in traditionally illiquid markets.

- Indices representing a basket of real-world assets, such as real estate indices or commodity indices, can be tokenized, providing diversified exposure to multiple assets.

- Sovereign debt instruments, including government bonds and treasuries, can undergo tokenization, facilitating efficient trading and accessibility for a broader investor base.

- Insurance contracts and policies can be tokenized, allowing investors to participate in insurance markets and potentially benefit from premium payments and claims.

- Funds, trusts, and other collective investment vehicles can be tokenized, enabling efficient management and distribution of returns to investors.

- Traditional fiat currencies, represented as stablecoins on the blockchain, serve as a form of tokenized real-world assets, providing stability and liquidity in the digital space.

How are real-world assets tokenized?

Tokenizing real-world assets involves converting tangible or intangible assets into digital tokens on a blockchain. This process utilizes blockchain technology, smart contracts, and decentralized ledger systems to represent ownership and facilitate transactions. Here’s a step-by-step overview of how real-world assets are tokenized:

- Choose the real-world asset that will undergo tokenization. This can include real estate, commodities, financial instruments, art, intellectual property, and more.

- Establish a legal and regulatory framework that governs the tokenization process. Compliance with local and international regulations is crucial to ensure the legitimacy of the tokenized asset.

- Determine the value of the asset through professional valuation methods. This valuation serves as the basis for determining the tokenization ratio and the number of tokens representing the asset.

- Develop smart contracts on the chosen blockchain platform. Smart contracts are self-executing contracts with the terms directly written into code. They automate processes such as ownership transfers, revenue distribution, and compliance.

- Generate digital tokens representing ownership of the real-world asset. Each token corresponds to a fraction or whole unit of the underlying asset. These tokens are often referred to as security tokens or asset-backed tokens.

- Ensure compliance with securities regulations and any other relevant laws. Depending on the jurisdiction and the nature of the asset, there may be specific requirements for tokenized securities.

- Integrate the tokenized asset onto the chosen blockchain. This involves recording details such as ownership, transaction history, and smart contract rules on the blockchain’s decentralized ledger.

- Implement secure custody solutions to safeguard the digital tokens. This may involve using blockchain-based custody services or traditional custodians, depending on the preferences of the asset issuer and investors.

- Onboard investors onto the platform or exchange where the tokenized assets will be traded. This process typically involves identity verification and adherence to Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations.

- Facilitate the trading of tokenized assets on a secondary market. This enhances liquidity, allowing investors to buy and sell these digital tokens freely.

- Implement mechanisms for ongoing asset management, including periodic valuations, updates to smart contracts, and compliance monitoring.

Risks and challenges in applying Real-World Assets

While the tokenization of real-world assets (RWAs) offers various benefits, it also comes with inherent risks and challenges. Understanding and addressing these concerns is crucial for the successful application of RWAs in blockchain technology. Here are key risks and challenges associated with the tokenization of real-world assets:

- Risk: Regulatory frameworks for tokenized assets are evolving and can vary significantly across jurisdictions. Non-compliance can lead to legal issues, fines, or restrictions.

- Challenge: Navigating complex and dynamic regulatory landscapes requires continuous monitoring and adaptation to changes, often posing challenges for issuers and investors.

- Risk: The absence of standardized practices and protocols for tokenization can result in interoperability issues, making it challenging to integrate tokenized assets across different platforms.

- Challenge: Establishing industry standards is an ongoing process, and until widespread adoption occurs, compatibility challenges may persist.

- Risk: Bugs or vulnerabilities in smart contracts could lead to security breaches, exploitation, or unauthorized access, compromising the integrity of the tokenized assets.

- Challenge: Conducting thorough audits and implementing rigorous testing are essential to minimize the risk of smart contract vulnerabilities.

- Risk: Tokenized assets may face liquidity challenges, especially in the early stages, affecting the ability to buy or sell tokens at fair market prices. Pricing volatility can also be a concern.

- Challenge: Building and sustaining a liquid secondary market requires attracting a critical mass of investors and addressing concerns related to price stability.

- Risk: Technical issues such as network congestion, software bugs, or failures in the underlying blockchain infrastructure may disrupt the tokenization process.

- Challenge: Implementing robust and scalable technology solutions, staying abreast of blockchain developments, and having contingency plans are essential to mitigate technical risks.

- Risk: Cybersecurity threats, hacking attempts, and fraudulent activities pose risks to the security of tokenized assets and the personal information of participants.

- Challenge: Implementing strong security measures, including encryption, multi-factor authentication, and secure custody solutions, is crucial to safeguard against fraudulent activities.

- Risk: Determining accurate valuations for tokenized assets, especially unique or illiquid ones, can be challenging and may lead to discrepancies in pricing.

- Challenge: Developing robust valuation methodologies, engaging professional appraisers, and ensuring transparency in pricing mechanisms are ongoing challenges.

- Risk: Limited awareness and understanding of tokenized assets among potential investors can hinder adoption and market growth.

- Challenge: Education and awareness campaigns are essential to familiarize stakeholders with the benefits and risks of tokenized assets, fostering broader acceptance.

Addressing these risks and challenges requires a collaborative effort from industry participants, regulators, and technology developers to create a secure, transparent, and efficient ecosystem for tokenized real-world assets. As the landscape continues to evolve, proactive measures and continuous improvements will be essential for the successful integration of RWAs in the blockchain space.

Conclusion

The tokenization of real-world assets represents a transformative paradigm shift in the intersection of traditional finance and blockchain technology. While offering numerous advantages such as enhanced liquidity, increased accessibility, and efficient transfer of ownership, the application of real-world assets on the blockchain is not without its challenges and risks.

Navigating the evolving regulatory landscape stands out as a primary concern, requiring constant vigilance and adaptability to ensure compliance across diverse jurisdictions. The lack of standardized practices and interoperability issues underscores the importance of industry collaboration to establish common frameworks. Smart contract vulnerabilities and technological risks necessitate rigorous auditing and ongoing development of secure infrastructure.

Market dynamics, including liquidity challenges and pricing volatility, call for strategic measures to attract investors and ensure stable secondary markets. Fraud and security concerns demand robust security protocols and vigilant cybersecurity measures to safeguard the integrity of tokenized assets.

Valuation complexities and the need for accurate pricing mechanisms pose ongoing challenges that require innovative solutions. Furthermore, the broader adoption of tokenized assets relies on effective education and awareness campaigns to familiarize stakeholders with the potential risks associated with this transformative technology.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.