Key Points:

- Arthur Hayes faces a staggering 50% loss selling ENS, FXS, LOOKS.

- Hayes rebounds, becoming the top GMX holder with 233,000 GMX ($12M).

- Insights into Hayes’ dynamic market moves and the unpredictable nature of crypto investments.

Arthur Hayes, the renowned founder of BitMEX, made significant moves in the cryptocurrency market that have left the community buzzing.

Recent transactions from Hayes’ address indicate a strategic shift in his portfolio, marked by substantial losses followed by a remarkable rebound.

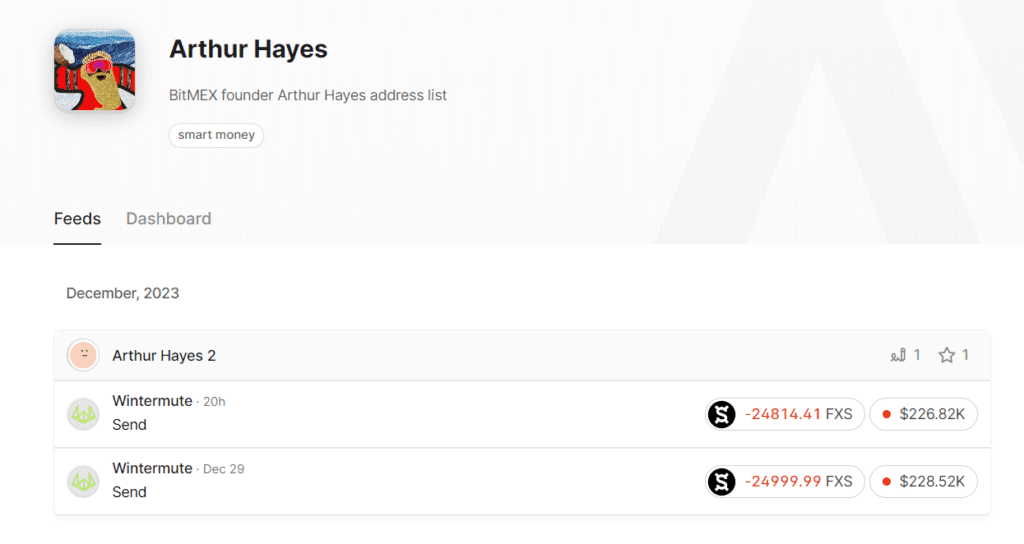

Hayes chose to part ways with three major tokens – ENS, FXS, and LOOKS – executing sales through Wintermute. The collective outcome was a staggering loss exceeding $5 million, a figure that translates to each token shedding more than 50% of its value. The crypto community was quick to react to the unexpected downturn in Hayes’ holdings, with speculation rife about the reasons behind the seemingly calculated decision.

BitMEX Founder Emerges as Top GMX Holder with $12M Holdings

However, the narrative took an intriguing twist as Hayes showcased his resilience and strategic acumen. In a swift countermove, he reinvested in the market, acquiring ETH, GMX, and PENDLE. The outcome of this tactical maneuver is nothing short of extraordinary – Arthur Hayes now stands as the single largest holder of GMX, with an impressive stash of 233,000 GMX tokens, equivalent to a staggering $12 million.

The significance of this transformation in Hayes’ portfolio extends beyond the individual gains and losses. It underscores the dynamic and unpredictable nature of the cryptocurrency market, where seasoned players like Hayes navigate with a combination of strategic foresight and risk-taking. The community awaits further insights into Hayes’ rationale behind these moves, eager to glean lessons from the founder’s approach to market dynamics.

As the crypto landscape continues to evolve, Arthur Hayes’ recent exploits serve as a captivating case study, reminding investors of the inherent volatility and potential for remarkable rebounds within the ever-fluctuating digital asset realm.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |