In 2023, the crypto industry is experiencing a remarkable resurgence of excitement. In light of this evolving landscape, the Coincu has compiled cryptocurrency trends to watch in 2024.

Introduction

The ever-changing world of finance has witnessed the continuous evolution of cryptocurrencies, showcasing the transformative power of digital assets. As we approach a new year, it is wise and timely to reflect on the potential path that crypto will forge in 2024.

Though it is too early to definitively declare the resurgence of a bullish market, there is a noticeable shift in sentiment, with a growing sense of optimism prevailing within the industry. We aspire for this compilation of cryptocurrency trends to serve as a valuable resource, offering insights to its users.

Best Cryptocurrency Trends to watch

- Bitcoin halving event in April 2024 is expected to be a significant catalyst for a potential supercycle.

- The approval of a spot Bitcoin ETF could have a positive impact on the market.

- Ethereum’s transition to Proof of Stake and the potential approval of a Spot ETF could contribute to its growth.

- Artificial intelligence (AI) is predicted to have a greater impact in 2024.

- Tokenization of real-world assets is gaining traction in the financial industry.

- SocialFi platforms are improving financial services by leveraging social networks and community-driven projects, providing access to underbanked individuals.

- After a challenging year, the NFT market is showing signs of revival, with trading volumes picking up and the emergence of Bitcoin NFTs, and is expected to revive in 2024.

- Web3 gaming is revolutionizing the gaming industry and has promising prospects for growth.

1. Bitcoin

Bitcoin Halving

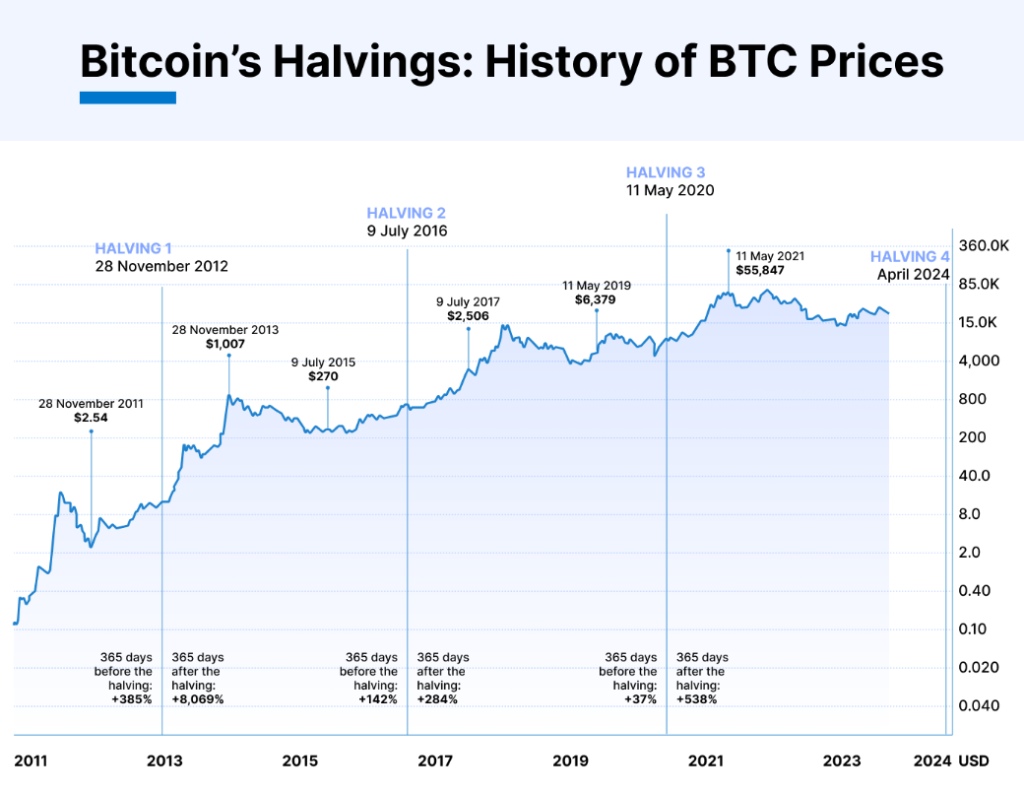

The upcoming halving event scheduled for April 2024 is expected to be a significant catalyst for a potential supercycle in Bitcoin. The exact timing of the halving has not yet been announced because the network generates new blocks at a rate of one every ten minutes on average.

Events involving halving have historically been connected to significant rises in the price of Bitcoin. The incentive for mining new blocks is decreased as a result of these occurrences, which lowers the rate at which new Bitcoin is created. Supply and demand dictate that when the number of new coins is reduced with each halving, prices may be under pressure to rise.

The price of Bitcoin has typically increased following each halving occurrence, albeit not immediately, according to historical data. A noteworthy instance is the time frame around the most recent halving, when the price of Bitcoin shot up to nearly $60,000 in just one year from $5,000 in March 2020.

Spot Bitcoin ETF Could Get Approved

2023 has been a significant year for Bitcoin, with significant advancements occurring over the board for investors. Because of optimistic anticipation for the approval of a spot bitcoin ETF application, the price of BTC has increased by almost 49% since October.

| Final SEC Deadline | Company |

| 10/1/2024 | 21Shares & ARK |

| 14-15/3/2024 | BlackRock, Fidelity, Bitwise, VanEck, Wisdomtree, Invesc & Galaxy |

| 19/3/2024 | Valkyrie |

| 19/4/2024 | Global X |

| 30/5/2024 | Hashdex, Franklin Templeton |

| 8/8/2024 | Pando |

| Deadlines passed | Grayscale |

Although regulated spot bitcoin exchange-traded funds (ETFs) have long been a possibility in the US, substantial advancements were achieved in 2023. In August, Grayscale won its legal battle with the SEC over the conversion of its Grayscale Bitcoin Trust (GBTC) into a spot BTC exchange-traded fund (ETF).

The largest asset management firm in the world, BlackRock, along with Fidelity and Invesco, were spurred by this verdict to file their applications for spot BTC ETFs in the next few months. With a final deadline of January 2024 for the earliest application and August for the latest, the SEC is currently considering 13 spot BTC ETF applications.

Readmore: Spot Bitcoin ETF Approval Timelines and Key Dates

2. Ethereum Reaching Its Full Potential

Ethereum has recently achieved significant milestones in its journey to become a leading digital asset. The successful completion of the “Merge” in September 2022 and the “Shapella” upgrade in April 2023 has solidified Ethereum’s reputation as a platform of immense technical prowess.

These upgrades have enhanced the functionality and security of the Ethereum network while paving the way for a new era of net deflationary digital assets.

The reasons Why the Ethereum Ecosystem Will Stand Out in 2024

One of Ethereum’s notable achievements is its transition from the energy-intensive Proof of Work (PoW) consensus mechanism to the more sustainable Proof of Stake (PoS) model. This transition has garnered attention from the cryptocurrency community, with experts predicting substantial growth for Ethereum’s ecosystem in the coming year.

Similar to Bitcoin, Ethereum is in the process of seeking approval for a Spot ETF application. If successful, this development could be a game-changer, allowing decentralized applications built on Ethereum to be included in ETFs, increasing their appeal to a broader range of investors.

Considering the dynamics of the money flow cycle within the crypto market, the approval of Bitcoin ETFs is expected to generate positive momentum for the entire market. As capital flows through different market capitalizations, Ethereum is well-positioned to benefit from its technological advancements and growing prominence.

Readmore: Ethereum Price Prediction For 2024, 2025, 2026 and 2030: Super Crypto Bull Run

3. Artificial intelligence (AI)

AI is gaining significant traction across various industries and is predicted to have an even greater impact in 2024. Investors in the field are actively looking for ways to benefit from AI by separating projects into two categories: those that support AI operations and those that create AI solutions and offer services.

AI-focused Decentralized Public Infrastructure Networks (DePINs) make up the first category. These initiatives are essential in providing the framework required for successful AI applications. Their main areas of concentration are computational resources and data storage.

For instance, there are projects such as Akash and Render that have set up decentralized marketplaces. These platforms allow individuals to trade GPU power, which plays a crucial role in the processing of data for AI applications.

In the second category, there are AI-related cryptocurrency projects, such as Fetch.ai. This project provides a platform that empowers developers to build and sell self-governing AI software and services, enabling businesses to automate various functions using independent AI technology.

Similarly, Bittensor is a prominent player in the decentralized AI industry, aiming to establish a decentralized ecosystem for the development of new AI frameworks and decentralized markets for compute resources, data storage, data processing, and oracles.

Readmore: AI DAO: 6 Application Directions Of DAO Using AI’s Powerful Potential

4. Real-world Assets

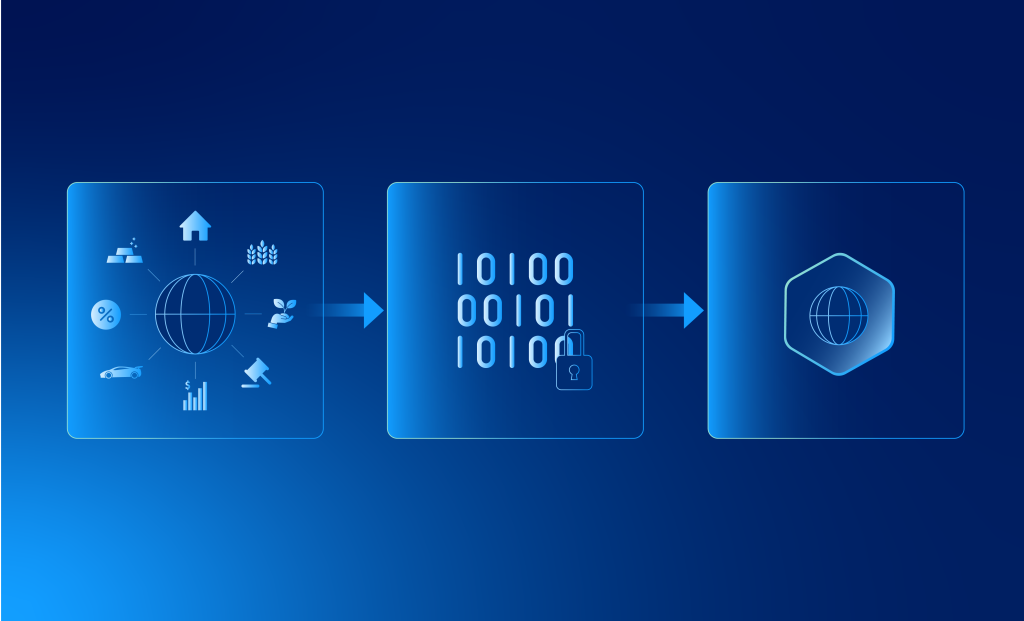

The process of representing assets like real estate, fine art, credit, and precious metals as digital tokens on a blockchain are known as RWA. Traditional finance companies are increasingly recognizing the advantages of tokenization, including secure, decentralized trading and transparent property rights.

Several factors contribute to the potential growth of RWA tokenization. Some tokenization use cases are now more economically feasible due to higher interest rates in the current cycle. Real-world assets that have been tokenized are likewise becoming more popular as a hedge against market volatility.

Tokenization offers a way to digitize financial assets, including money market funds, sovereign bonds, and repurchase agreements, in the current high-yield environment. Some real-world asset classes are less accessible because of issues including low liquidity and high entrance hurdles. Transferability and divisibility limits apply to many of these assets as well.

Governments and regulators’ perspectives on real-world assets are changing, though, and as a result, many jurisdictions are thinking about changing their regulations to take advantage of or introduce their real-world assets.

Financial services businesses have greatly increased their teams and capacities related to digital assets since the introduction of tokenization five years ago. We should anticipate seeing more tokenization used in financial transactions as these teams get bigger.

Readmore: Top 5 Notable Real World Assets Crypto Projects In 2024

5. SocialFi

Within the quickly developing field of decentralized finance, investors and fans are taking notice of a new movement called SocialFi. In contrast to traditional finance, SocialFi improves financial services by utilizing social networks and community-driven projects.

Through leveraging social networks, SocialFi programs put inclusivity first, enabling people from different backgrounds to engage in financial activity. By removing obstacles, these platforms give underbanked and unbanked people access to financial services.

In 2023, the SocialFi space witnessed the emergence of friend.tech, a project that has captured significant attention. With its launch, friend.tech has not only achieved over $25M in protocol fees, but it has also managed to attract a notable user base.

In addition, the buzz surrounding friend.tech has extended beyond the boundaries of the crypto community, as influencers from various fields have taken notice, underscoring the immense potential of Web3 social applications. Apart from friend.tech, several other noteworthy projects, including Farcaster, Lens Protocol, and Binance Square, have been instrumental in driving the SocialFi movement forward.

As we look ahead to 2024, the ability of SocialFi to continue gaining traction will have far-reaching implications for the future of social interactions on Web3. It is a pivotal moment that will shape the landscape of online communication for years to come.

Readmore: SocialFi Landscape Early Of 2024: Potential Opportunity For Early Participants

6. NFT Market Model

The year 2023 was a challenging one for the NFT market, with leading companies in the field experiencing a continuous decrease in trading volumes from February to September. However, a change in cryptocurrency trends occurred in October when trading volumes saw a significant uptick in November.

OpenSea was still the NFT marketplace with the most users despite all the drama, layoffs, and challenges. OpenSea’s goal is to develop a platform that is user-friendly for creators. However, in 2023, they had to make some tough choices, such as modifying how creator royalties were applied.

In addition, Blur has emerged as a dominant force. With the NFT audience fragmenting and new investments and liquidity declining sharply, Blur recognized the opportunity to introduce complex trading tools that enhance liquidity. Their low-fee transactions also prompted OpenSea to reduce royalties for creators.

The rise of Bitcoin NFTs is one of the market’s most notable highlights. With over $375 million in trading volume, Bitcoin NFTs overtook Ethereum as the most popular kind in November. The emergence of Bitcoin NFTs is evidence of the market’s dynamic character and the possibility of sudden changes in demand.

Following several months of low pricing and gloom, November 2023’s spike in trading volumes suggests that the market is turning around and that the NFT scene is about to revive. Keeping a careful eye on these NFT patterns as 2024 approaches will be essential to determining whether the market can continue to rebound.

Readmore: What Is An NFT? The Crypto Industry’s Breakthrough Leap

7. Web3 Gaming

In the second half of 2023, there has been a notable resurgence of interest in Web3 gaming, with a particular emphasis on attracting mainstream gamers who have yet to explore the crypto space.

This exciting fusion of blockchain technology and gaming ecosystems is completely revolutionizing the way we perceive and engage with video games, taking them to new heights. It enables players to not only enjoy the games but also monetize their skills and dedication, turning their passion into a source of income.

Currently, the total value of the game market stands at an impressive 250 billion USD. However, experts predict that this figure will soar to a staggering 390 billion USD within the next five years, signaling a remarkable growth trajectory for the industry.

With such promising prospects, it is clear that Web3 gaming is poised to become a prominent cryptocurrency trends that will leave an indelible mark on the gaming landscape in 2024 and beyond.

Readmore: Big Time Review: The First Triple-A Title In Blockchain Gaming

How to Track Cryptocurrency Trends?

#1. Update information

- Follow reputable cryptocurrency trends sources, such as CoinDesk, Coincu, The Block, CoinTelegraph, etc.

- Subscribe to crypto blogs and podcasts for in-depth analysis and expert opinions.

#2. Monitor Social Media and Forums

- Keep an eye on Twitter trends and hashtags related to crypto, following key influencers for real-time updates.

- Engage in discussions on Reddit forums like r/cryptocurrency to gauge community sentiments.

#3. Follow Influencers and Thought Leaders

- Identify influential figures like Andreas M. Antonopoulos or Vitalik Buterin and follow their social media for expert perspectives.

- Engage with YouTubers and podcast hosts who specialize in crypto analysis and commentary.

#4. Macro Trends

- Stay informed about broader cryptocurrency trends, such as inflation rates and global economic indicators.

- Monitor institutional adoption through news on major financial institutions entering the crypto space.

#5. Onchain Analysis, TVL, Cash Flow

- Understand on-chain analysis tools like Glassnode for insights into blockchain metrics and transaction data.

- Monitor Total Value Locked (TVL) in decentralized finance (DeFi) projects and analyze cash flow patterns within crypto ecosystems

#6. Network and collaborate

- Attend virtual or in-person crypto meetups and conferences to connect with industry professionals

- Join collaborative platforms like Clubhouse to participate in live discussions and share insights with the crypto community.

In conclusion

In recent months, there has been a noticeable change in sentiment in the cryptocurrency market. The introduction of new and varied market players, along with an enormous wave of excitement, has propelled this shift. Keeping abreast of the most recent cryptocurrency trends and measures that will influence this dynamic industry’s trajectory is crucial as we enter 2024.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |